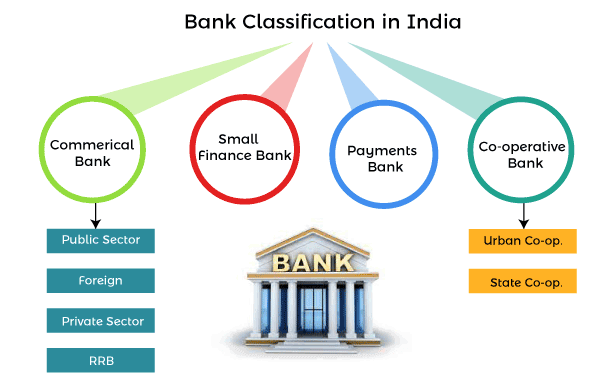

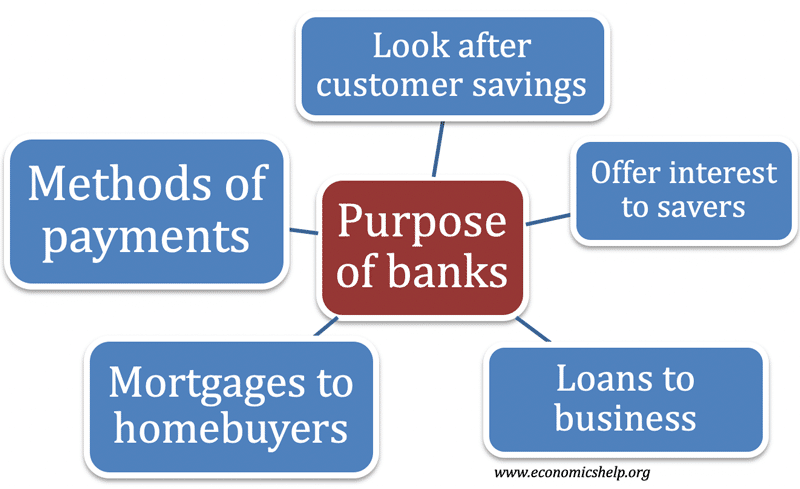

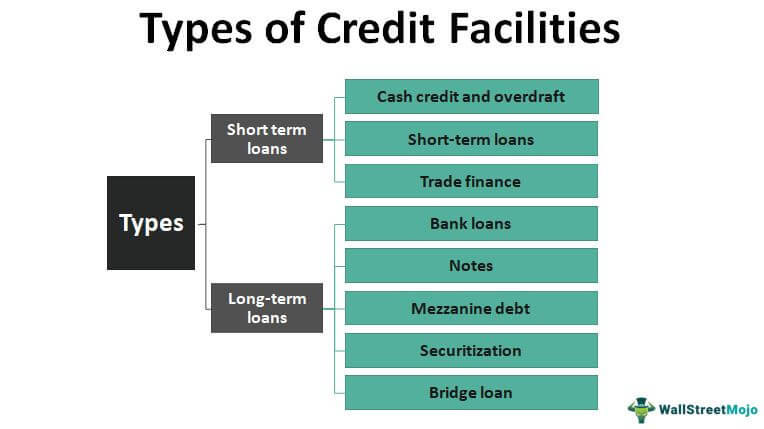

Banks are financial institutions that provide various financial services to their customers. These services include accepting deposits, making loans, and facilitating the transfer of funds. Banks can be classified into different categories based on various criteria such as the type of services they offer, their ownership structure, and the size of their operations.

One way to classify banks is based on the type of services they offer. Commercial banks are the most common type of bank and they offer a wide range of services to businesses and individuals. These services include accepting deposits, making loans, and facilitating the transfer of funds. Commercial banks also offer services such as checking and savings accounts, debit and credit cards, and online banking.

Another type of bank is an investment bank, which specializes in providing financial services to businesses and governments. Investment banks assist with the issuance of securities, such as stocks and bonds, and also provide financial advice and underwriting services. Investment banks do not typically accept deposits from the general public and do not make loans to individuals.

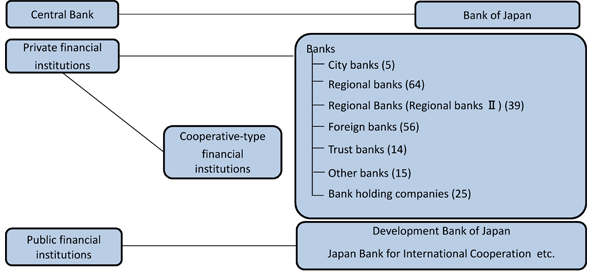

A third type of bank is a central bank, which is a government-owned financial institution that regulates the monetary policy of a country. Central banks are responsible for managing a country's money supply and interest rates, and they also act as a lender of last resort to other banks in times of financial crisis.

Banks can also be classified based on their ownership structure. Some banks are owned by shareholders and are known as publicly-traded banks. These banks are required to disclose financial information to the public and are subject to government regulations. Other banks are owned by a single person or a group of individuals and are known as privately-owned banks. These banks are not required to disclose financial information to the public and are not subject to the same level of regulation as publicly-traded banks.

Another way to classify banks is based on the size of their operations. Some banks are small, local institutions that serve a specific community. These banks are known as community banks and they often have a close relationship with their customers. Other banks are large, national or international institutions that serve a wider geographical area. These banks are known as large banks or multinational banks.

In conclusion, banks can be classified in various ways based on the type of services they offer, their ownership structure, and the size of their operations. Understanding the different types of banks and the services they offer can help individuals and businesses make informed decisions about their financial needs.