Electronic banking, also known as e-banking or online banking, refers to the use of electronic means, such as the internet or mobile phone apps, to access banking services. E-banking has become increasingly popular in recent years, as it offers convenience and flexibility for customers and can also be cost-effective for banks. However, there are also some potential disadvantages to consider.

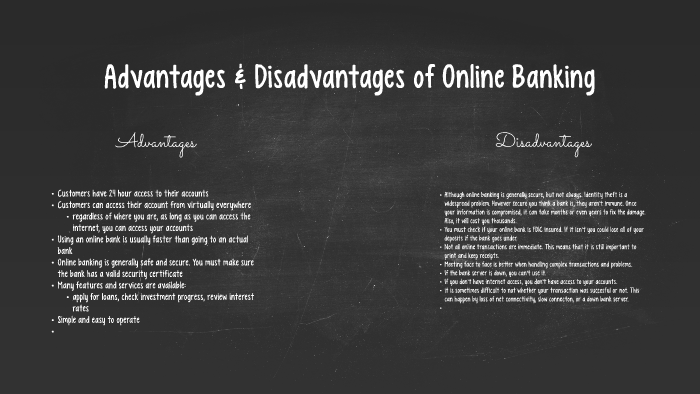

One major advantage of e-banking is the convenience it offers. Customers can access their accounts and conduct financial transactions at any time, from any location with an internet connection. This is particularly useful for people who live in rural areas or have busy schedules that make it difficult to visit a physical bank branch. E-banking also allows customers to easily monitor their accounts, track their spending, and set up alerts for unusual activity.

Another advantage of e-banking is the ability to easily compare financial products and services. Customers can easily search for the best interest rates, fees, and features offered by different banks and financial institutions. This allows them to make more informed decisions about where to open an account or take out a loan.

E-banking can also be cost-effective for both customers and banks. Customers can save time and money by not having to visit a physical bank branch, and banks can save on the cost of maintaining brick-and-mortar branches and hiring staff to work at them.

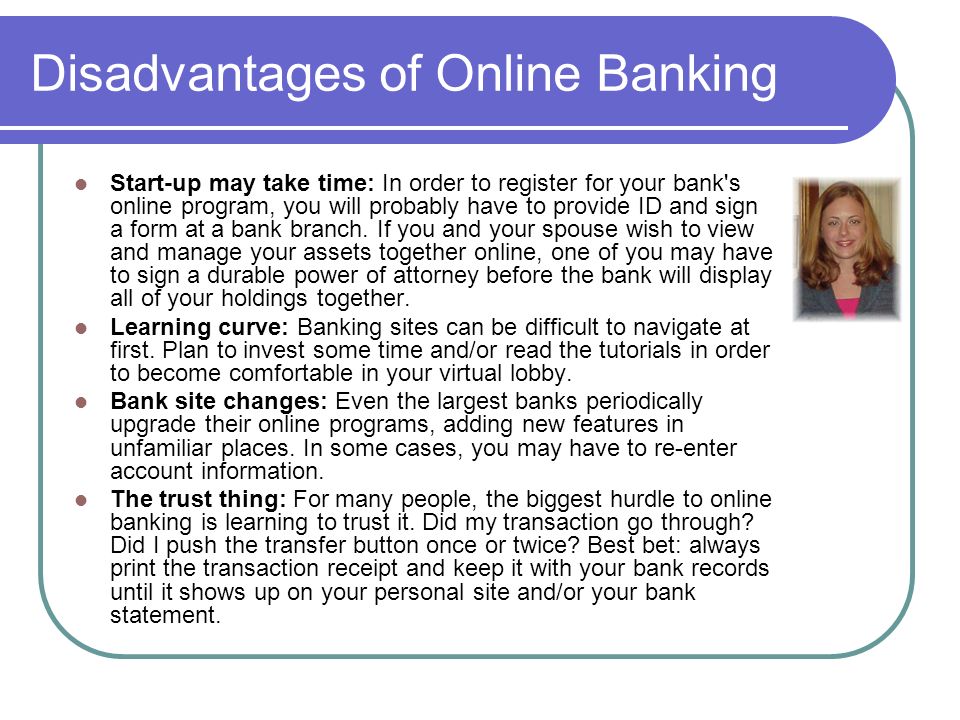

However, there are also some potential disadvantages to consider when it comes to e-banking. One concern is security. While e-banking systems are generally secure, there is always the risk of cyber attacks or other types of online fraud. Customers should be vigilant about protecting their personal information and using secure passwords to minimize this risk.

Another potential disadvantage is that e-banking may not be accessible to everyone. Some people may not have access to the internet or a computer, or may not be comfortable using electronic banking services. For these individuals, traditional banking methods may be more suitable.

Overall, e-banking offers a number of advantages, including convenience, the ability to easily compare financial products and services, and cost-effectiveness. However, it is important to be aware of the potential risks and ensure that personal information is protected.