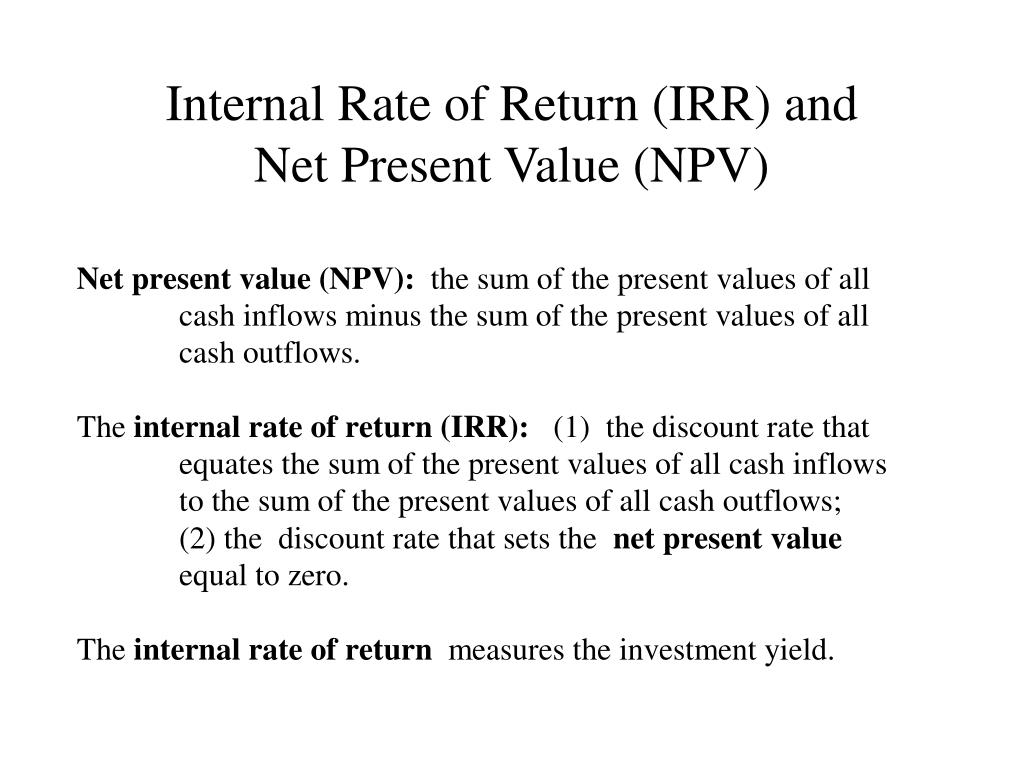

Net present value (NPV) and internal rate of return (IRR) are two commonly used financial metrics that help businesses and investors evaluate the profitability of a potential investment or project. Both NPV and IRR are used to determine the value of an investment by considering the time value of money and the expected cash flows of the investment.

