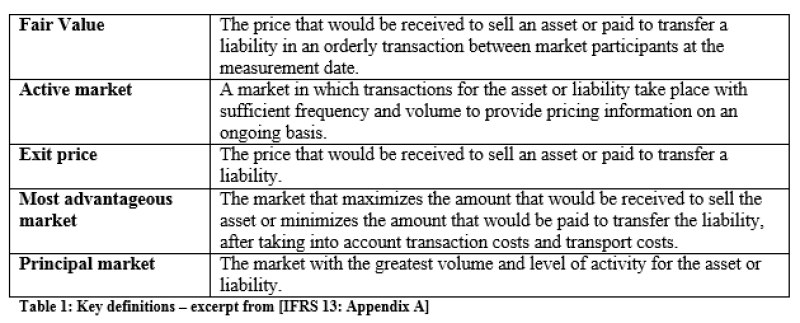

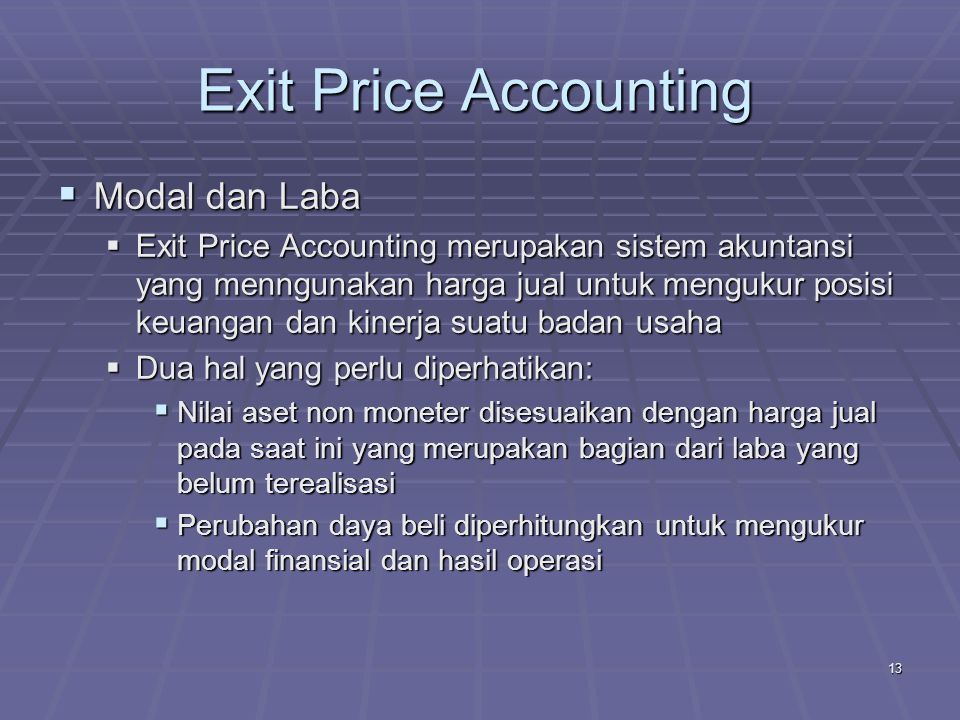

Exit price accounting is a method of valuing inventory that is based on the price at which the inventory is expected to be sold or otherwise disposed of. This approach is in contrast to traditional inventory valuation methods such as first-in, first-out (FIFO) or weighted average cost, which are based on the cost of the inventory when it was acquired.

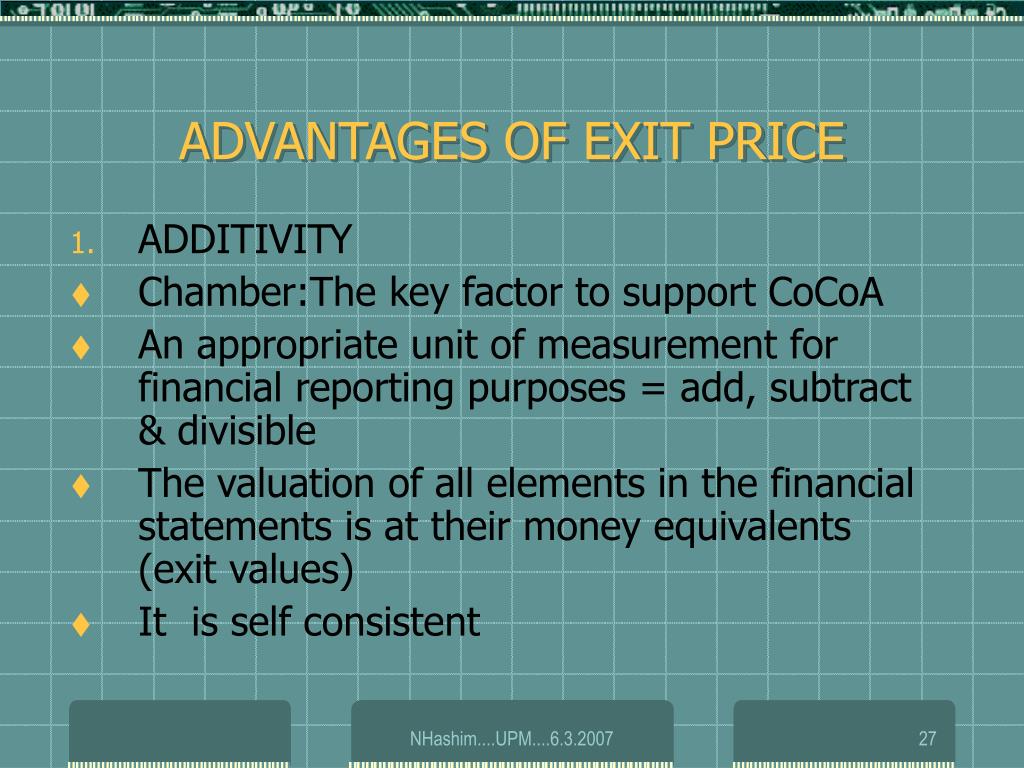

There are several benefits to using exit price accounting. First, it provides a more accurate reflection of the current value of the inventory. The cost of inventory can change over time due to inflation, market fluctuations, and other factors, so basing the value on the expected sale price provides a more realistic picture of the inventory's value.

Second, exit price accounting can be useful in industries where the value of inventory can fluctuate significantly. For example, in the fashion industry, the value of clothing and accessories can change quickly based on changing trends and consumer demand. Using exit price accounting can help ensure that the value of the inventory is more closely aligned with its actual market value.

Finally, exit price accounting can be beneficial for tax purposes. In some cases, using exit price accounting can result in a lower tax liability because the value of the inventory is based on the expected sale price rather than the cost of the inventory when it was acquired.

There are also some potential drawbacks to using exit price accounting. One concern is that it relies on estimates and projections, which can be subject to error or uncertainty. Additionally, if the exit price is lower than the cost of the inventory, this can result in a loss, which can have negative implications for a company's financial statements.

In conclusion, exit price accounting is a method of valuing inventory that takes into account the expected sale price of the inventory rather than the cost of acquisition. While it can provide a more accurate reflection of the current value of the inventory, it is important to carefully consider the potential risks and limitations of this approach.

:max_bytes(150000):strip_icc()/historical-cost-4195079-final-1-d728fd1156554296a0335140ed17a8a3.png)