The deductive approach in accounting theory refers to the process of developing accounting principles and concepts based on logical reasoning and principles of formal logic. It involves starting with a set of assumptions and deducing logical conclusions based on these assumptions. This approach is often contrasted with the inductive approach, which involves starting with specific observations and drawing general conclusions from them.

In the field of accounting, the deductive approach is often used to develop and justify accounting principles and concepts. For example, a researcher might start with the assumption that financial statements should accurately reflect a company's financial position and performance. From this assumption, they might deduce that certain accounting practices, such as the use of historical cost or the matching principle, are necessary to achieve this goal.

One advantage of the deductive approach is that it allows for the development of clear, logical principles that can be consistently applied. This can help to ensure the reliability and comparability of financial statements, which is important for investors and other users of financial information.

However, the deductive approach also has its limitations. One potential drawback is that it may not always accurately reflect the complex and dynamic nature of real-world business situations. This can lead to accounting principles that are too rigid or inflexible to be applied effectively in practice. Additionally, the deductive approach relies on the accuracy of the assumptions on which it is based. If these assumptions are incorrect or incomplete, the resulting principles may be flawed or inadequate.

Despite these limitations, the deductive approach continues to play an important role in the development of accounting theory and practice. By carefully considering the assumptions and logical conclusions that underlie accounting principles, researchers and practitioners can help to ensure that financial statements accurately and reliably reflect a company's financial position and performance.

Deductive approach in accounting Free Essays

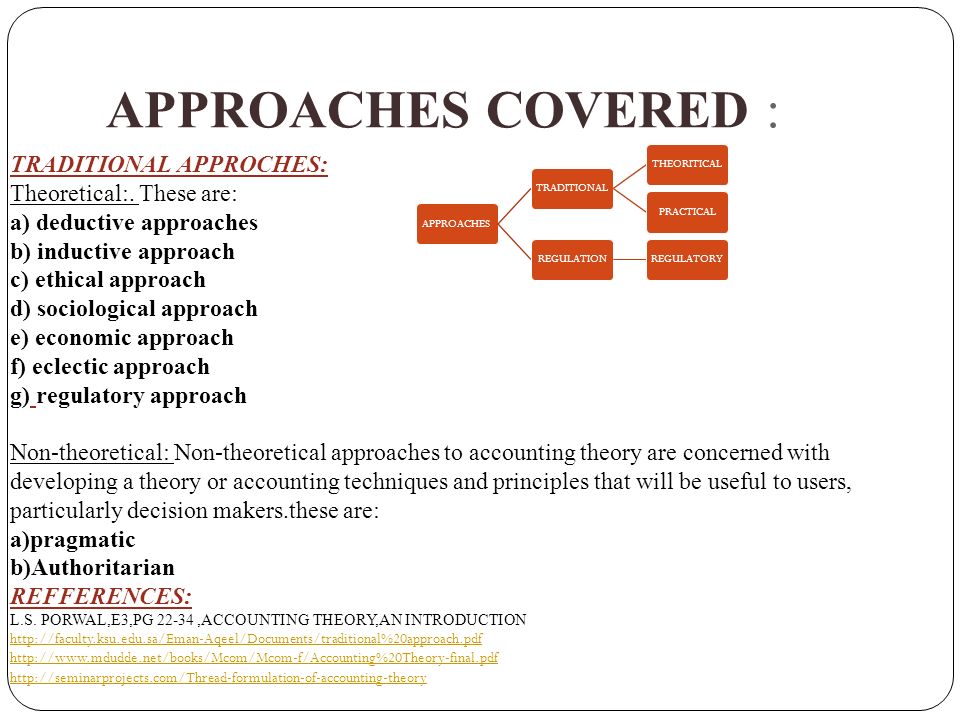

Changes suggested as a result of such a study have a much better chance of being actually implemented. Instead, different theories have been proposed and continue to be proposed in the accounting literature. Finally, good theory should provide for research to assist advances in knowledge. Since accounting is considered to be a behavioural process, this theory applies behavioural science to accounting. That is, the definition of simple truths describing the phenomenon is the goal of the investigation, not the starting point! The statement enjoyed an inductive approach towards accounting theory and provided an explanatory framework for accounting based on historical cost. Intended to provide guidance on financial accounting and reporting problems on a timely basis NOW: FASB Accounting standards Codification FASB ASC became single source of generally acceptable accounting principles The FASB ASC is composed of the following literature issued by various standard setters: 1.

Accounting Theory: Role, Levels and Methodology

Axel Polleres, in Handbook of the History of Logic, 2014 5Particular Challenges to Using Logic-Based Knowledge Representation on the Web The use of logic-based knowledge representation and reasoning at the scale of the World Wide Web poses a number of particular challenges which have so far not received primary attention in logic research. Nevertheless, there are good reasons why certain things practices rather than others, should be done; and there are reasons why certain ways are superior to other ways. The ethical approach to accounting theory places emphasis on the concepts of justice, truth and fairness. Characteristics of an event other than just monetary values may have to be disclosed. In some cases, users of accounting information react when they should not react or should not react the way they did. Littleton, An Introduction to Corporate Accounting Standards 1940.

Basic

When analysing the outcome of tests, it is important to compare research findings with the literature review findings. Accountants use four different types of financial statements to accomplish this. In the main these queries center on whether we should accept a free market approach to the regulation, a private sector regulatory approach or public sector regulatory approach. The goal is to reduce the influence of personal biases and to give a fair judgment or ruling. ADVERTISEMENTS: All the users are interested to know the effect of alternative reporting methods, on their decisions welfare. Obviously, there are many users. It is directly beneficial to society.

DEDUCTIVE ACCOUNTING THEORY DEFINITION

State the hypotheses to be tested. This approach has come about more by accident than as a deliberate attempt, due to the interfering in the development of accounting theory by specialists, governmental bodies and individuals. He also observes that when an inductive theorist, Littleton 1935 , collaborates with a deductive theorist, Paton 1922 , a hybrid results showing compromise between the two approaches. Even W3C recommended standards, which on purpose are designed to be of limited variety, expose this issue. The above writers in interpretational theory are more analysts and explicators than advocates and preachers. This theory provides a suitable basis for evaluating accounting practices, resolving accounting issues and making accounting propositions. The under mentioned theories can be regarded as descriptive theory: Ø The principle of following same accounting methods year after year.

Accounting Theory (NOTES for EXAM 1) Flashcards

Practice originated Generally, practice depends on theory. In spite of the existence of positive and normative methodologies in accounting theory, theorists and writers have to be very careful in discriminating between positive and normative propositions. Advent of various branches of Accounting The Joint Stock Companies necessitated efficient cost management and strategic decisions making, so Cost Accounting and Management Accounting were introduced to fulfil the needs. On the one hand, Andronov was a pioneer in the early awareness of the possibility of instability. Prescriptions require the specification of an objective and an objective function. The second kind of theory and theoretician related to the basic conceptual framework that supported the conventional practice The Importance Of Accounting History As An Academic Discipline 1108 Words 5 Pages It is this that justifies accounting history as a crucially important academic discipline.