Countries trade with each other for a variety of reasons, including to obtain resources, access new markets, and achieve economies of scale. Trade allows countries to specialize in the production of certain goods and services, and to exchange those goods and services with other countries in order to meet the needs and wants of their citizens.

One of the main reasons countries trade with each other is to access resources that are not readily available within their own borders. For example, a country with a shortage of oil may trade with a country that has an abundance of oil in order to meet its energy needs. Similarly, a country with a lack of arable land may trade with a country that has a surplus of agricultural products in order to feed its population.

Another reason countries trade with each other is to access new markets for their goods and services. By exporting their products to other countries, companies within a country can increase their sales and revenue, which can drive economic growth and job creation. For example, a small country with a limited domestic market may trade with a larger country in order to access a larger customer base and increase its competitiveness.

Finally, countries may trade with each other in order to achieve economies of scale. By specializing in the production of certain goods and services and trading with other countries that also specialize in the production of certain goods and services, countries can reduce their costs of production and increase their efficiency. This can lead to lower prices for consumers and increased profits for businesses.

In conclusion, countries trade with each other for a variety of reasons, including to access resources, access new markets, and achieve economies of scale. Trade allows countries to specialize in the production of certain goods and services and to exchange those goods and services with other countries in order to meet the needs and wants of their citizens.

