The capital structure of a company refers to the way in which the company finances its operations and growth through a combination of debt and equity. While there are several advantages to using a mix of debt and equity in a company's capital structure, there are also a number of disadvantages that companies should be aware of when deciding on their capital structure.

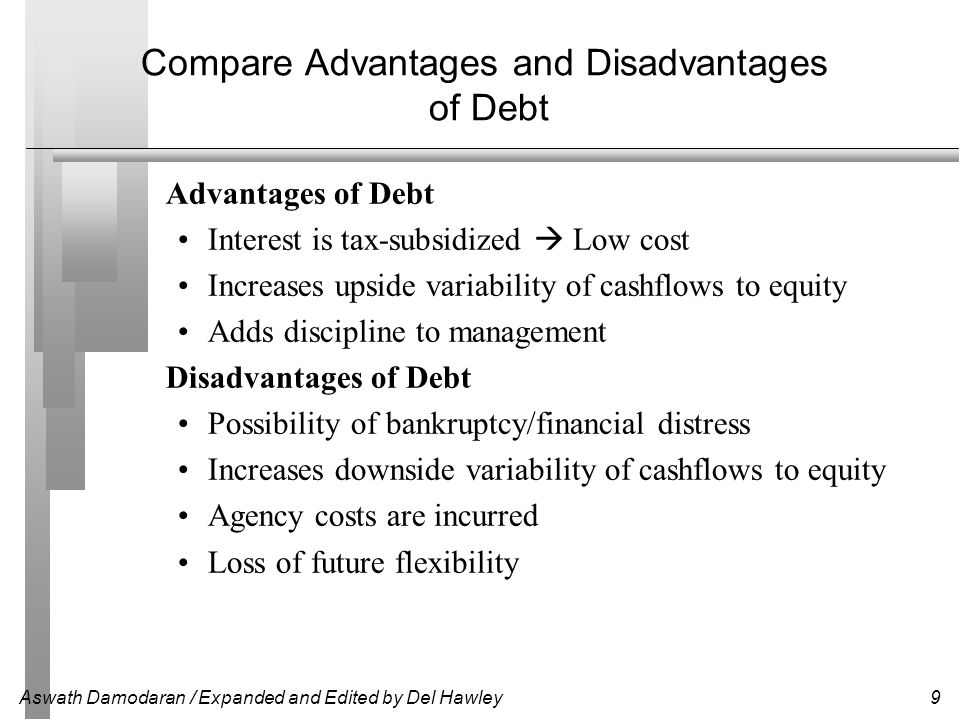

One of the main disadvantages of capital structure is the cost of debt. When a company borrows money, it is required to pay interest on the loan. This can be a significant expense for the company, especially if it has a high level of debt relative to its equity. Additionally, if the company is unable to make its debt payments, it may be at risk of default, which can have serious consequences for the company's credit rating and ability to borrow in the future.

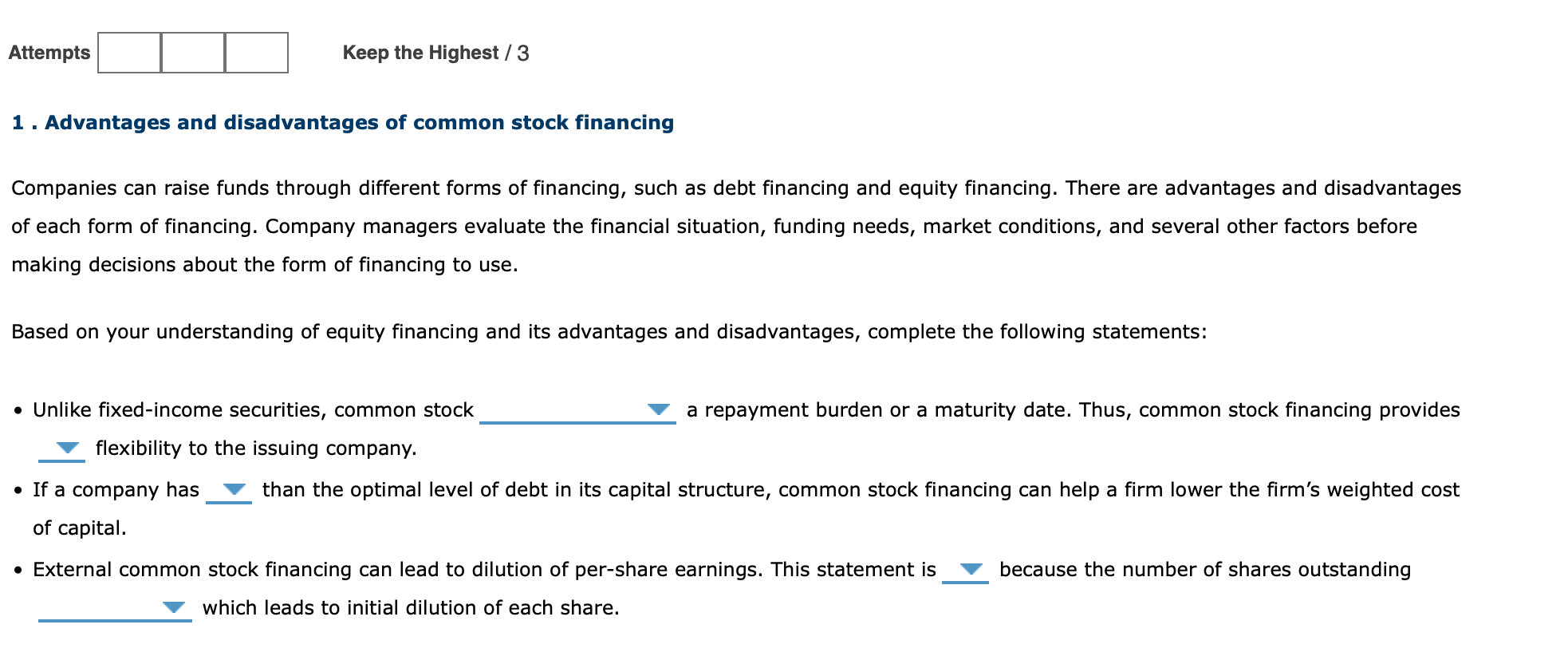

Another disadvantage of capital structure is the potential for dilution of ownership. When a company raises capital through the sale of equity, it is essentially selling a portion of the company to investors. This can dilute the ownership of existing shareholders, as they now own a smaller percentage of the company. This can be particularly problematic for founders or other early investors who may feel that they are losing control of the company as it grows and takes on additional equity investors.

A third disadvantage of capital structure is the potential for conflicts of interest between shareholders and creditors. Shareholders are typically interested in maximizing the value of their equity, while creditors are more concerned with the company's ability to repay its debts. This can lead to tension and conflict between these two groups, especially if the company is facing financial difficulties.

Finally, the capital structure of a company can also impact its flexibility and ability to respond to changing market conditions. If a company has a high level of debt, it may be more restricted in its ability to raise additional capital or make strategic investments, as it may be unable to take on additional debt or may face higher borrowing costs due to its existing debt burden.

In conclusion, the capital structure of a company is a key consideration for any business, as it can have significant impacts on the cost of financing, ownership structure, and flexibility of the company. While there are advantages to using a mix of debt and equity in a company's capital structure, it is important for businesses to carefully consider the potential disadvantages and ensure that their capital structure is appropriate for their needs.