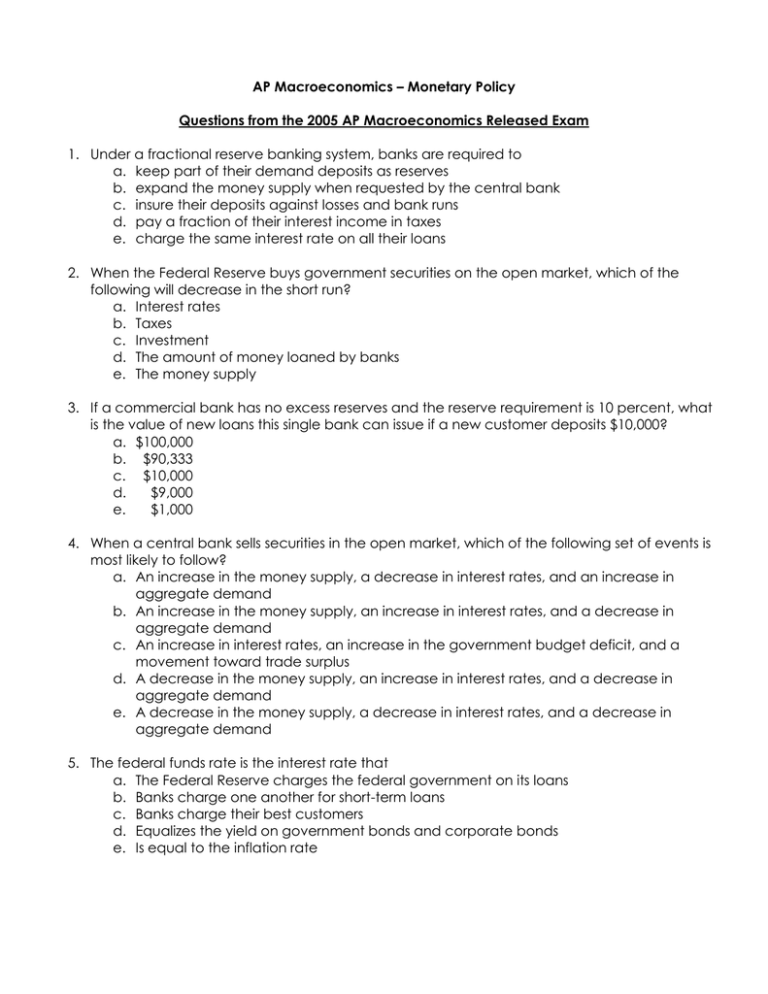

The Stranger is a novel written by Albert Camus in 1942. It tells the story of Meursault, a young man living in Algiers who becomes emotionally detached from the world around him after the death of his mother. The novel is often considered an example of absurdist literature, as it explores themes of absurdity, nihilism, and the human condition.

One example of the absurdity present in The Stranger is Meursault's lack of emotional response to the death of his mother. Despite being the protagonist of the novel, Meursault is unable to feel grief or sadness over his mother's death, and instead spends much of the time after her funeral casually chatting with his neighbors and even going to the beach. This detachment from his emotions is a clear example of the absurdity present in the novel, as it is not a typical or expected response to the loss of a loved one.

Another example of absurdity in The Stranger is Meursault's eventual murder of an Arab man on the beach. The murder is completely unprovoked and seems to happen almost by accident, with Meursault later stating that he killed the man because he was "too close" and the sun was in his eyes. The absurdity of this act is further highlighted by the fact that Meursault seems to have no remorse or guilt over the murder, and instead focuses on the practicalities of his impending trial.

In addition to absurdity, The Stranger also explores themes of nihilism and the human condition. Meursault's detachment from emotions and his lack of concern for the consequences of his actions can be seen as a form of nihilism, as he seems to lack any sense of purpose or meaning in life. This is further reflected in his statement that "nothing really mattered" and his belief that life is ultimately meaningless.

Overall, The Stranger is a powerful example of absurdist literature that explores themes of absurdity, nihilism, and the human condition. Through the character of Meursault, Camus presents a thought-provoking critique of modern society and the human experience.