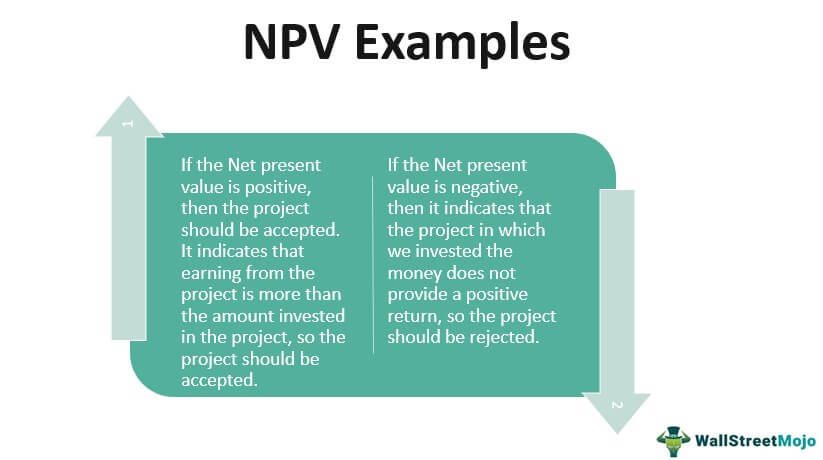

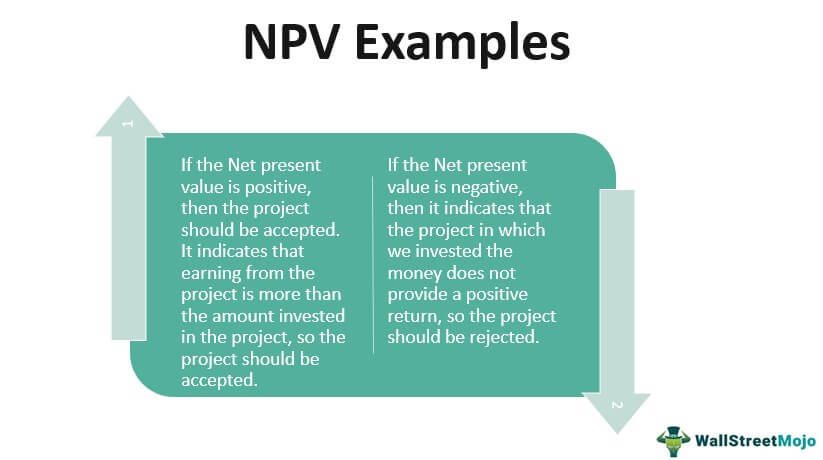

NPV is the difference between the present value of an investment's expected cash flows and the investment's initial cost. To calculate NPV, one must first determine the discount rate, which is used to convert the investment's future cash flows into their present values. The discount rate reflects the time value of money, as it takes into account the fact that money has a greater value today than it does in the future. Once the present value of the investment's expected cash flows has been calculated, it can be subtracted from the investment's initial cost to determine the NPV. A positive NPV indicates that the investment is expected to generate more cash flow than its initial cost, while a negative NPV indicates that the investment is expected to generate less cash flow than its initial cost.

