The Coca-Cola Company is a multinational beverage corporation headquartered in Atlanta, Georgia, United States. It is best known for its flagship product, Coca-Cola, a carbonated soft drink that is enjoyed by millions of people around the world. In addition to Coca-Cola, the company produces and markets a wide range of other nonalcoholic beverages, including juices, sports drinks, teas, and energy drinks.

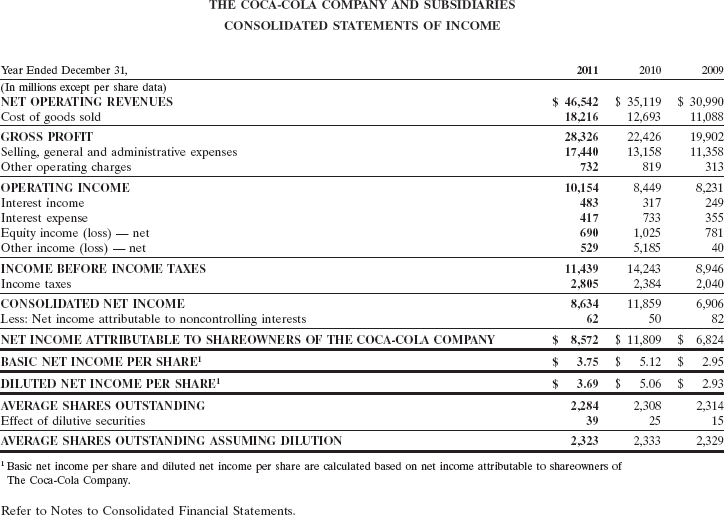

Founded in 1886, the Coca-Cola Company has a long history of financial success. In 2020, the company reported net revenues of $37.2 billion, making it one of the largest and most successful beverage companies in the world. The company's financial performance has been consistently strong over the years, with steady growth in revenues, profits, and shareholder value.

One key factor contributing to the Coca-Cola Company's financial success is its strong global presence. The company operates in over 200 countries and territories, with a diverse portfolio of products that appeal to a wide range of consumers. The Coca-Cola brand is one of the most recognized and trusted brands in the world, which helps to drive demand for the company's products.

In addition to its strong global presence, the Coca-Cola Company has also benefited from its strong focus on innovation. The company has a long history of introducing new products and marketing campaigns that have helped to keep it ahead of the competition. For example, the company has launched a number of successful energy drinks in recent years, including Monster Energy and Red Bull, which have helped to diversify the company's product portfolio and appeal to new customer segments.

Another key factor contributing to the Coca-Cola Company's financial success is its efficient and effective supply chain. The company has a well-developed network of bottling partners and distribution channels that help it to efficiently produce and distribute its products around the world. This has helped to keep costs low and improve the company's profitability.

