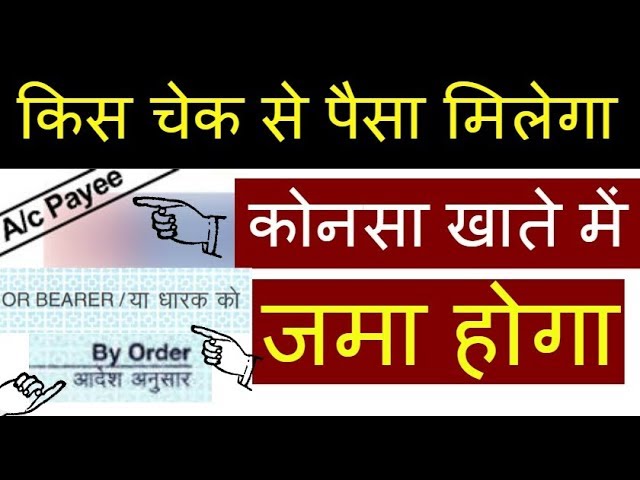

A bearer cheque is a type of negotiable instrument that is payable to whoever presents it for payment. In other words, the person who holds the physical cheque is entitled to receive the funds written on it. Bearer cheques are not personalized and do not require endorsement for the funds to be transferred.

On the other hand, an order cheque is a type of cheque that is payable to a specific individual or organization. In order to receive the funds from an order cheque, the payee's endorsement is required. This means that the payee must sign the back of the cheque in order to transfer ownership and claim the funds. Order cheques are often used when the payee is not present at the time the cheque is issued, or when the payee wishes to transfer ownership of the cheque to another party.

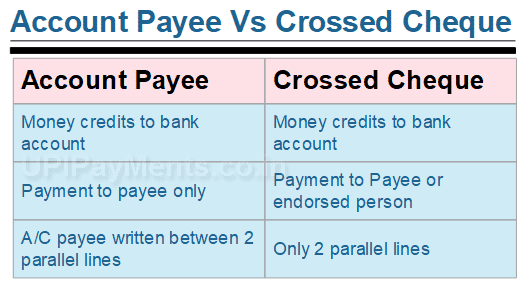

There are a few key differences between bearer cheques and order cheques. One of the main differences is that bearer cheques are generally considered to be more risky for both the issuer and the payee. This is because anyone who possesses a bearer cheque can present it for payment, regardless of whether they are the intended recipient of the funds. This means that if a bearer cheque is lost or stolen, the issuer may have a difficult time recovering the funds.

In contrast, order cheques are considered to be safer because they require endorsement before the funds can be transferred. This means that the payee must physically receive the cheque and sign it before the funds can be claimed. This helps to prevent fraud and ensures that the funds are being transferred to the intended recipient.

Another difference between bearer cheques and order cheques is that bearer cheques are generally considered to be less common. While they were once a popular form of payment, they have largely been replaced by other forms of payment such as electronic transfers and debit cards. Order cheques, on the other hand, are still a common form of payment, particularly in business transactions where the payee may not be present at the time the cheque is issued.

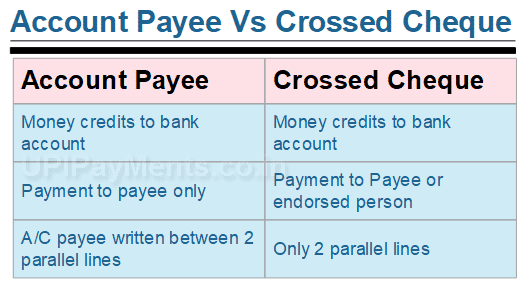

In conclusion, the main difference between bearer cheques and order cheques is the way in which they are transferred and the level of security they offer. Bearer cheques are payable to whoever presents them for payment, while order cheques are payable to a specific individual or organization and require endorsement before the funds can be transferred.

[PDF Notes] Difference between “Order” and “Bearer Cheques”

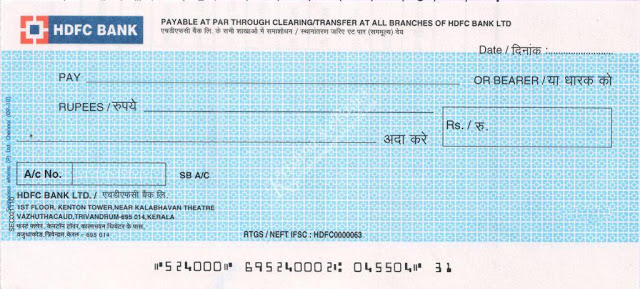

When compared to flyers and leaflets, which are throw-away documents, a brochure is a promotional sales tool, which is meant to be kept and refer more than once. For example while buying a car if buyer has to pay the amount of car in 24 months then he can issue 24 cheques for the next 24 months to the supplier of the car and these are called postdated cheques. For a cheque to be a bearer cheque it must contain the words "or Bearer" on the document and it must not contain words which prohibit transfer for eg. The invention of cheques is credited to the ancient banking systems; this method of payment eased and increased trade because it crossed out the strenuous and sometimes dangerous need for traders to carry large quantities of forms of legal tenders such as gold, to transact business. . Moreover, one must note that a bearer cheque is always a bearer.

What is the difference between order and bearer?

The Act states that if a cheque is to be made payable to order, the payee must be specified with certainty. A bearer cheque can be used to be payable as Cash or bearer with a specific name. Pay to order checks can also remain pay to order if they are endorsed over to another party, with that party then becoming the new order to whom the check will be paid. But now, if you see the charts, most of the top brokers are discount brokers covering more than 50% of the active investors. . Full-Service Brokers … Last updated on July 20, 2022 by Surbhi S While a pamphlet is a non-commercial advertising tool, a brochure is a commercial one.

What is the difference between order cheque and bearer cheque? What is a bearer cheque? What is an order cheque?

The mere signature of the transferer will be sufficient to transfer or negotiate the cheque. The cheque sometimes can be made payable to Cash or bearer or made payable to a specific name, for example, Ahmad Osman or Bearer. That is, it is not registered to any individual but is payable to the person who possesses it. . This means that if you take the cheque to the bank, the bank issues payment to you against the cheque. If you lost it, somebody else could encash it.

What Is Difference Between Bearer Cheque And Order Cheque?

Further, the payee can pass this cheque to another party by signing on the back of the cheque, who can take payment on the payee's behalf. Sometimes, the cheque may be issued to pay Cash. Look it another way, think of the broadband service, electricity service or gas service that you avail at your home, the companies that render those services are all service-based companies. Meaning that no endorsement can make the cheque payable except to its holder. .

Key Differences

The letter tells the bond agent who is to be paid and the address where the payment is to be sent. When an order cheque is endorsed in blank? Since the resulting order cheque may be converted back to a bearer cheque by means of a blank indorsement, it is clear that the Act has no fundamental policy against the conversion of one form of cheque to the other. On the contrary, an audit report contains a statement of fact or expression of opinion about the truth and fairness of the fact, figures and statements. But there is an exception when there is the conversion of cheque from bearer to order. However, scheduling involves the allocation of resources or production facilities to process work … Last updated on May 30, 2022 by Surbhi S An audit certificate ratifies the truth and correctness of a fact, figure or statement. This is why it is often dangerous to endorse a check immediately and why it makes a great deal more sense to attempt to endorse the check only when actually using it.