Foreign direct investment (FDI) refers to the direct investment of foreign assets into domestic structures, equipment, and organizations. It is a major source of capital for developing countries, as it can bring in much-needed capital, technology, and management expertise. However, FDI also has its disadvantages, particularly for developing countries.

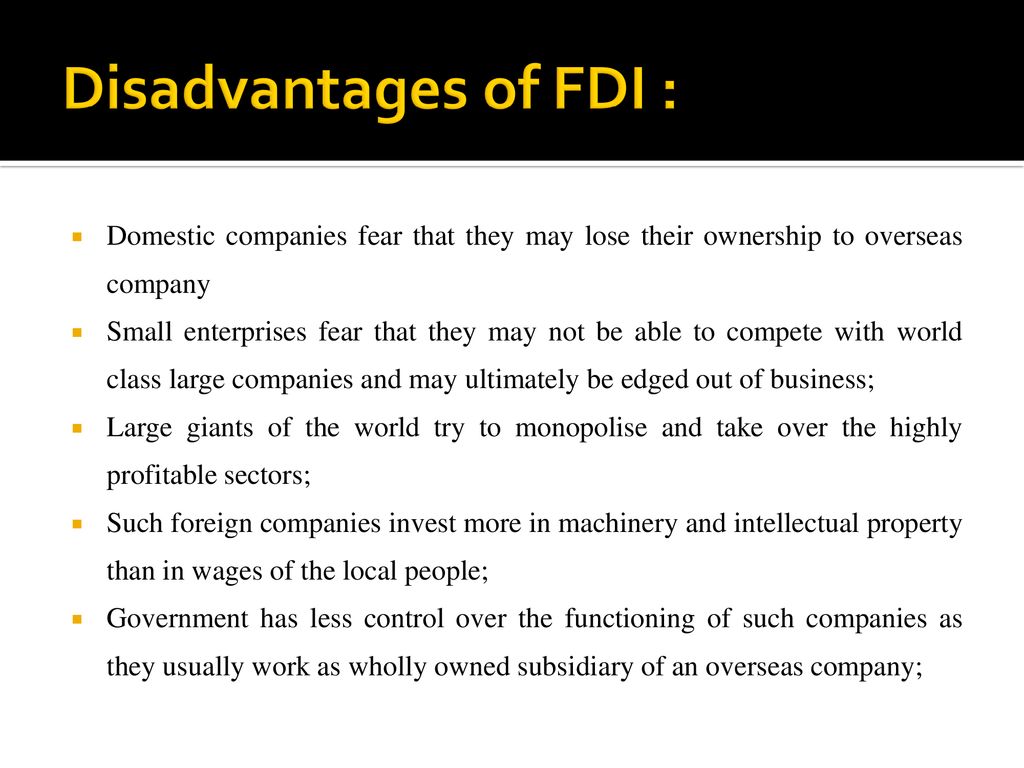

One major disadvantage of FDI in developing countries is that it can lead to a loss of domestic control over the economy. When foreign companies invest in a developing country, they often bring with them their own management and production systems, which can displace local management and workers. This can lead to a loss of control over the domestic economy, as decisions about production and investment are made by foreign firms rather than domestic actors. This can also lead to a loss of cultural identity, as local traditions and practices may be replaced by those of the foreign investors.

Another disadvantage of FDI in developing countries is that it can lead to a lack of technology transfer. While foreign investors often bring with them advanced technologies and management expertise, they may not be willing to transfer this knowledge to local workers and businesses. This can lead to a situation where local workers and businesses are unable to compete with the foreign firms, leading to a further loss of control over the domestic economy.

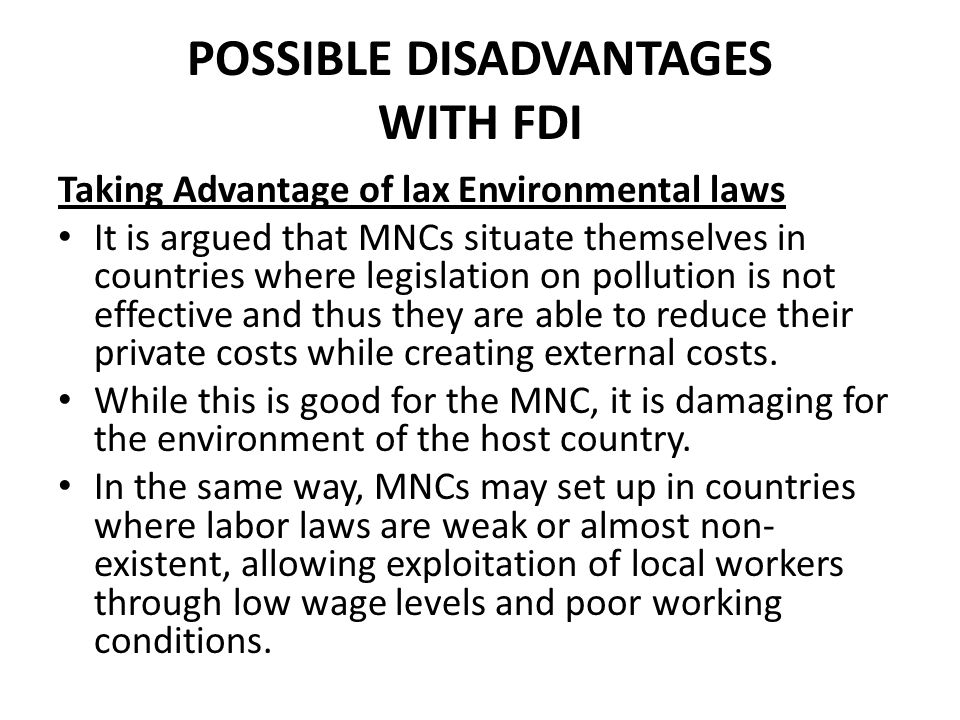

FDI can also lead to environmental degradation in developing countries. Foreign investors may not be as concerned with environmental regulations and standards as domestic firms, and may engage in activities that have negative environmental impacts. This can lead to pollution, deforestation, and other environmental problems that can have long-term consequences for the local population and the environment.

Finally, FDI can also lead to income inequality in developing countries. Foreign firms often pay higher wages than local firms, which can lead to a widening of the income gap between skilled workers who work for foreign firms and unskilled workers who work for local firms. This can lead to social and economic tensions within the country.

In conclusion, while FDI can bring much-needed capital and expertise to developing countries, it also has its disadvantages. It can lead to a loss of domestic control over the economy, a lack of technology transfer, environmental degradation, and income inequality. Developing countries must carefully consider the potential costs and benefits of FDI and take steps to mitigate any negative impacts.