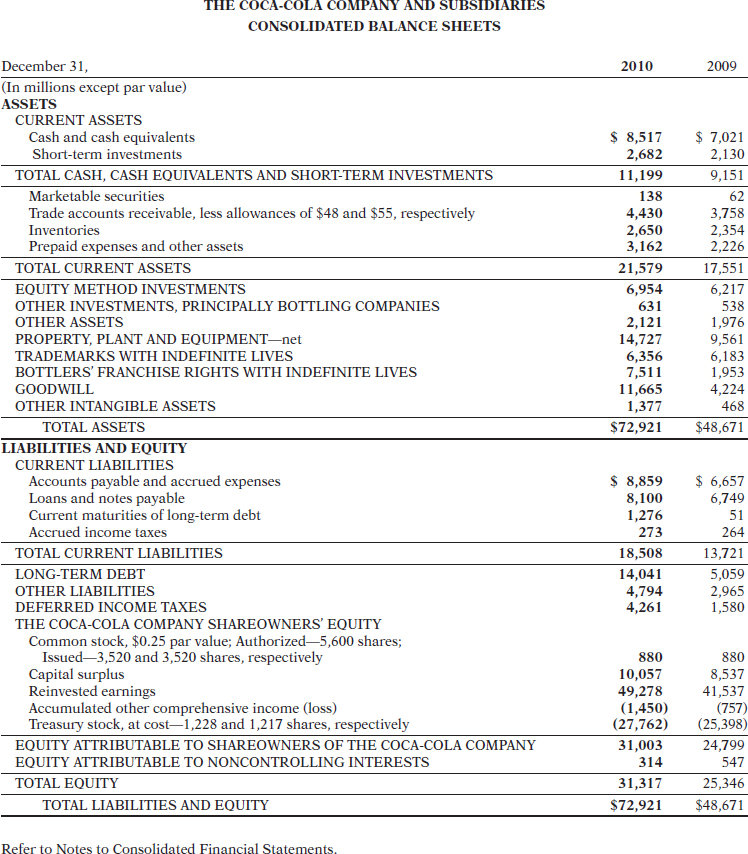

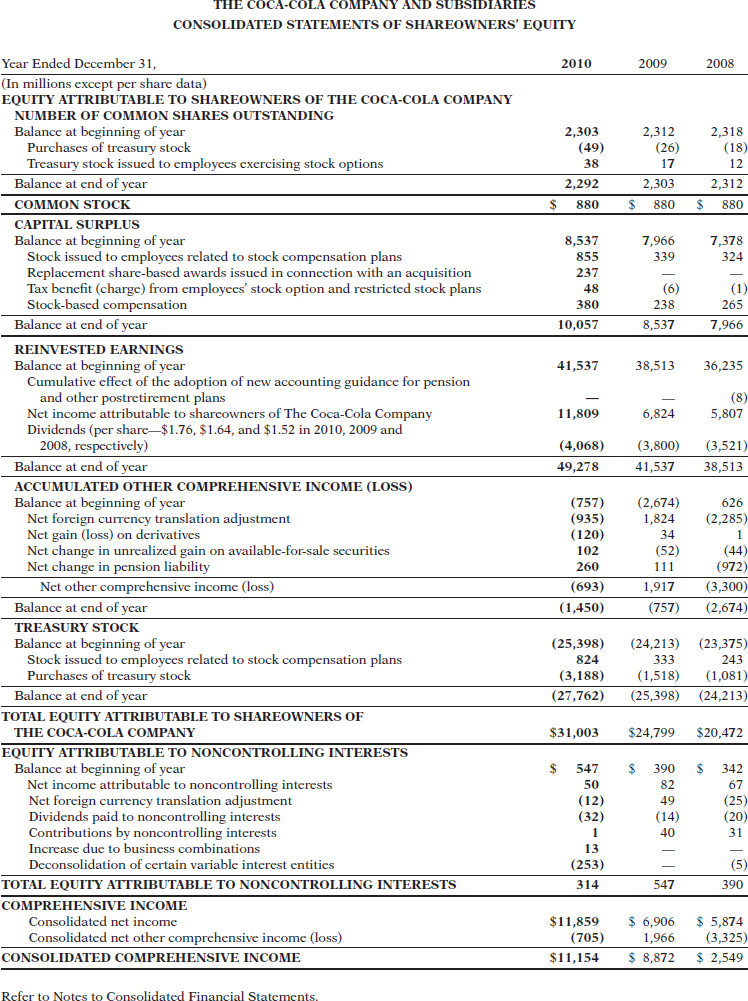

In terms of financial performance, the Coca-Cola Company has consistently delivered strong results over the years. In 2020, the company reported net income of $8.7 billion, up from $7.9 billion in 2019. This represents a strong return on investment for shareholders, as the company has consistently paid dividends and repurchased shares to return value to its investors.

Looking ahead, the Coca-Cola Company is well positioned for continued financial success. The company is focused on expanding its product portfolio and increasing its presence in emerging markets, which should help to drive growth in the coming years. Additionally, the company's strong brand and efficient supply chain will continue to be key assets that help to support its financial performance.

In conclusion, the Coca-Cola Company is a financially strong and well-managed company with a long history of financial success. Its strong global presence, focus on innovation, and efficient supply chain have all contributed to its financial performance. Looking ahead, the company is well positioned for continued growth and success.