The development of international accounting standards has played a crucial role in promoting transparency and comparability in the global financial market. Prior to the emergence of these standards, each country had its own set of accounting practices and principles, which made it difficult for investors and other stakeholders to compare the financial performance of companies across borders.

The need for international accounting standards emerged in the mid-20th century as global trade and investment increased and companies began to operate in multiple countries. In 1973, the International Accounting Standards Committee (IASC) was established with the goal of developing a set of accounting standards that could be used globally.

Over the next several decades, the IASC worked to create a comprehensive set of standards that covered various aspects of financial reporting, including the recognition and measurement of assets and liabilities, income and expenses, and financial instruments. In 2001, the IASC was replaced by the International Accounting Standards Board (IASB), which continued the work of developing and promoting the use of international accounting standards.

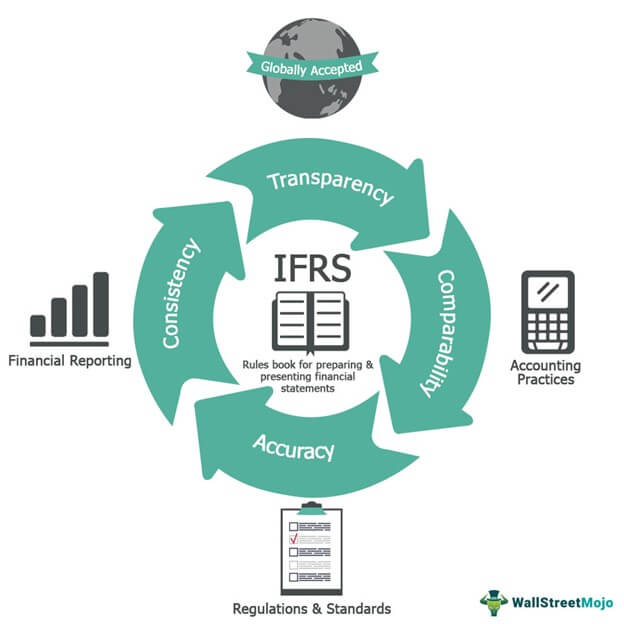

One of the key achievements of the IASB has been the creation of the International Financial Reporting Standards (IFRS), which are a set of internationally recognized accounting standards that provide a common language for business affairs. The IFRS are designed to be used by companies of all sizes and sectors, and are now used in more than 120 countries around the world.

The adoption of international accounting standards has brought numerous benefits to the global financial market. It has facilitated cross-border investment by providing investors with reliable and comparable financial information about companies. It has also helped to increase the transparency of financial reporting, which has improved the confidence of investors in the integrity of financial statements.

In addition to the IFRS, the IASB has also developed a number of other standards and guidelines that are used by companies and auditors around the world. These include the International Standards on Auditing (ISAs), which provide guidance on the conduct of audits, and the International Financial Reporting Standard for Small and Medium-sized Entities (IFRS for SMEs), which is a simplified set of standards designed for use by smaller companies.

Despite the progress that has been made in the development of international accounting standards, there are still challenges that need to be addressed. One of the main challenges is the need to ensure that the standards are consistently applied and interpreted across different countries and cultural contexts. In addition, there is a need to keep the standards updated to reflect the changing nature of the global economy and business practices.

In conclusion, the development of international accounting standards has played a crucial role in promoting transparency and comparability in the global financial market. The adoption of these standards has facilitated cross-border investment and increased the transparency of financial reporting, which has improved the confidence of investors in the integrity of financial statements. However, there are still challenges that need to be addressed, including the need to ensure consistent application and interpretation of the standards across different countries and cultural contexts.