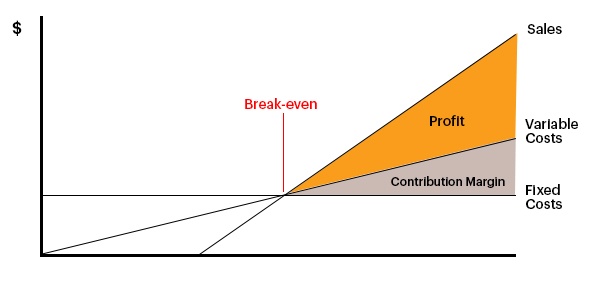

The concept of contribution margin and break even analysis is an important tool for businesses to understand and analyze their financial performance. Contribution margin refers to the difference between a company's revenue and the variable costs associated with producing and selling a product or service. Break even analysis, on the other hand, is a method used to determine the minimum level of sales or production at which a company will cover all of its costs and start to generate a profit.

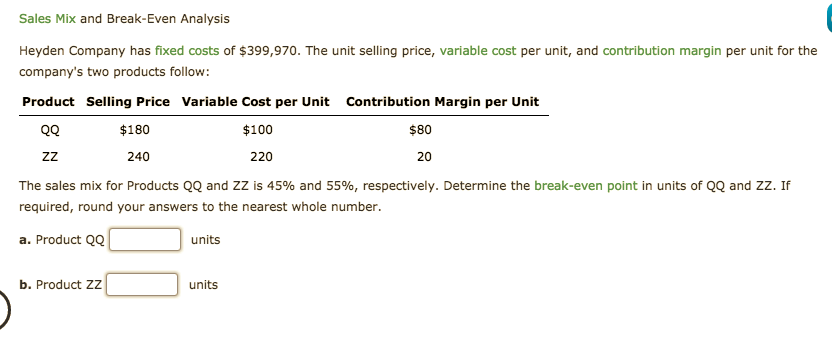

One of the primary uses of contribution margin and break even analysis is to help a company determine how many units of a product or service it needs to sell in order to break even. This can be especially useful for businesses that are just starting out, or for those that are looking to expand their operations and want to ensure that they have a clear understanding of the financial implications of their decisions.

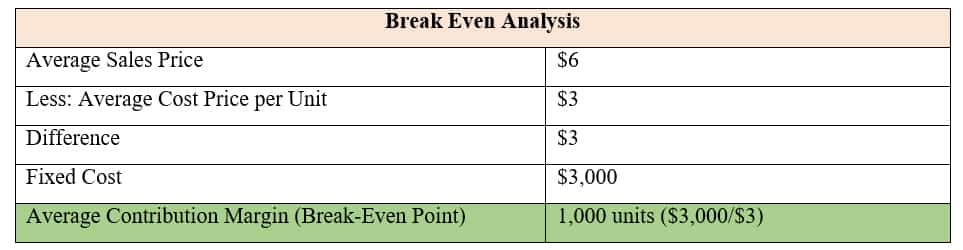

To calculate the contribution margin, a company first needs to determine its total fixed costs, which are expenses that do not vary with changes in the volume of sales or production. These costs might include things like rent, salaries, and insurance. The company then needs to subtract its total fixed costs from its total revenue to determine its contribution margin.

For example, if a company has total fixed costs of $50,000 and total revenue of $100,000, its contribution margin would be $50,000. This means that for every unit of product or service the company sells, it will contribute $50,000 towards covering its fixed costs and generating a profit.

