Determinants of interest rates. Factors that Determine Interest Rates 2022-12-17

Determinants of interest rates

Rating:

4,8/10

989

reviews

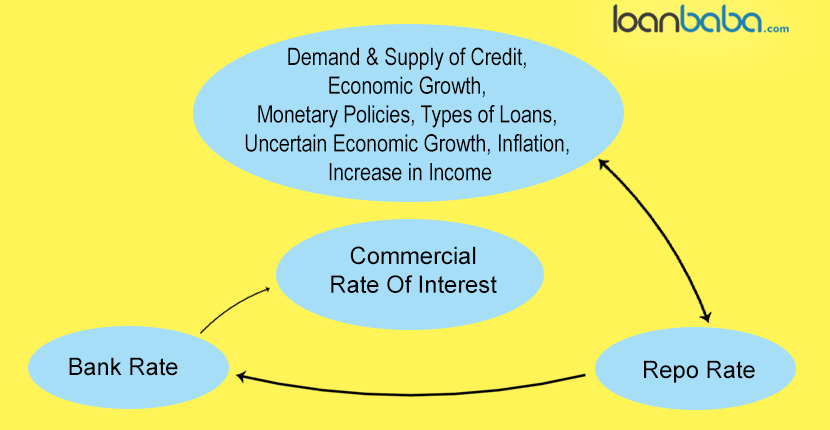

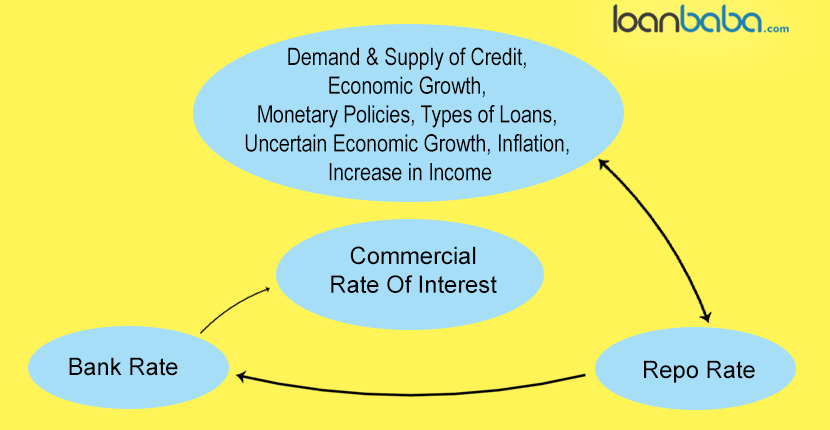

Interest rates are a key factor in the economy and play a central role in financial decision-making for both individuals and businesses. Determining the level of interest rates is the responsibility of central banks, such as the Federal Reserve in the United States, and their decisions can have a significant impact on the economy. There are several key factors that influence the level of interest rates, including:

Inflation: Central banks often set interest rates in order to keep inflation at a target level. If inflation is running high, central banks may raise interest rates in order to slow down the economy and reduce demand for goods and services, which can help to bring down prices. On the other hand, if inflation is low or declining, central banks may lower interest rates in order to stimulate the economy and encourage borrowing and spending.

Economic growth: Interest rates can also be influenced by the overall level of economic activity. In times of strong economic growth, central banks may raise interest rates in order to curb demand and prevent overheating, while in times of weak economic growth, they may lower interest rates in order to boost demand and encourage borrowing and spending.

Creditworthiness: The level of interest rates can also be influenced by the creditworthiness of the borrower. Borrowers with a strong credit history and financial stability may be able to access lower interest rates, while those with a weaker credit history may face higher interest rates as lenders seek to compensate for the increased risk.

Global economic conditions: Interest rates can also be influenced by global economic conditions, as central banks take into account the impact of their decisions on the international economy. For example, if there is a global economic downturn, central banks may lower interest rates in order to stimulate demand and help boost the economy.

Government debt: The level of government debt can also influence interest rates, as higher levels of debt may lead to increased concerns about the government's ability to meet its financial obligations. This can result in higher interest rates as lenders demand a higher return on their investments.

Overall, the level of interest rates is determined by a complex interaction of economic, financial, and global factors. Central banks must carefully consider these factors when setting interest rates, as their decisions can have significant consequences for the economy and the financial well-being of individuals and businesses.

Chapter 2 Determinants of Interest Rates

Similarly, E 3 r 1 is the expected return on a security with a one-year life purchased in period 3. You might feel the most impact on a home mortgage. What the multiplier is and its effects on changes in equilibrium GDP. As the total wealth of financial market participants households, businesses, etc. Moreover, the RBA will generally increase the interest rate if the rate of inflation is over the business cycle or outside its target range as mentioned above. What is its default risk premium? Likewise, if a security is illiq- uid, investors add a liquidity risk premium LRP to the interest rate on the security. Words: 2519 - Pages: 11 Premium Essay Module 2.

Next

The Determinants of Interest Rates

Special Provisions or Covenants Numerous special provisions or covenants that may be written into the contracts under- lying the issuance of a security also affect the interest rates on different securities see Chapter 6. How Interest Rates Affect You Interest rates impact any financial product you have. Due to lack of investor confidence, private investment has reached its lowest point in the recent economic history of the private sector led growth phase 1978 to 2002 in Pakistan. For example, for investors, interest payments on municipal securities are free of fed- eral, state, and local taxes. The market interest rate is the function of many factors including the real cost of money, inflation, risk, etc. We have already described the positive relation between interest rates and the supply of loanable funds along the loanable funds supply curve.

