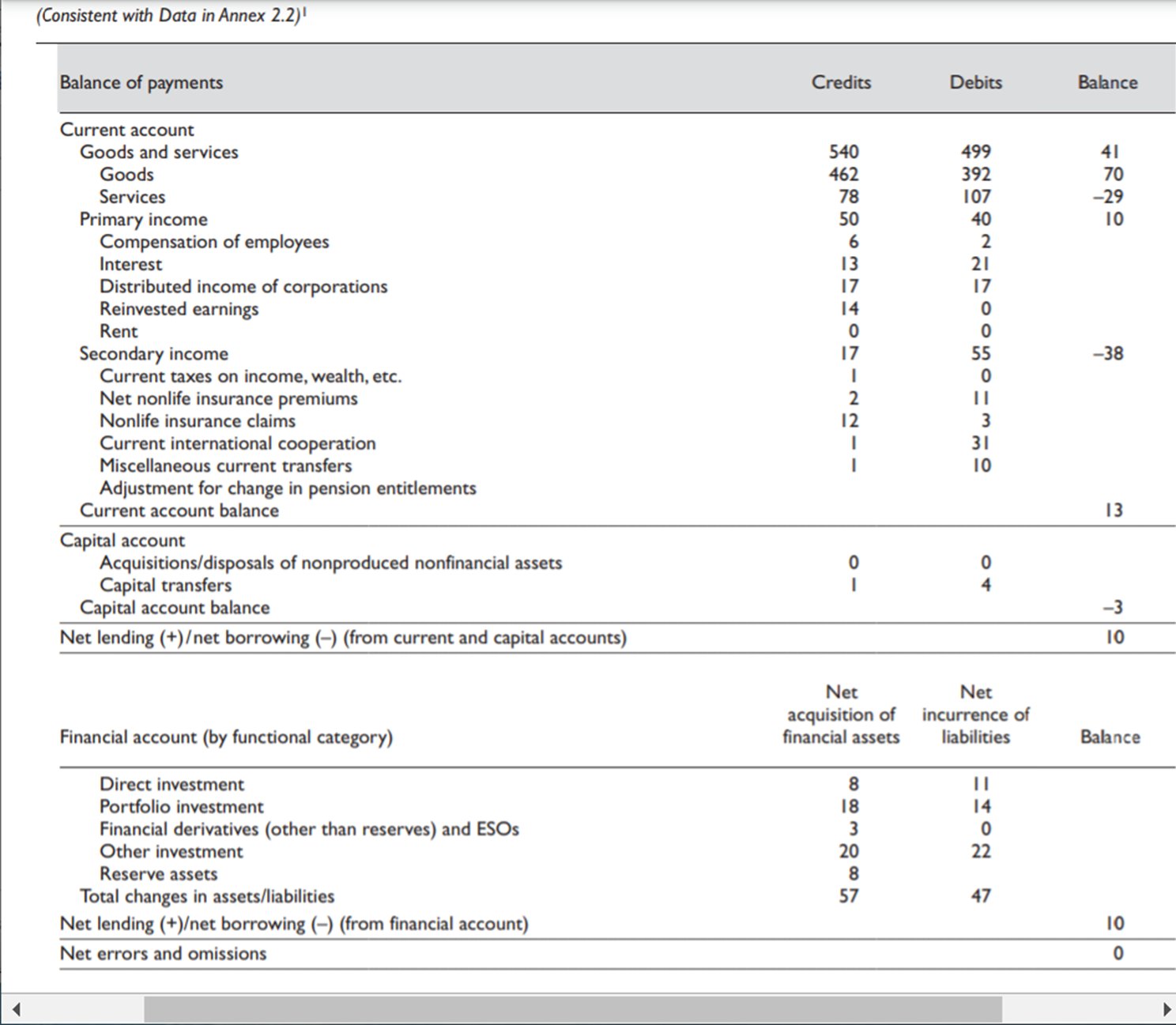

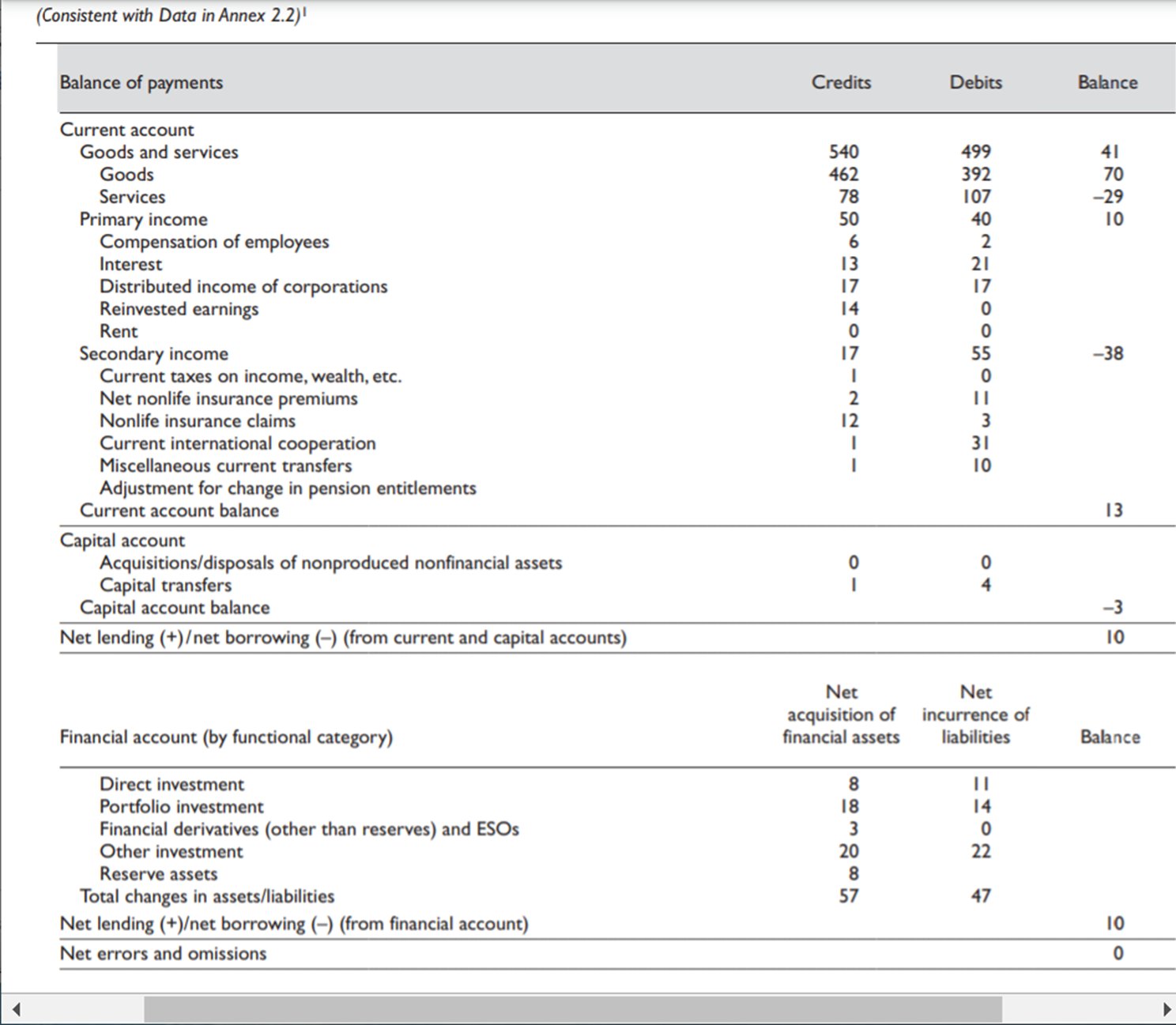

The balance of payments is a summary of a country's international transactions with the rest of the world over a certain period of time, usually a year. It includes the country's exports and imports of goods and services, as well as capital flows, such as investments and loans. The balance of payments is divided into two main components: the current account and the capital account.

The current account measures a country's trade in goods and services, as well as income from investments made in foreign countries. If a country exports more goods and services than it imports, it is said to have a positive balance of trade, and the excess is called a trade surplus. On the other hand, if a country imports more goods and services than it exports, it is said to have a negative balance of trade, or a trade deficit.

For example, let's say that Country A exports $100 million worth of goods and services to Country B, and imports $50 million worth of goods and services from Country B. Country A would have a trade surplus of $50 million, which would be recorded in its current account.