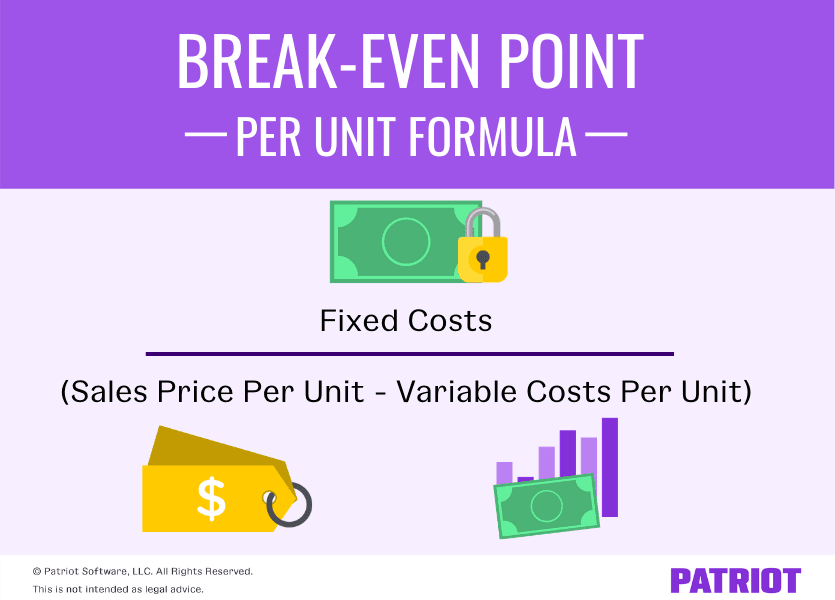

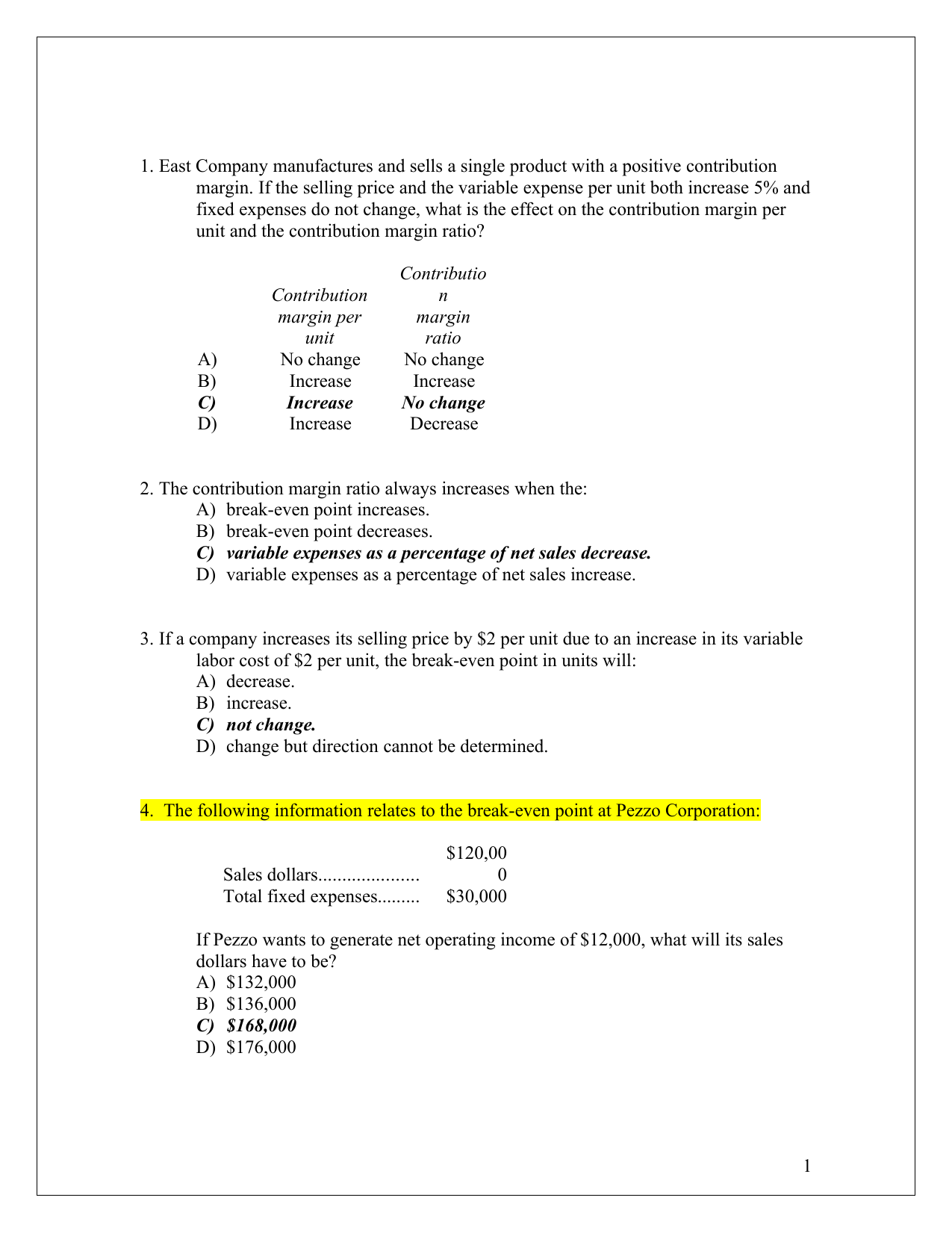

Once a company has calculated its contribution margin, it can then use this information to determine its break even point. This is the point at which the company will have covered all of its costs and will start to generate a profit. To calculate the break even point, the company needs to divide its total fixed costs by its contribution margin.

For example, if a company has total fixed costs of $50,000 and a contribution margin of $50,000, its break even point would be 1,000 units. This means that the company would need to sell 1,000 units of product or service in order to cover all of its costs and start to generate a profit.

In addition to helping a company understand how many units it needs to sell in order to break even, contribution margin and break even analysis can also be useful for identifying cost-saving opportunities and for making pricing decisions. For example, if a company is able to reduce its variable costs, it will increase its contribution margin and potentially lower its break even point. This can help the company to be more competitive in the marketplace and to increase its profitability.

In conclusion, contribution margin and break even analysis are important tools for businesses to understand and analyze their financial performance. By understanding the relationship between their revenue, costs, and the volume of sales or production, companies can make informed decisions about pricing, expansion, and cost-saving opportunities.