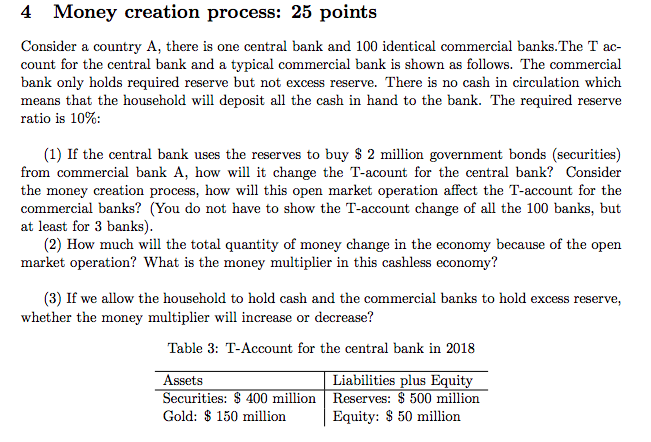

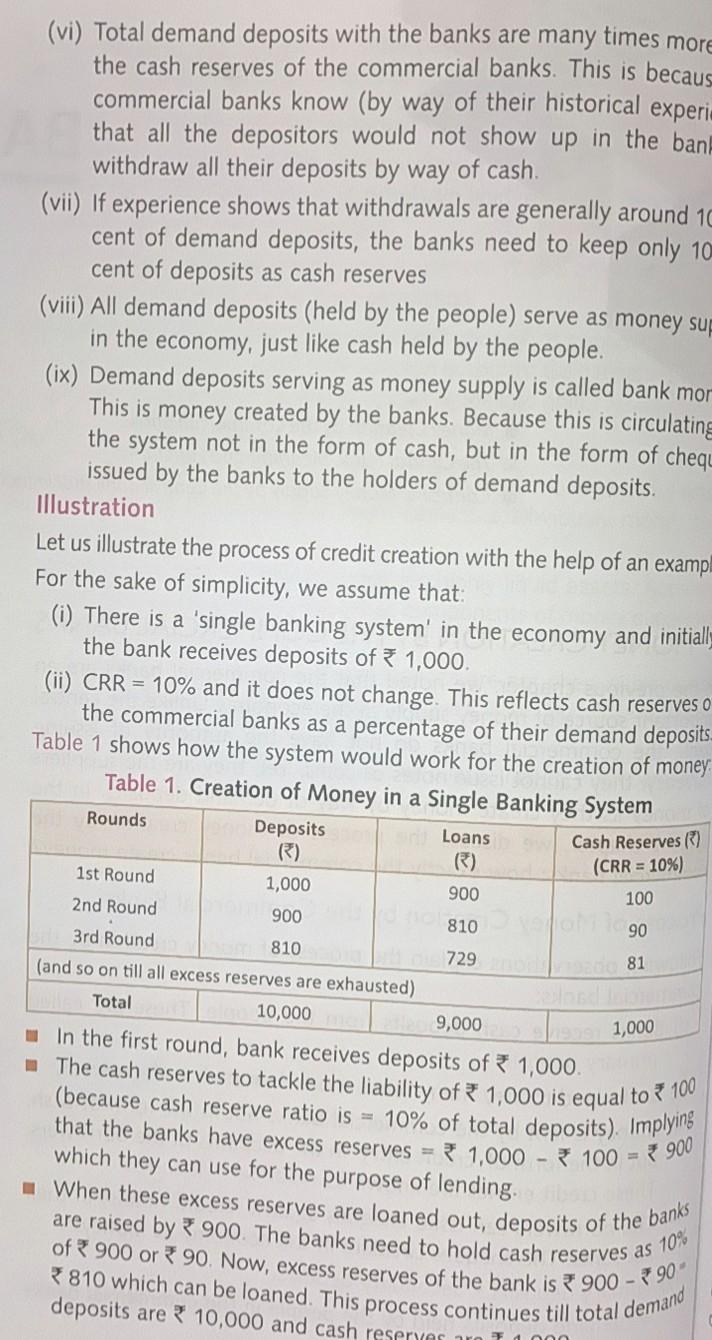

What happens in a 100 percent reserve banking system?