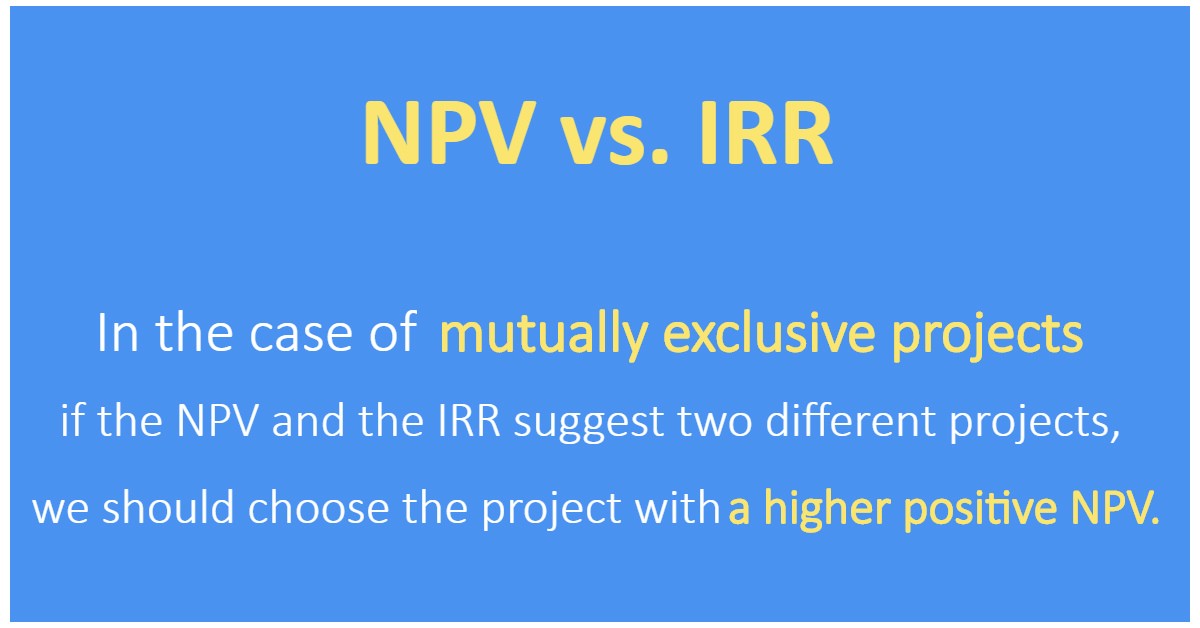

IRR is the discount rate at which the NPV of an investment is equal to zero. In other words, it is the rate of return at which an investment is expected to break even. To calculate IRR, one must first determine the investment's expected cash flows over time, and then use an iterative process to find the discount rate that results in a NPV of zero. The IRR can then be used to compare the profitability of different investments, as it reflects the rate at which an investment is expected to generate returns.

