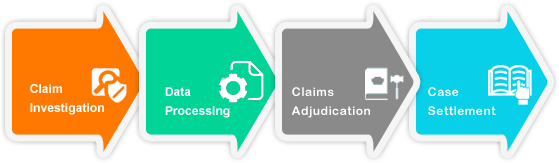

Claim adjudication is the process of evaluating and determining the validity of a claim made in a legal or insurance context. This process is essential to ensuring that individuals and businesses receive fair and just treatment when seeking compensation or coverage for damages or losses. The claim adjudication process can involve several steps, depending on the specific context and nature of the claim. In this essay, we will explore the general steps involved in the claim adjudication process and discuss some of the key considerations and challenges that can arise during this process.

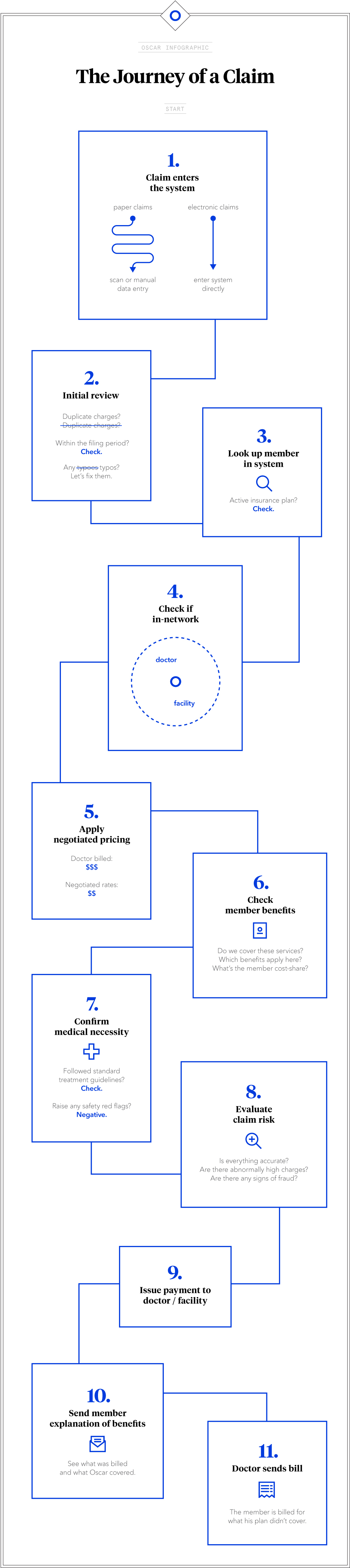

The first step in the claim adjudication process is typically the submission of a claim. This involves providing all necessary documentation and information to support the claim, including evidence of damages or losses, and any relevant contracts or policies. The claimant must also provide a clear and detailed explanation of the circumstances that led to the claim.

After a claim has been submitted, it is typically reviewed by an adjudicator or claims adjuster, who is responsible for evaluating the merits of the claim and determining whether it is eligible for coverage or compensation. This can involve reviewing the relevant policies or contracts to determine whether the damages or losses are covered, and evaluating the evidence provided by the claimant to determine the extent of the damages or losses.

If the claim is found to be valid, the adjudicator or claims adjuster will determine the appropriate amount of compensation or coverage based on the terms of the policy or contract, and any applicable laws or regulations. This can involve negotiating a settlement with the claimant, or issuing a payment or other form of compensation.

If the claim is denied, the claimant has the right to appeal the decision. This typically involves submitting additional evidence or arguments in support of the claim, and may require the involvement of legal counsel. The appeal process can be complex and time-consuming, and may involve further review by a higher authority or a dispute resolution process.

There are a number of challenges and considerations that can arise during the claim adjudication process. One of the main challenges is ensuring that the process is fair and unbiased. Adjudicators and claims adjusters must be trained to evaluate claims objectively and impartially, and to follow established procedures and guidelines. There may also be legal requirements or industry standards that must be followed during the claim adjudication process.

Another challenge is ensuring that the process is efficient and timely. Claimants may be facing financial or other hardships as a result of the damages or losses they are seeking compensation for, and delays in the claim adjudication process can cause further hardship. It is important that claims are processed and resolved in a timely manner to minimize the impact on claimants.

In conclusion, the claim adjudication process is an essential part of the legal and insurance systems, and plays a vital role in ensuring that individuals and businesses receive fair and just treatment when seeking compensation or coverage for damages or losses. The process involves several steps, including the submission of a claim, review by an adjudicator or claims adjuster, determination of compensation or coverage, and the possibility of appeal. Ensuring that the process is fair, unbiased, and efficient is crucial to ensuring that claimants receive the justice they deserve.