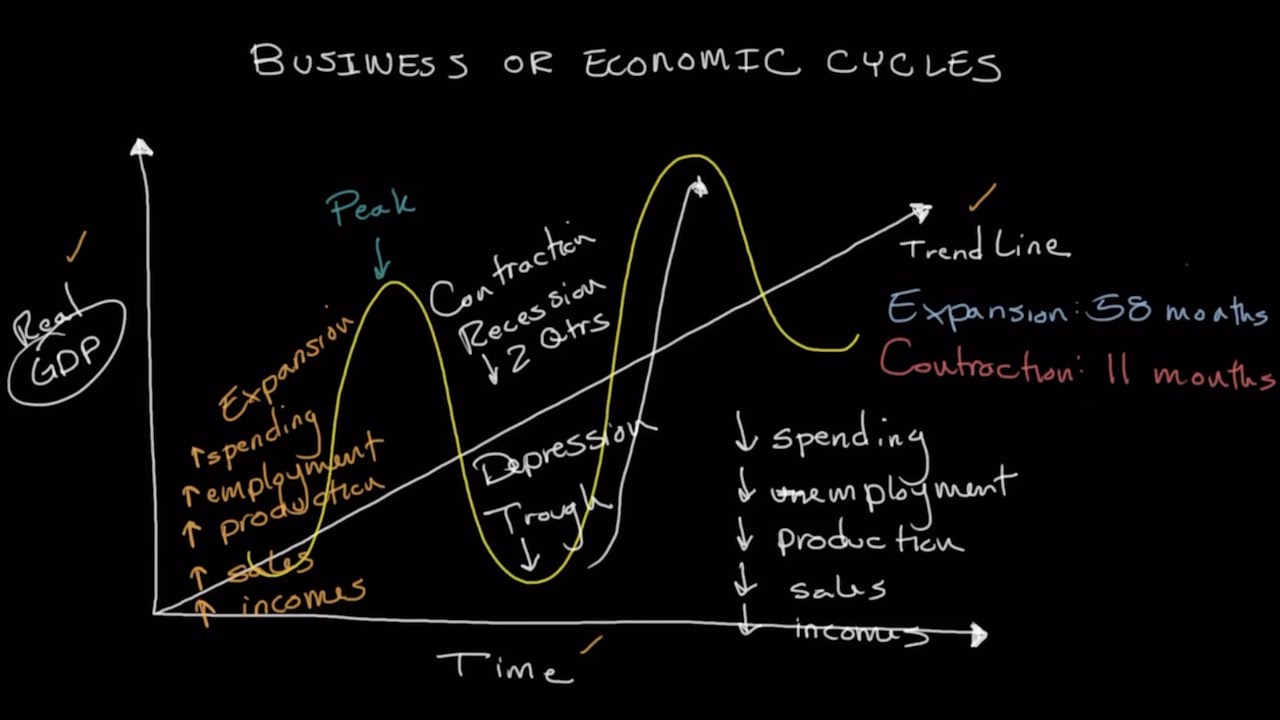

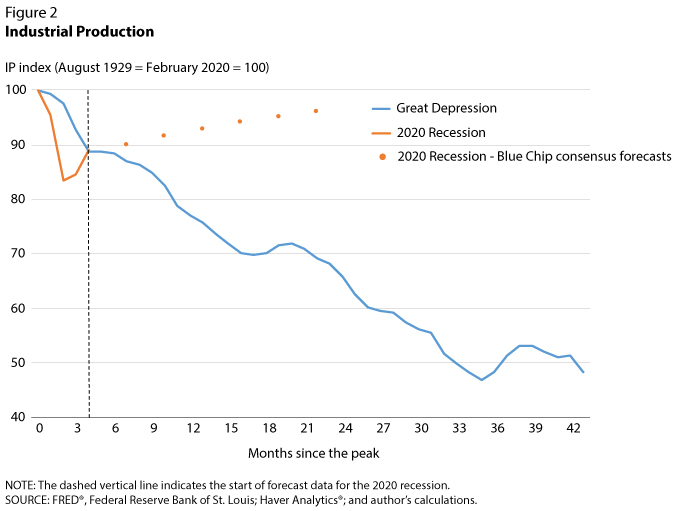

The business cycle, also known as the economic cycle or trade cycle, is the periodic fluctuations in the level of economic activity that an economy experiences over time. These fluctuations are characterized by periods of economic expansion, during which GDP and employment tend to rise, followed by periods of economic contraction, during which GDP and employment tend to fall.

One of the main theories of the business cycle is the Keynesian theory, which emphasizes the role of aggregate demand in driving economic fluctuations. According to this theory, changes in consumer spending, investment, and government spending can lead to fluctuations in economic activity. For example, if consumer spending increases, businesses may see an increase in demand for their goods and services, leading to increased production and hiring. On the other hand, if consumer spending decreases, businesses may see a decrease in demand, leading to decreased production and layoffs.

Another theory of the business cycle is the monetarist theory, which emphasizes the role of the money supply and monetary policy in driving economic fluctuations. Monetarists believe that changes in the money supply, such as those caused by central bank actions, can lead to changes in economic activity. For example, if the central bank increases the money supply, this may lead to increased spending and economic growth. On the other hand, if the central bank decreases the money supply, this may lead to decreased spending and economic contraction.

Regardless of the specific cause of the business cycle, it is important for governments and businesses to be aware of and prepared for these fluctuations. Governments can use monetary and fiscal policy to try to smooth out the business cycle and mitigate its negative effects. For example, during economic contractions, the government may use expansionary fiscal policy, such as increasing government spending or cutting taxes, to stimulate demand and encourage economic growth. On the other hand, during economic expansions, the government may use contractionary fiscal policy, such as decreasing government spending or increasing taxes, to prevent inflation and overheating of the economy.

Businesses can also take steps to prepare for and mitigate the effects of the business cycle. For example, they may diversify their product offerings or markets to reduce the impact of fluctuations in any one area. They may also implement risk management strategies, such as hedging against currency fluctuations or implementing contingency plans in case of economic downturns.

Overall, the business cycle is an important and inevitable aspect of economic activity. By understanding and preparing for these fluctuations, governments and businesses can better navigate the ups and downs of the economic cycle and help to promote stability and prosperity.