A budget is a financial plan that outlines the expected expenses and income for a specific period of time, typically a month or a year. A budget paper is a document that outlines the details of a budget, including the expected sources of income and the planned expenses.

An example of a budget paper might include the following information:

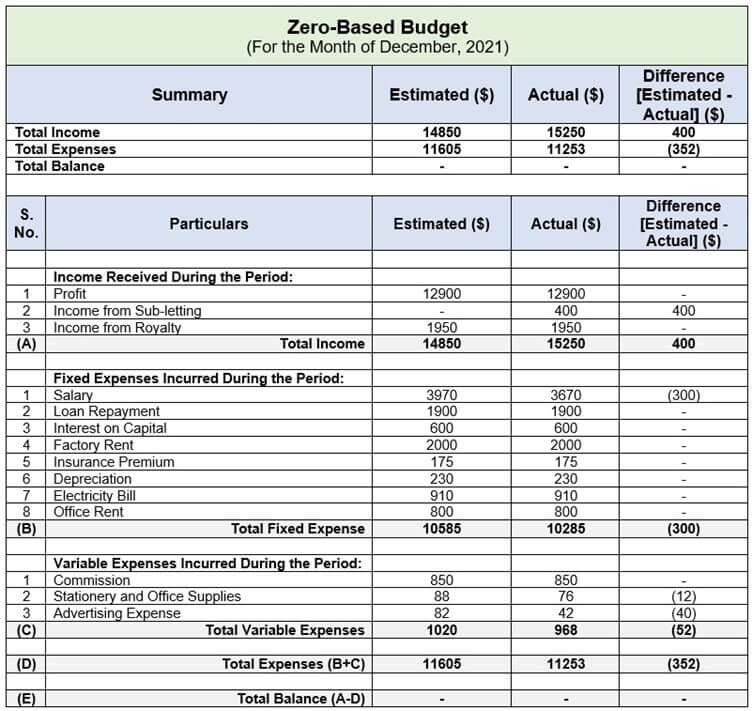

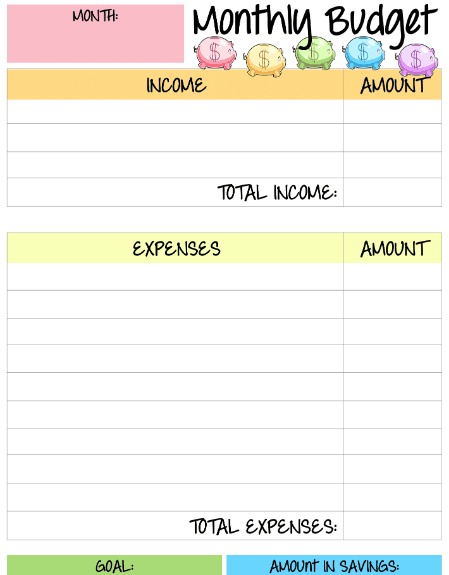

Personal or household income: This can include salary, wages, self-employment income, investments, and any other sources of income.

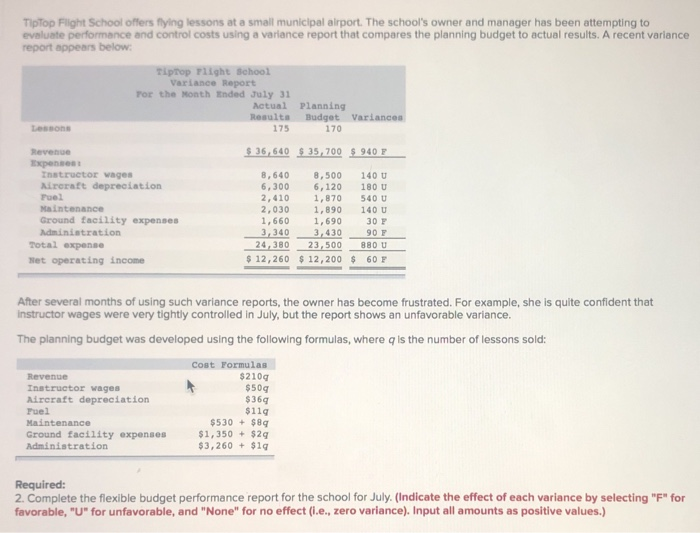

Fixed expenses: These are expenses that do not vary from month to month, such as rent or mortgage payments, car payments, insurance premiums, and student loan payments.

Variable expenses: These are expenses that may vary from month to month, such as groceries, gas, entertainment, and clothing.

Savings: This category can include any money set aside for emergencies, retirement, or other long-term financial goals.

Debt repayment: If you have any outstanding debt, such as credit card balances or personal loans, you may want to allocate a portion of your budget towards paying them off.

To create a budget paper, you can start by listing your expected income and expenses for a specific period of time, such as a month or a year. You can use a spreadsheet or a pen and paper to track your expenses, and make sure to include any irregular or infrequent expenses that may not occur every month, such as car maintenance or holiday gifts.

Once you have a list of your income and expenses, you can then determine if you are spending more than you are earning. If you are spending more than you are earning, you will need to find ways to reduce your expenses or increase your income in order to balance your budget. This may involve cutting back on non-essential expenses, such as dining out or subscription services, or finding ways to earn more money, such as taking on additional work or starting a side hustle.

On the other hand, if you are earning more than you are spending, you can use the excess money to save for emergencies, pay off debt, or invest in your future.

A budget paper can be a useful tool for managing your finances and ensuring that you are able to meet your financial goals. By tracking your income and expenses and regularly reviewing your budget, you can make informed decisions about how to best allocate your money and make the most of your resources.