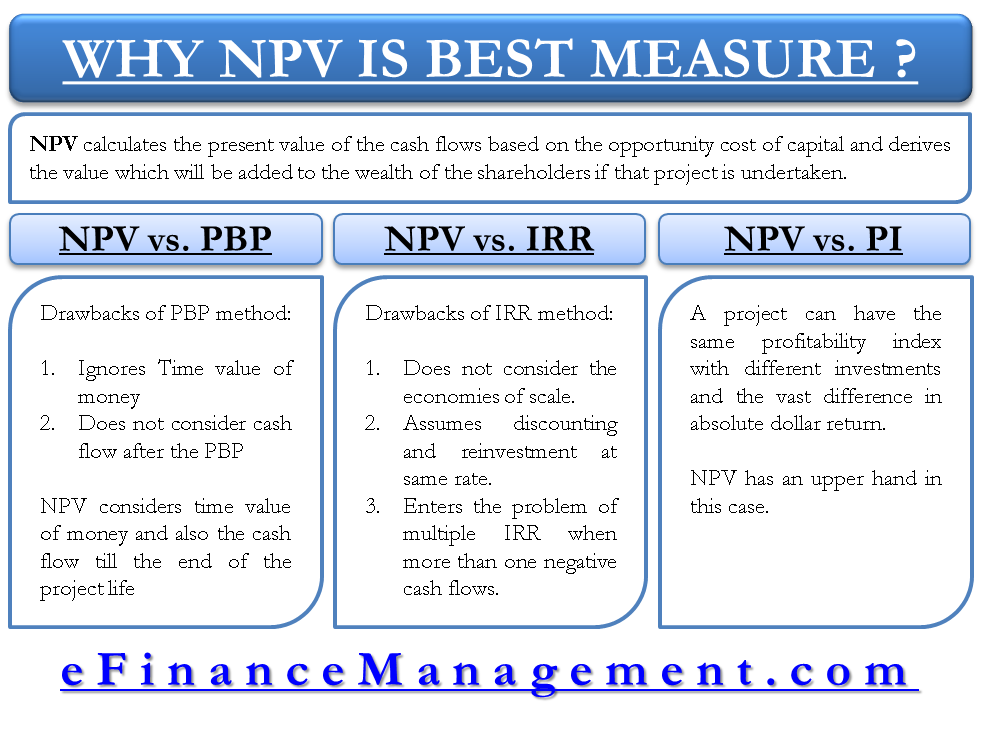

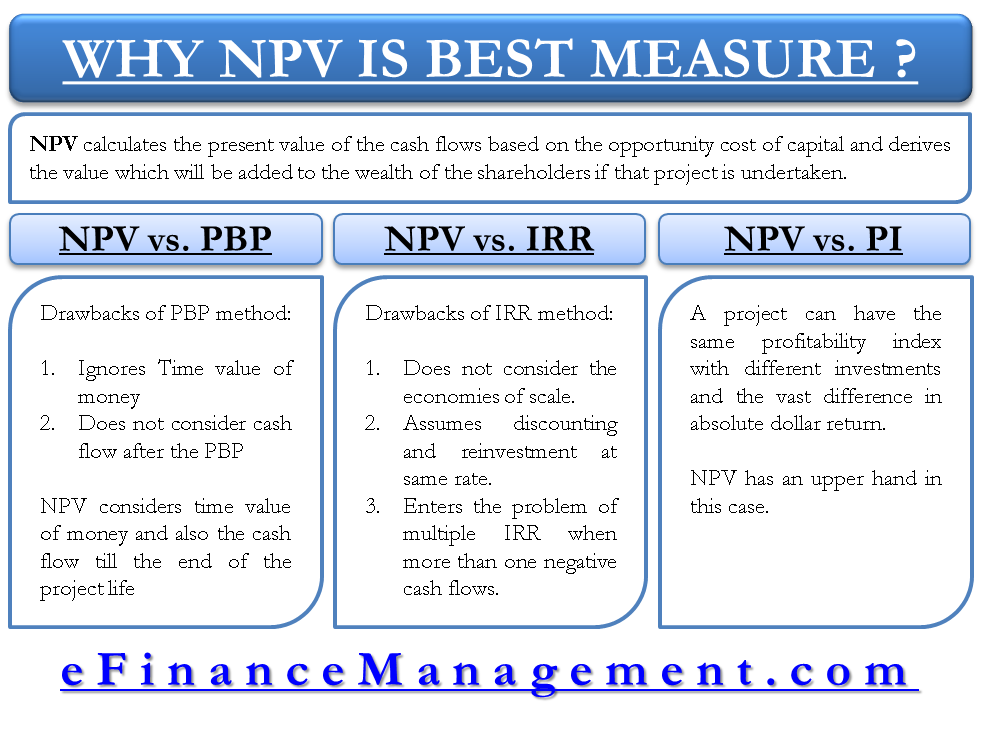

Both NPV and IRR are useful tools for evaluating the profitability of an investment or project. However, there are some limitations to these metrics. For example, NPV relies on the accuracy of the investment's expected cash flows and the discount rate, which can be difficult to predict with certainty. Additionally, IRR assumes that the investment's cash flows are reinvested at the IRR rate, which may not be realistic in the real world. As a result, it is important to consider both NPV and IRR in conjunction with other financial metrics when evaluating the profitability of an investment.

Net Present Value (NPV)

