An application form for the surrender of a life insurance policy is a document that an individual uses to request the cancellation of their life insurance policy before its term has expired. This form is typically used when an individual no longer wishes to continue their coverage or when they no longer have a need for the policy.

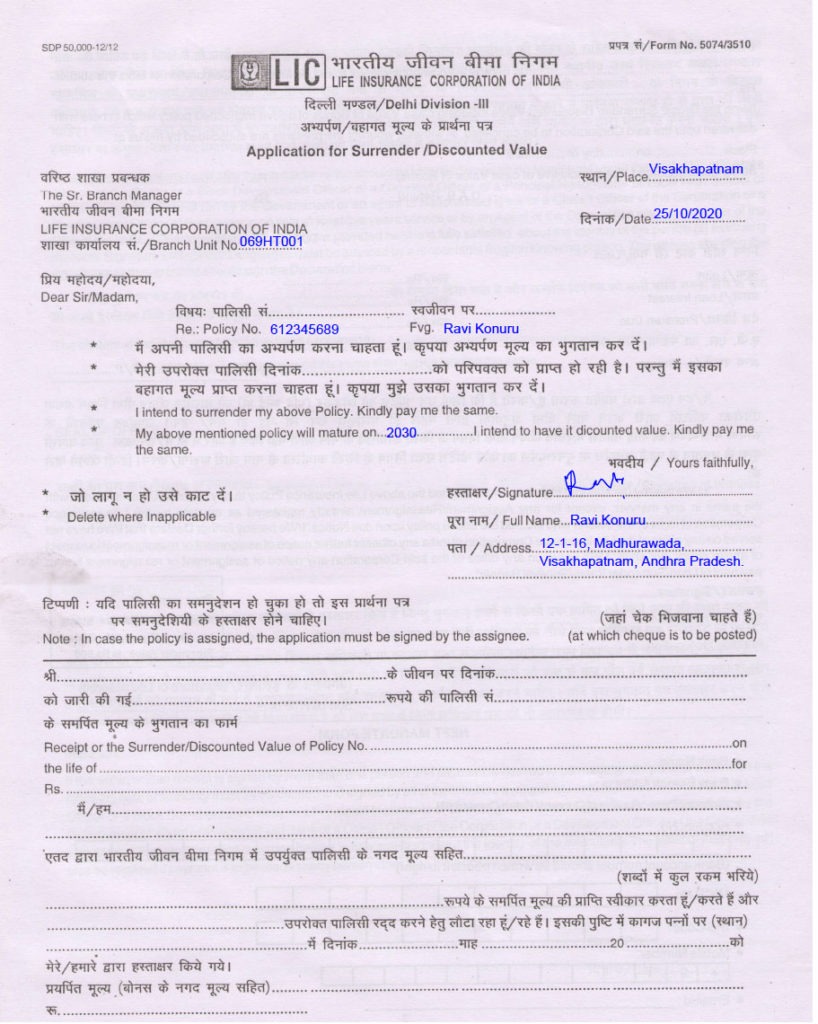

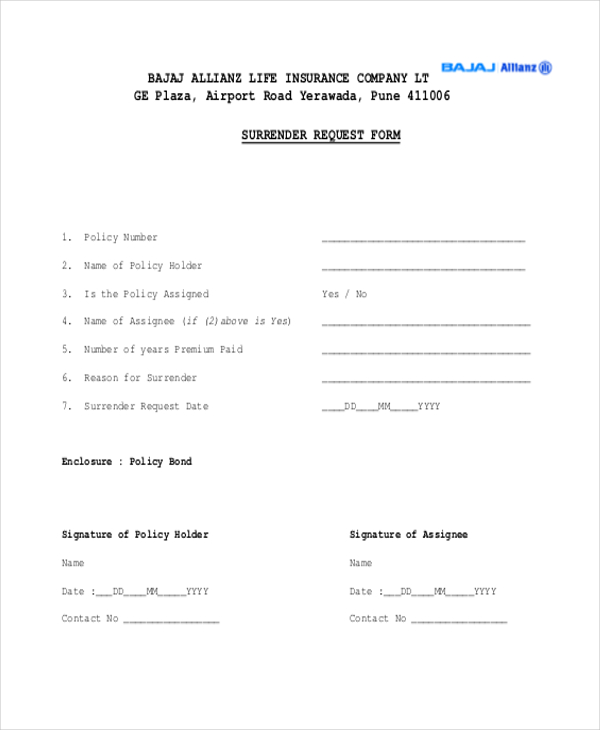

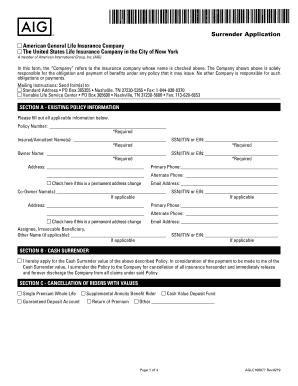

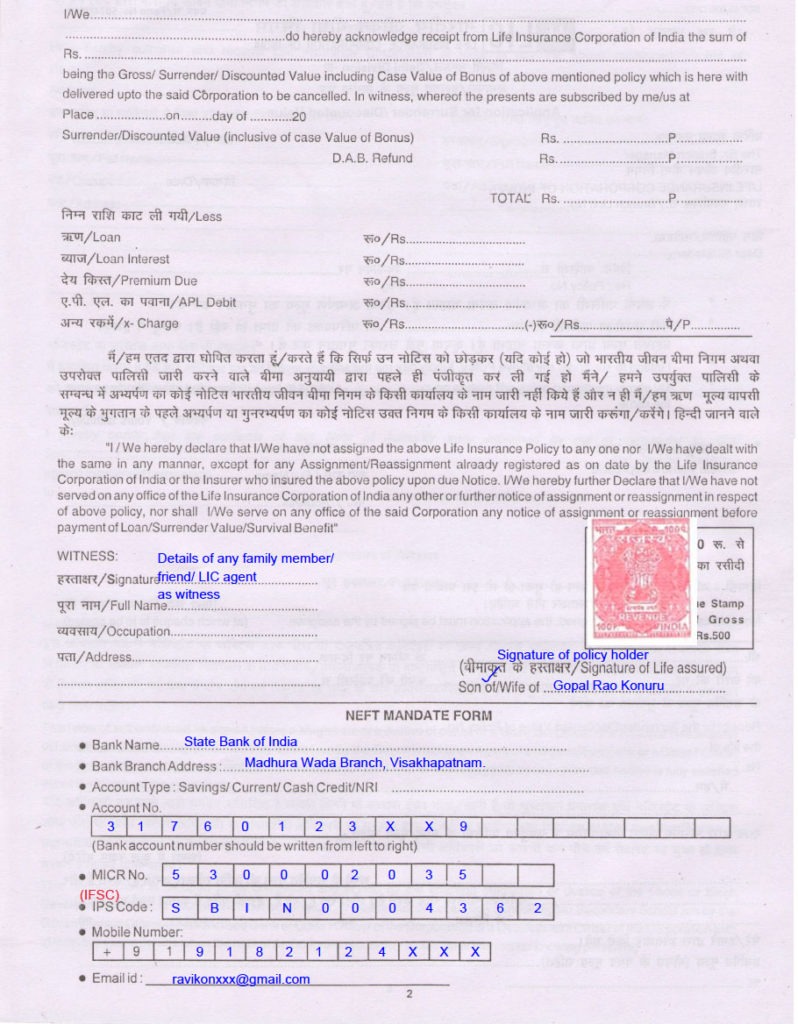

To complete an application form for the surrender of a life insurance policy, an individual will need to provide some basic personal and policy information. This may include their full name, policy number, and contact information. They will also need to provide a reason for their request to surrender the policy.

Once the application form has been completed and submitted, the insurance company will review the request and determine if it can be approved. If the policy has not yet reached its surrender value, the insurance company may require the policyholder to pay a surrender charge. This charge is a fee that is assessed to cover the cost of the policy, including any commissions that were paid to the agent who sold the policy.

If the policy has reached its surrender value, the insurance company will process the request and cancel the policy. The policyholder will then receive a payment for the surrender value of the policy, which is typically a portion of the premiums that were paid over the life of the policy.

It is important to note that surrendering a life insurance policy can have significant financial implications, as it may result in the loss of any accumulated cash value and the potential for future coverage. Therefore, it is important for individuals to carefully consider their decision to surrender a policy before doing so.

In summary, an application form for the surrender of a life insurance policy is a document that is used to request the cancellation of a policy before its term has expired. To complete this form, an individual will need to provide some basic personal and policy information, as well as a reason for their request. The insurance company will review the request and, if approved, will cancel the policy and pay the surrender value to the policyholder. However, it is important to consider the potential financial implications of surrendering a life insurance policy before making this decision.