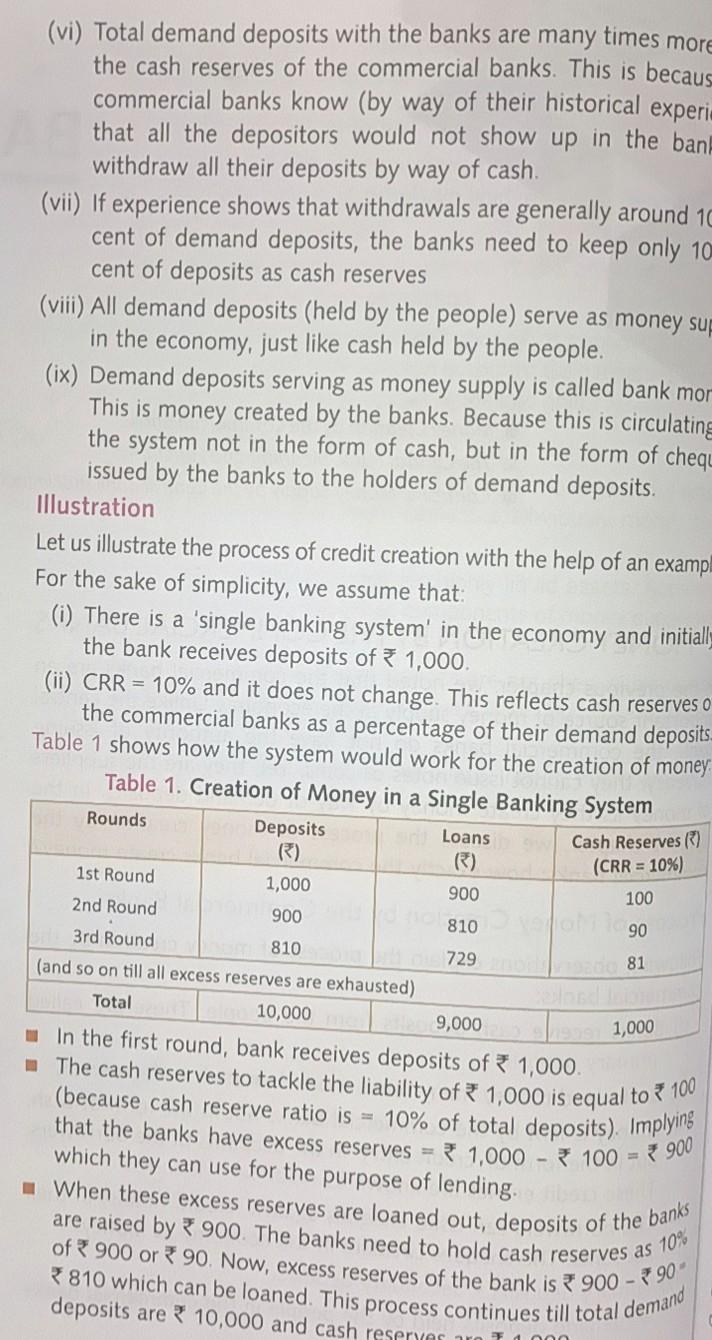

If the borrower, already has an account, he will be allowed an overdraft to the extent of Rs. How much is the bank holding in excess reserves? When does the money supply decrease what happens? The Central Bank can bring about variations in money supply by changing bank rate, by open market operations, by changing cash reserve ratios of commercial bank etc. In conclusion, therefore, it may be said that the liquidity ratio theory of the determination of the volume of bank deposits in the UK is no more satisfactory than the cash ratio theory. Bankers have always made out a case that they lend only the deposits they receive or out of it. Government : Government is another source through which significant variations or changes in money supply take place in a country. What effect does a bank run have on the money supply? Primary deposits, as we know arise from the actual deposits of cash in a bank.

Money Supply and Credit Creation by Commercial Banks

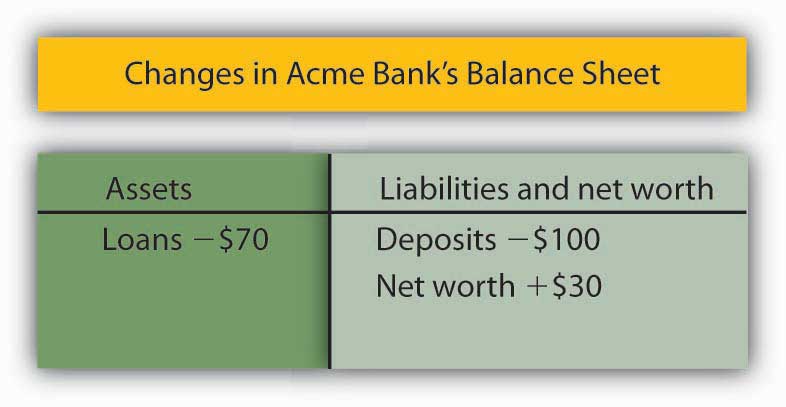

In a fractional reserve banking system, banks create money when they: make loans. Raises the reserve ratio, lowers the money multiplier, and decreases the money supply. Some reserves must still be kept. What happens when a bank is required to hold more money in reserve? ADVERTISEMENTS: However, the bank can create deposits actively by creating claims against itself in favour of a borrower or of a seller of securities or of property acquired by the bank. The purchase of security by any banker is bound to increase the deposits either of his own bank or of some other bank, in any case, the deposits of the banking system as a whole. What does it mean if a bank is considered a fractional reserve bank? He may further grant a loan of Rs. A one-dollar increase in the monetary base causes the money supply to increase by more than one dollar.

As commercial banks keep more excess reserves, what happens to money creation

It is clear, therefore, that the total amount of credit creation will be the reverse of the cash reserve ratio. A: When the Fed raise the discount rate, it is more expensive for banks to borrow from the Fed. It would decrease the banks money supply because banks would earn less interest, and their share prices could fall. How is money multiplied? The required reserve ratio is 10 percent of checkable deposits, and banks do not hold any excess reserves. Lend out no more than the amount of their required reserves C. What happens when reserve requirements are increased? Total reserves in the banking system increase Before 2008, what was the incentive for banks with excess reserves to lend money overnight to banks short of required reserves? It will be seen that the most important function of a commercial bank is the creation of credit money—a function which overshadows all other banking functions. Not been affected D.

That creates more money in the banking system. Let us consider each one of them individually. The monetary base: the sum of currency in circulation and reserve balances deposits held by banks and other depository institutions in their accounts at the Federal Reserve. The money supply is the total amount of money—cash, coins, and balances in bank accounts—in circulation. Although the debate whether the variable liquid assets ratio is superior to the cash ratio as an effective means of credit control still continues ; it is, however, clear that in future the liquidity ratio theory may become more important in explaining movements in clearing bank deposits.