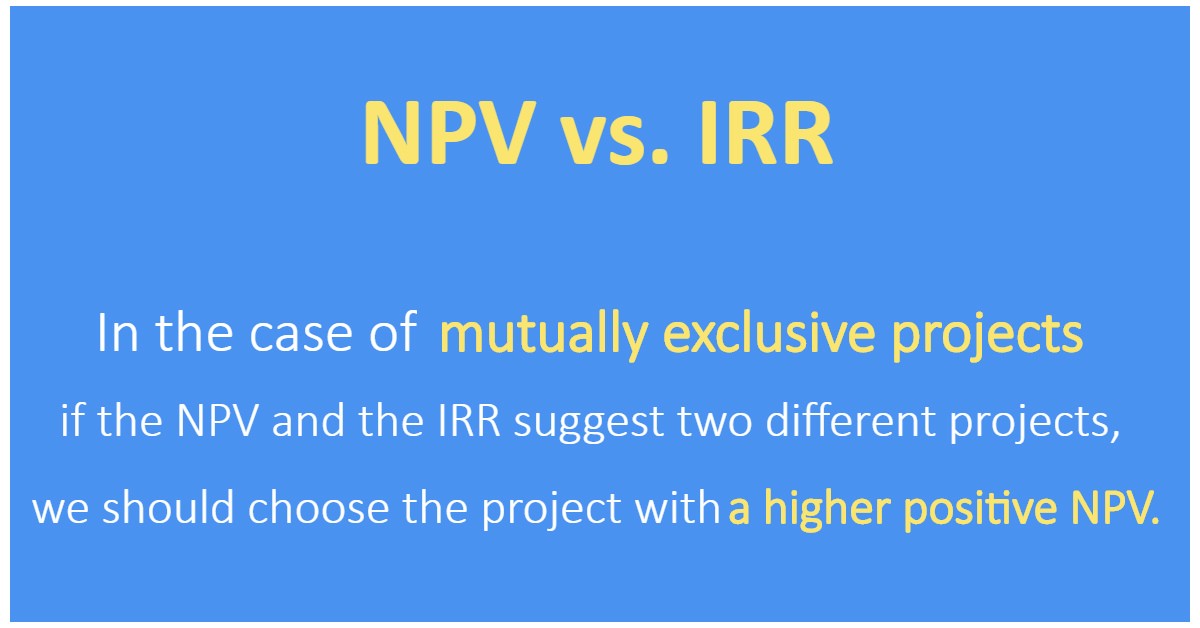

If market conditions change over the years, this project can have multiple IRRs. IRR is the cost of capital required to make a project turn a profit. Then, these cash flows are discounted to present value using a discount rate representing the project's capital costs, risk, and desired rate of return. Put another way, the probability of receiving cash flow from a US Treasury bill is much higher than the probability of receiving cash flow from a young technology startup. While one uses a percentage, the other is expressed as a dollar figure. While NPV and IRR are useful metrics for analyzing mutually exclusive projects — that is, when the decision must be one project or another — these metrics do not always point you in the same direction. Advantages: With the NPV method, the advantage is that it is a direct measure of the dollar contribution to the stockholders.

Internal Rate of Return (IRR) vs. Net Present Value (NPV)

If the NPV is negative, it is not. Vice versa is the case for a negative NPV. Expressed in the form of percentage returns expected from a project. Related: Capital Budgeting: Definition, Importance and Different Methods What is NPV? Absolute Measure: Currency value gained or lost on a project. Jess has a journalism degree from the University of Maryland Philip Merrill College of Journalism. Typically, investors and managers of businesses look at both NPV and IRR in conjunction with other figures when making a decision. Policies with the same premiums and a high IRR are often more desirable.

Internal Rate of Return (IRR) vs. Net Present Value

They may only differ based on their minimum rate of return on the market. The Net Present Value represents the discounted added monetary value a firm gains from a venture, given its net cash flows and opportunity cost of capital. IRR is less useful when making investment choices as its results don't provide information about the amount of money a project is likely to generate. Considering the fact that it pays off in the final year only, we now know why a higher discount rate was applied to it in the first place. To put simply, discounted cash inflows are equal to discounted cash outflows. When a project is an independent project, meaning the decision to invest in a project is independent of any other projects, both the NPV and IRR will always give the same result, either rejecting or accepting a project. However, there are a few differences between IRR and NPV that are also worth mentioning.

Net present value (NPV) profile

Real Estate Finance: Theory and Practice 6th Edition. The returns are measured by the Net Present Value NPV , Internal Rate of Revenue IRR , and Payback Period. NPV is calculated by estimating a company's future cash flows related to a project. This period can be several months or years. In above graph, the point at which the two NPV curves cross each other represents the crossover rate of the projects. IRR can help individuals make financial decisions such as evaluating various insurance policies using death benefits and premiums.

Advantages and Disadvantages: NPV and IRR Essay Example

Related: How To Calculate Discount Rate Using Microsoft Excel Applications You can often use IRR for budgeting a proposed project. . Example: A repair shop can spend some money on several new lifts. Related: What Is Capital? Uses of NPV profile NPV profile is constructed as a part of overall NPV analysis of capital budgeting. NPV values are more difficult to calculate because they require discount rates, which can be hard to determine because financial planners must consider several variables. During the computation of Net Present Value, the discount rate is assumed to be known, and it remains constant.

Should IRR or NPV be Used in Capital Budgeting?

The sum of all discounted cash flows represents the net present value, and the net present value is the difference between the project cost and the income it generates over time. Advantages and Disadvantages: NPV and IRR The difference between the present value of cash inflows and the present value of cash outflows. Recommended Articles This is a guide to NPV vs IRR. If the IRR is above the discount rate, the project is feasible. To get the net present value of a project, you perform a weighted-average cost of capital WACC analysis.