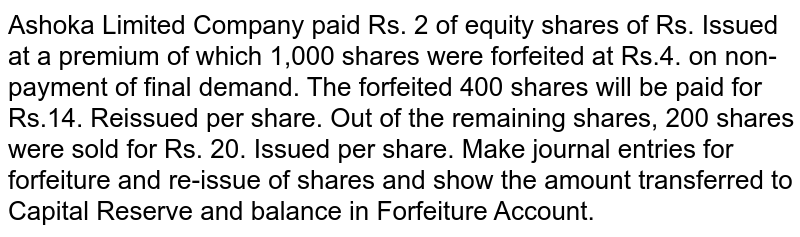

Forfeiture of Shares: Practical Problems and Solutions

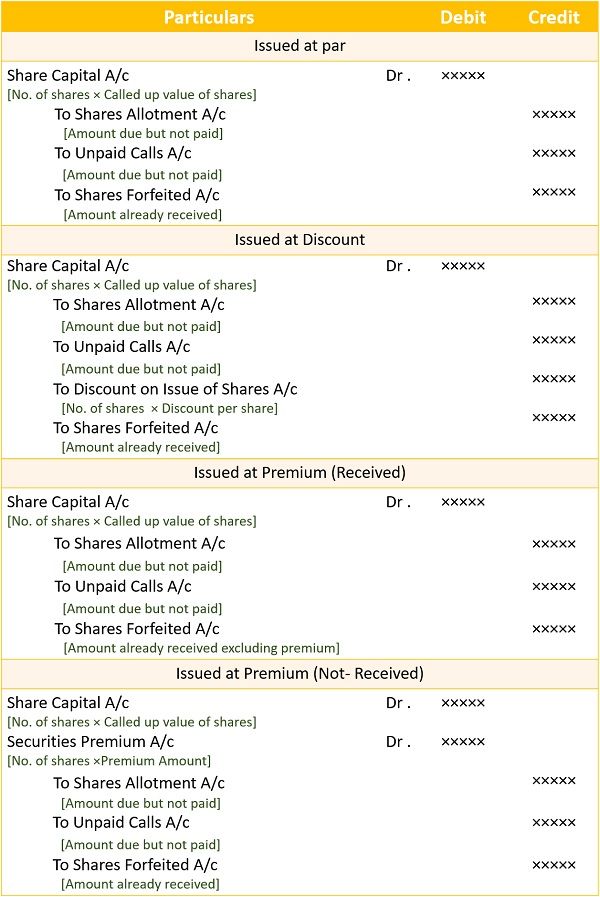

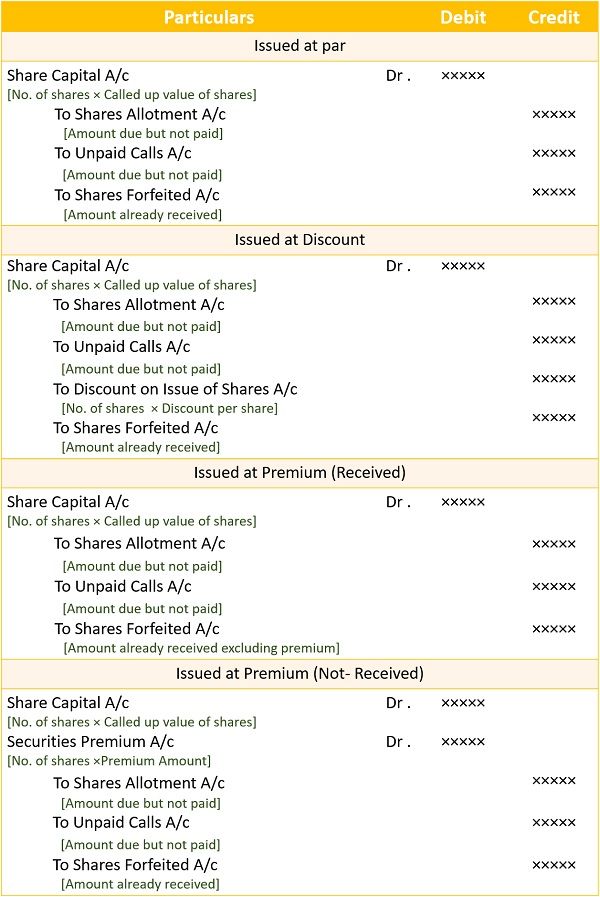

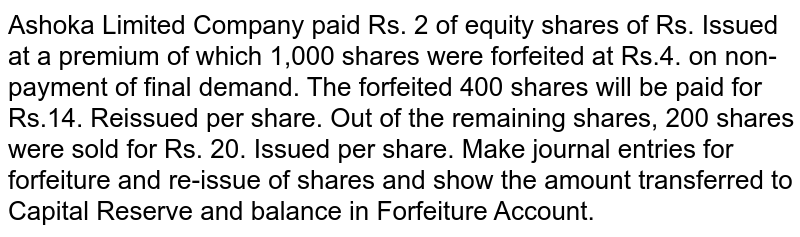

Accounting Treatment of Forfeiture of Shares At the time of issue, we recorded the share capital on the credit side. Forfeited shares often result from when investors in equity shares fail to comply with pre-specified purchase agreements or restrictions. The company can then reissue those shares. She decodes industry jargon, making complicated finance topics like paying taxes, managing a portfolio, and boosting a credit score easy to understand. The compilation of these Forfeiture of Shares There are circumstances under which the shares of a stakeholder can be forfeited by the company under the provisions of the law. Any amount of profit on re-issue is a capital receipt and should be transferred to capital reserve account because this profit is a capital gain for the company. The accounting entries for the Forfeiture of Shares issued at par are as follows.

"Forfeiture of Shares: Practical Problems and Solutions"

Such money will not be refunded. The proportion is applied to the total stock-based compensation expense. Seth, the holder of 1,000 shares, did not pay the amount due on call and his shares were forfeited by the company. With this type of agreement, a company agrees to sell and issue its stock before it receives payments, which may be made in multiple installments. Before such forfeiture is done a notice must be given to the shareholder.

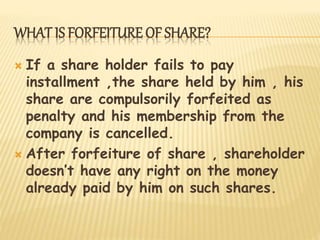

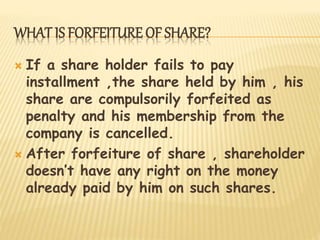

FORFEITURE OF SHARES Definition

The premium was payable on an allotment. The called-up amount is credited to its relevant account. What is a forfeiture charge? You are free to use this image on your website, templates, etc. Solution Practical Problem 5 A Ltd. In fact, sometimes, the shareholders have to pay installments for owning the shares.

Forfeited Shares Definition

The shares represent ownership of the shareholders in the company. The aim of the forfeiture of shares is to motivate and notify the defaulter to pay the dues on time. What is the aim of the process of forfeiture of shares? It can also create complications for the company if it needs to enforce its rights against the former shareholder. Securities Premium amount has been received: In this case, we will debit the Share Capital Account with the amount called up and will credit Forfeited Shares amount received less premium , Shares Allotment amount not received on allotment , First Call amount not received on calls ; Final Call Account in the same manner. Vikram, who was allotted 1,000 Shares, and a notice was served for payment of call money. What are the consequences of the forfeiture of shares? He is liable to pay all the liabilities even after his ownership has been removed. Therefore, at the time of forfeiture of shares, it is debited with a called -up amount.

Forfeiture of Shares

The board forms the top layer of the hierarchy and focuses on ensuring that the company efficiently achieves its goals. It typically involves notifying the shareholder of the company's intention to reclaim the shares, providing them with an opportunity to respond, and then making a decision based on that response. It is done due to delays in payments of the dues, but there is a set period of time to pay the dues. They are recorded as owner's equity on the Company's balance sheet. Solution Journal Alternatively, the first entry can also be passed using the following method: What is the forfeiture and reissue of shares? What is the Forfeiture Rate? Journal entry for forfeiture of shares is: Date Particulars Amount Dr. We need to analyze the initial conditions of the shares issued at the beginning. Carbon Collective's internet-based advisory services are designed to assist clients in achieving discrete financial goals.