A convergent cobweb is a graphical representation of a dynamic system that is used to analyze the behavior of the system over time. It is a useful tool for understanding how a system changes and evolves in response to different input conditions.

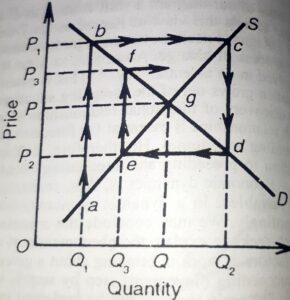

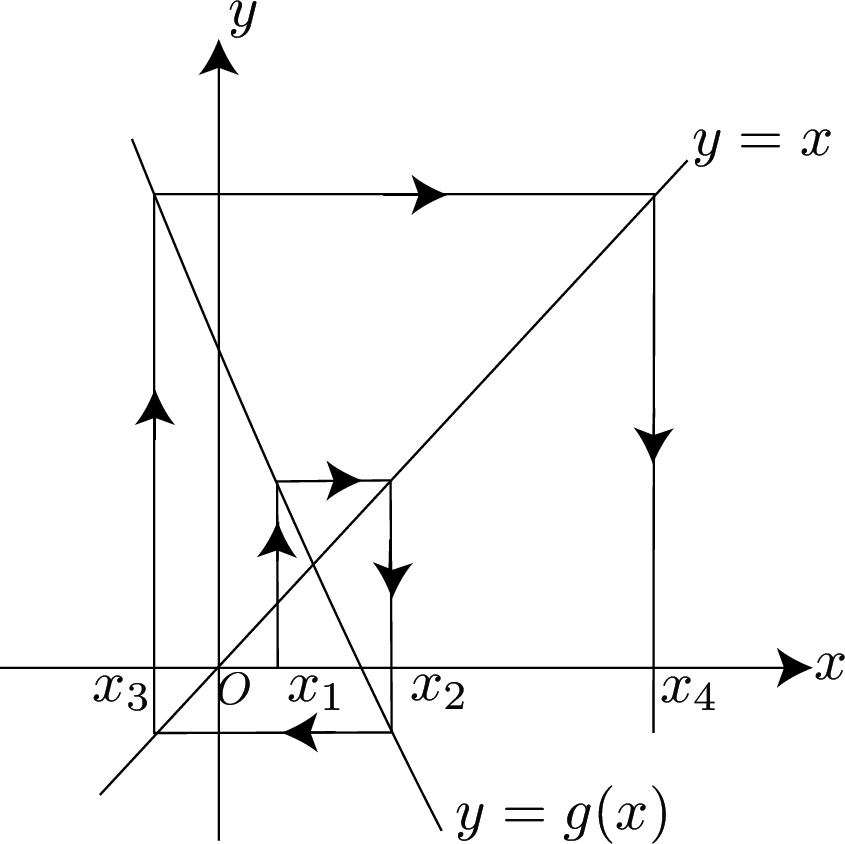

In a convergent cobweb diagram, the horizontal axis represents the value of a variable in the system, and the vertical axis represents the change in the value of that variable over time. The diagram is called a "cobweb" because it resembles a spider's web, with lines converging towards a central point.

To construct a convergent cobweb diagram, one must first choose a variable to track and determine the equation that governs its change over time. For example, in an economic model, the variable might be the price of a good, and the equation might describe how the price changes in response to changes in supply and demand.

Once the variable and equation have been chosen, the convergent cobweb diagram can be constructed by plotting the value of the variable at different points in time. As the value of the variable changes over time, the lines on the diagram will converge towards a stable point, known as an equilibrium point.

The shape of the convergent cobweb can reveal important insights about the behavior of the system. For example, if the lines on the diagram oscillate around the equilibrium point, it may indicate that the system is unstable and prone to fluctuations. On the other hand, if the lines on the diagram quickly converge towards the equilibrium point, it may indicate that the system is stable and well-behaved.

Convergent cobweb diagrams are often used in economics to study market behavior and to predict the effects of policy changes. They can also be used in other fields, such as biology, to study the dynamics of population growth and the spread of diseases.

Overall, convergent cobweb diagrams provide a useful tool for analyzing and understanding the behavior of dynamic systems over time. They help us to understand how different variables in a system interact and influence one another, and can help us to make more informed decisions about how to intervene in the system to achieve desired outcomes.

.svg/500px-Cobweb_theory_(convergent).svg.png)