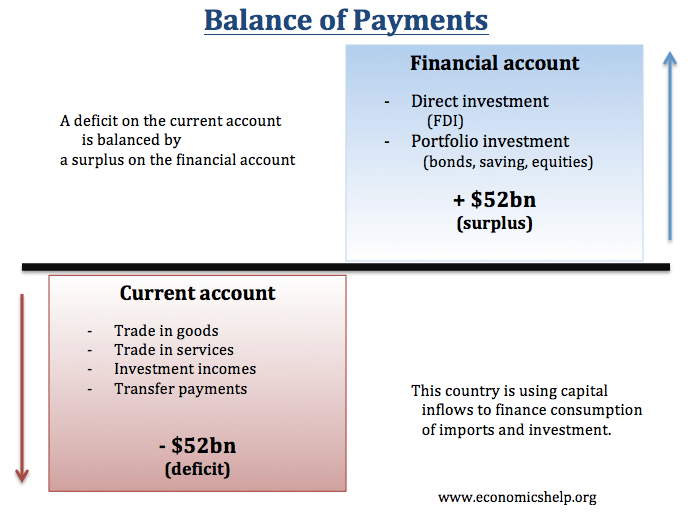

The capital account measures a country's investment and financial transactions with the rest of the world. This includes foreign direct investment, portfolio investment, and loans. If a country receives more foreign investment and loans than it gives out, it is said to have a positive balance of capital, or a capital surplus. On the other hand, if a country gives out more foreign investment and loans than it receives, it is said to have a negative balance of capital, or a capital deficit.

For example, let's say that Country C receives $100 million in foreign direct investment from Country D, and gives out $50 million in foreign loans to Country E. Country C would have a capital surplus of $50 million, which would be recorded in its capital account.

It is important to note that a country's balance of payments must always balance out, meaning that the sum of the current account and the capital account must equal zero. This means that if a country has a trade deficit in its current account, it must be offset by a capital surplus in its capital account, or vice versa.

In summary, the balance of payments is a record of a country's economic transactions with the rest of the world, and is divided into the current account and the capital account. It is important to keep track of a country's balance of payments to understand its economic relationships with other countries and to ensure that its international transactions are in balance.

Balance of Payments: Definition, Components, Deficit

International balance of payments Most countries in the world have their own national currency, used as money within the respective countries. A multinational corporations or MNCs, also known as Multinational enterprise MNE , is a company that operates is business or produce and sale product in more than one country Daniels, Radebaugh and Sulivan, 2001. The Balance of Payments BOP is a statement recording all the financial transactions made between the residents of a country and the rest of the world over a certain period. Conversely, positive balance of payment improves the economic condition. As a result of the uneven flow of cash, the nation's money supply will be reduced, causing an increase in the country's exchange rate relative to other currencies. When an economy has a trade imbalance, foreign financial assets will flow into the region. The capital account is divided into financial flows originating from loan forgiveness, the trade of goods and financial assets by migrants departing or entering a nation, the exchange of possession on fixed assets assets like machinery used in the manufacturing process to generate revenue , the transfer of money received to the trade or acquirement of fixed assets, donation and inheritance taxes, demise levies, and ultimately, uninsured loss to capital assets.

What is Balance of Payments and how is it affected?

The MNC can also get the lower tax benefit, when the country tries to increase their export and reduce import. These are usually leased locally, interest rates, and interest on investments. Here we learn how to calculate BOP using its formula, practical examples, and downloadable excel templates. Capital account : Capital transactions like purchase and sale of assets non-financial like lands and properties are monitored under this account. This account calculates the foreign proprietor of domestic assets and domestic proprietor of foreign assets, and analyses if it is acquiring or selling more assets like stocks, gold, equity, etc. If the deficit lasts for too long, the country might have to start selling off its assets to pay for its debt. Investments - funds invested in corporate equities.

What Is the Balance of Payments?

The balance of payment is usually evaluated based on certain period such as year. This left the Indian government in a crisis as they could not afford to simply print more money especially when they did not have the value of the money as a reserve. As there are various obstacles for a multinational business, the manager have to overcome the obstacle by grabbing the best available opportunity. The financial account documents international monetary flows related to investment in businesses, real estate, bonds, and stocks. Again, if the home country has high balance of payment, they allow MNC to start its business with lower fees. According to Investopedia, the balance of payment generally should be zero to be optimum 2013. Trading, unilateral transfers, or other payouts could all be examples.

:max_bytes(150000):strip_icc()/what-is-balance-of-payments-components-and-deficit-3306278-Final-HL-7a43df76501348ef9cde2c9193ae390d.png)