Next

Factors that Determine Interest Rates

Similar to domestic suppliers of loanable funds, foreigners assess not only the interest rate offered on financial securities, but also their total wealth, the risk on the security, and their future expenditure needs. These nominal interest rates or just interest rates directly affect the value price of most securities traded in the money and capital markets, both at home and abroad. What is the yield on 3-year Treasury securities? How adding international trade affects equilibrium output. Accordingly, at every interest rate, the supply of loanable funds decreases, or the supply curve shifts up and to the left. We discuss these ratings in more detail in Chapter 8.

Next

Determinants of Interest Rates

The loanable funds theory proposes that interest rate is determined by the demand and supply of loanable funds. Meanwhile, inflation and market share have no significant relationship with interest rate fluctuations. As a result, interest rates will increase, causing more suppliers of loanable funds to enter the market and some demanders of funds to leave the market. Share this: Facebook Facebook logo Twitter Twitter logo Reddit Reddit logo LinkedIn LinkedIn logo WhatsApp WhatsApp logo Interest rate can be defined as the return to the owner funds or the cost of borrowing money which is lent out or invested. Words: 1679 - Pages: 7 Premium Essay -8988. .

Next

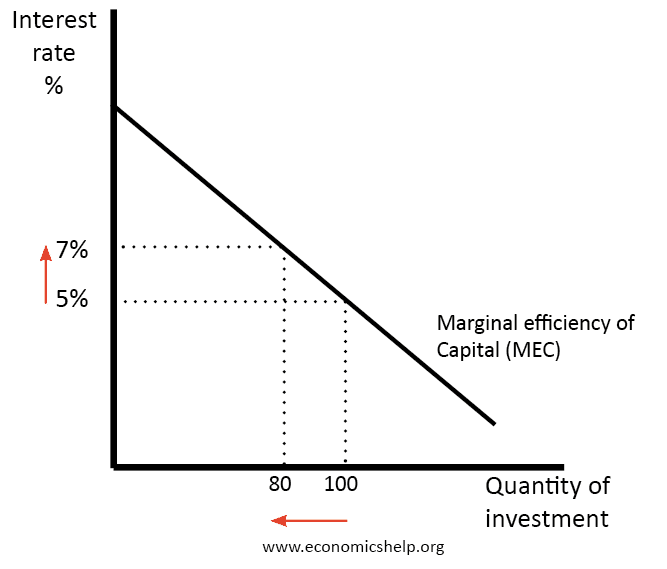

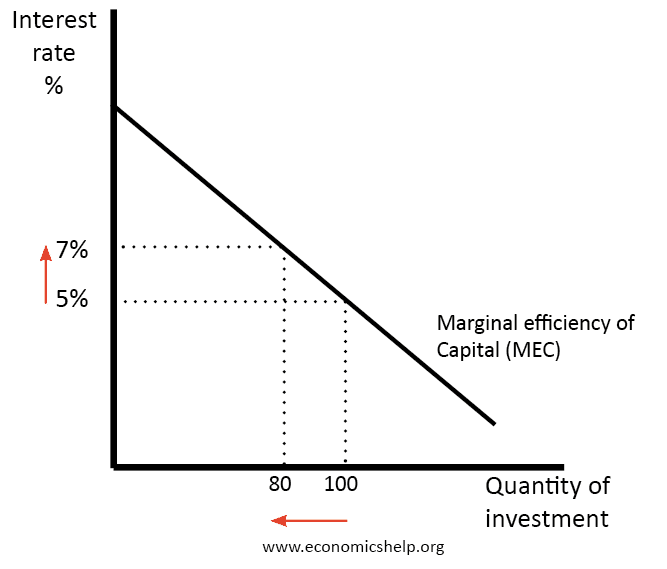

Determinants of Interest Rates Q A

Get Help With Your Essay If you need assistance with writing your essay, our professional essay writing service is here to help! How are interest rates determined? Utilizing a dataset of 662 relatively large commercial banks in 29 OECD countries from 1992 to 2006, we find that banks with relatively large asset sizes, low net interest margins, high impaired loan ratios, and high cost-income ratios tend to exhibit higher non-interest income shares. Words: 5033 - Pages: 21 Premium Essay Impact of Monetary Policy on Inflation. . Impact of interest rate on Investment Introduction: An interest rate is the rate at which interest is paid by borrowers for the use of money that they borrow from a lender. Finally, Section 9 demonstrates how interest rates affect the value of financial securities by reviewing time value of money concepts.

Next

How Are Interest Rates Determined?

The learning objectives have been designed to ensure that the competencies are met. The second is investor demand for U. The equilibrium interest rate point E in Figure 2—3 is only a temporary equilibrium. . Words: 9807 - Pages: 40 Premium Essay Finance.

Next

Determinants Of Interest Rates

Words: 7237 - Pages: 29 Premium Essay Determinants of Banking Instability in Malaysia. This is when the Treasury Note long-term rates are lower than the short-term rates. In order to control external trade deficits, a policy of devaluation increased the cost of production through an increase in prices of imported raw material especially of plant and machinery. Instead, they follow the yields on the 10- or 30-year The U. For this purpose three main variables are selected which are Interest rate, Income level and Investment.

Next

DETERMINANTS OF INTEREST RATES

JULY, 2014 DECLARATION Declaration by the Researcher This research is my original work and has not been presented for a degree in any other University. In general, people prefer to have money paid to them today rather than tomorrow. Conversely, when domestic economic growth is stagnant, market participants reduce their demand for funds. This document also lists the topics, the level of competence for each topic, and the related learning objectives. . Source : Federal Reserve Board Web site, June 2010. .

Next