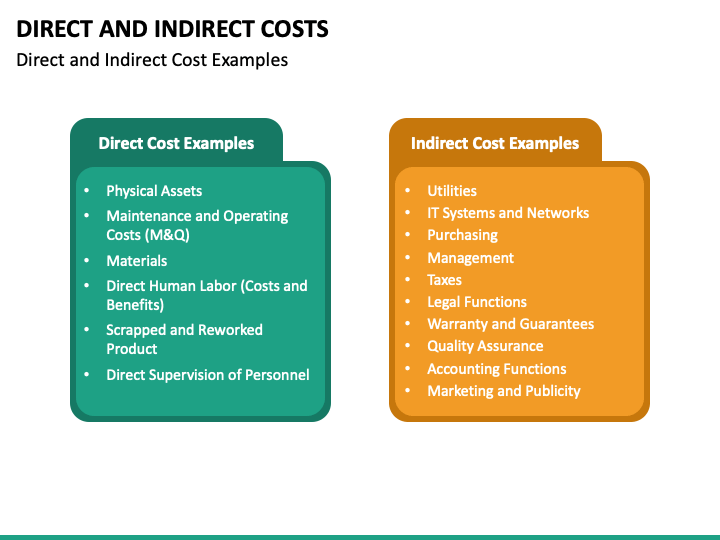

Direct and indirect rates are terms that are commonly used in the field of project management, particularly in relation to the pricing of services or products. In general, a direct rate is a cost that can be directly attributed to a specific project or task. This might include the labor costs of employees working on the project, materials used specifically for the project, and other expenses that are directly related to the project.

Indirect rates, on the other hand, are costs that are not directly tied to a specific project or task, but are still necessary for the operation of the business. These might include overhead expenses such as rent, utilities, and insurance. Indirect rates are often calculated as a percentage of direct costs and are used to cover the expenses that are not directly tied to a specific project.

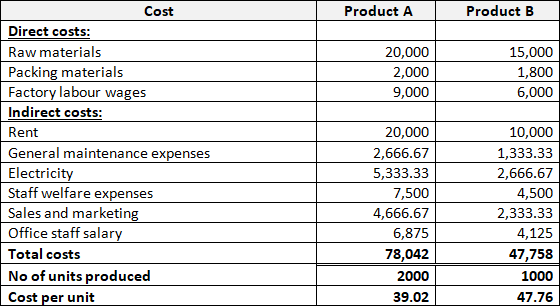

One important aspect of direct and indirect rates is that they are often used to determine the final cost of a project. When bidding on a project, a company will typically provide a quote that includes both direct and indirect costs. This allows the customer to understand the full cost of the project and make an informed decision about whether to move forward with the work.

There are several factors that can influence the direct and indirect rates that a company charges for its services. For example, the complexity of the project, the level of expertise required, and the availability of materials can all affect the direct costs of a project. Indirect costs, on the other hand, might be influenced by factors such as the location of the business and the size of the company.

In conclusion, direct and indirect rates are important concepts in project management, as they help to determine the total cost of a project. Direct rates are costs that are directly tied to a specific project or task, while indirect rates are costs that are necessary for the operation of the business but are not directly tied to a specific project. Understanding these rates is crucial for businesses when it comes to pricing their products and services and for customers when evaluating the cost of a project.

Direct vs. Indirect Labor: What's the Difference?

Indirect costs are one of the most confusing, misunderstood and controversial concepts in nonprofit financial management. You want to make sure customers pay you more than what you pay to produce your products or offer your services. These include fuel for office cars, property insurance and other general business expenses that you can't trace back to any product or service. It is probably the most contentious subject under accounting for government contracts. This includes office space, salaries for management where management overlooks more than one project, salaries of workers that are shared between projects, etc. Even the federal government is finally acknowledging the importance of funding a fair share of running your organization itself, not just its programs. Foreign exchange risk management There are three ways in which a company can be exposed to foreign exchange risk: a The transaction exposure can be management using either a The translation exposure can be managed using the balance sheet hedge.

Indirect cost rates

In a multi-tiered indirect rates structure indirect costs are allocated in a hierachy structure to other costs, and finally to the allocaiton base to develop the cost pools. Direct labor refers to any employee that is directly involved in the manufacturing of a product. In one instance, board meeting snacks and lunches were recorded as indirect costs and included in the indirect pool. To do this, find the overhead rate, or indirect cost ratio. It is a manner of assuring fair and equitable reimbursing across different businesses and organizations. If you have a service business, your direct labor costs are the wages of staff members that provide services directly to your customers, which would include retail salespeople, wait staff, beauty salon stylists, and even accountants and attorneys.

A Guide to Understanding Indirect Costs and Indirect Rate Structuring

Indirect costs may not be easily identifiable, but they're still important in business operations. Most indirect pools contain 5 to 8 accounts that drive 70 to 85 percent of the costs in that pool. This indirect rate should be valid for one year. Yes they can be, but it depends on the treatment of the costs. Direct labor employees will require support costs such as supervisory salaries, other indirect salaries, office supplies, equipment, building utilities, training, payroll taxes, insurance, lease or rent, depreciation of buildings and equipment, and maintenance of building or factory space. Not all firms will have all of these categories, nor will all firms break them out to this level of detail or in this manner. Some of the key factors to consider include the following: 7 Indirect Cost Pools In order to calculate an indirect cost rate, a company must first group all indirect costs into distinct indirect cost pools.

Exchange Rates

Job Type of Business Direct or Indirect Labor Reason Accountant Manufacturing Indirect Not directly involved in product production Accountant Service Direct Directly provides services to customers Welder Manufacturing Direct Directly involved in product production Assembly worker Manufacturing Direct Directly involved in product production Machinist Manufacturing Direct Directly involved in product production Quality control Manufacturing Indirect Quality control oversees all products so it cannot be tied back to one individual product Administrative assistant Service Indirect Not directly involved in providing services Security Service Indirect Not directly involved in providing services Security Manufacturing Indirect Not directly involved in providing services Painter Manufacturing Direct Directly involved in product production The chart lists various jobs and whether they should be considered direct or indirect labor. Indirect Costs Indirect Costs are a little more complex. Indirect costs, on the other hand, are expenses that cannot be directly traced to a specific cost object but are incurred in the process of producing or providing a product, service, or project. The smaller your overhead rate, the better. Investments in office technology improve efficiency, reduce costs and can help attract and retain top talent. It might be challenging to forecast how much money a company may need if you don't know whether certain expenses are direct or indirect.