The abolitionist movement was a social and political movement that aimed to end the practice of slavery and the slave trade in the United States and other parts of the world. This movement was driven by a belief in the inherent dignity and equality of all human beings, and it sought to challenge the deeply ingrained notion that some people were meant to be owned and controlled by others.

One of the most significant effects of the abolitionist movement was the eventual end of slavery in the United States. The abolitionist movement was a key factor in the adoption of the 13th Amendment to the United States Constitution, which permanently ended slavery and involuntary servitude throughout the country. This amendment, which was passed in 1865, was a major milestone in the long struggle to end slavery and ensure equal rights for all people.

The abolitionist movement also had a major impact on the way that people thought about slavery and race relations in the United States. Before the abolitionist movement, many people believed that slavery was a natural and necessary part of society. However, the abolitionist movement helped to challenge these beliefs and promote the idea that all people are created equal and deserve to be treated with dignity and respect. This shift in thinking laid the foundation for the civil rights movement of the 20th century and the ongoing struggle for racial justice.

In addition to ending slavery and promoting equality, the abolitionist movement also had a significant economic impact. The abolition of slavery meant that slave owners were no longer able to profit from the labor of their slaves, which had a significant impact on the economy of the South. This, in turn, led to major changes in the way that work was organized and compensated, as employers had to rely on wages rather than slavery to attract and retain workers.

Overall, the abolitionist movement was a crucial turning point in the history of the United States and had a far-reaching impact on the way that people thought about race, equality, and human rights. Its legacy lives on today in the ongoing struggle for justice and equality for all people.

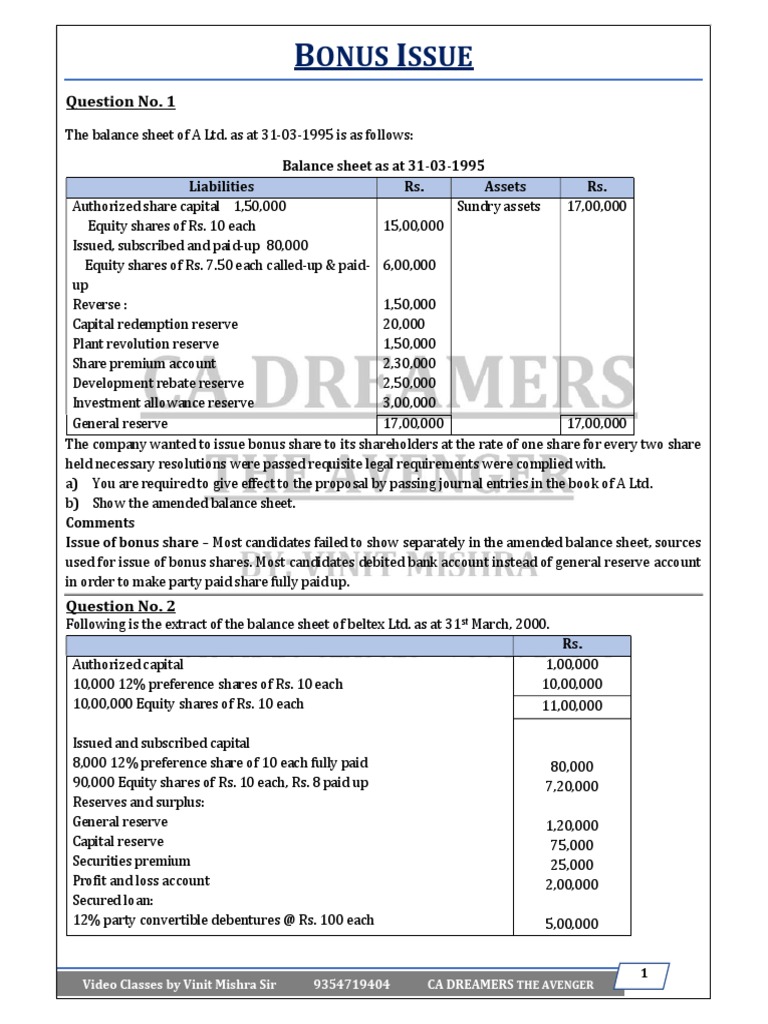

Bonus Shares: What Are Bonus Shares & Its Benefits

The other share movement-related factors that can be controlled by companies and can dictate the market price of the share are bonus issues, rights issues, stock splits, buyback of shares, and paying dividends. So, bonus shares increase the share capital of the company whereas in a stock split, the share capital remains the same, but in both the cases the number of shares increases and the share price proportionately goes down. Bonus shares are mainly used as an alternative to paying cash dividends. This may not be good news for dividend lovers. From an accounting perspective, a bonus issue is a simple reclassification of reserves which causes an increase in the share capital of the company on the one hand and an equal decrease in other reserves. Here we discuss examples of Bonus Shares along with advantages and disadvantages. There is no value creation in the process.

Bonus Issue of Shares

No, it might have chosen to reinvest reserves, i. A minimum subscription is needed for the rights issue as shareholders need to pay for the issue. A rights issue is one method of raising capital from the market. Subscribe Fully to the Offer When a company announces a bonus issue, all shareholders receive new shares. READ: Bill of Exchange Vs Letter of Credit It is an offer to existing shareholders for receiving additional shares in proportion to their existing shareholding in the company. These factors are mainly influenced by movement of shares in the company, which trigger external events, thus, affecting the prices of the shares.

Bonus Issue of Shares: Definition, Effect, Accounting, Advantages

Bonus shares also known as capitalization issues or scrip issues are extra shares offered to the current shareholders without any additional cost, which is based on a common multiplication of the number of shares owned by each shareholder. Recently UMS holding just announce 1 for 4 shares, bonus issue. As the name suggests, the offer is a rights issue. This website is intended to provide a general guide to the valuer World and the services it provides. For example, a three-for-two bonus issue entitles each shareholder three shares for every two they hold before the issue.

Bonus Issue: Explanation, Calculation & Real

But on other hand, the bonus issue is an alternative to dividends. Hong Fok Is Going XB Today 13 Apr 2016 , Hong Fok, which is listed on Singapore Stock Exchange SGX , is going XB. In addition, shareholders selling bonus shares to meet liquidity needs lowers shareholders' percentage stake in the company, giving them less control over how the company is managed. The company then distributed a 1:1 bonus on June 9, 2022, so received 10 additional shares. But whether it is the true intent we will never know. How Can You Participate in Bonus Share Issues in the Future? Instead, the entire loss amount would be considered as the cost of acquisition for bonus shares.

BONUS ISSUE & ITS ADVANTAGES

While Wipro has been regularly issuing bonuses nearly eight times since inception , MRF Ltd. Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. One bonus share will be issued for every five shares held 1:5. Hi Alvin, I have question about bonus issues. This article will focus on Bonus Issue. It means that shifting the profits earned by the company to increase the capital invested by the shareholders. Effect of Bonus Issue After a bonus issue, more shares will be introduced into the stock market and share price should drop accordingly.