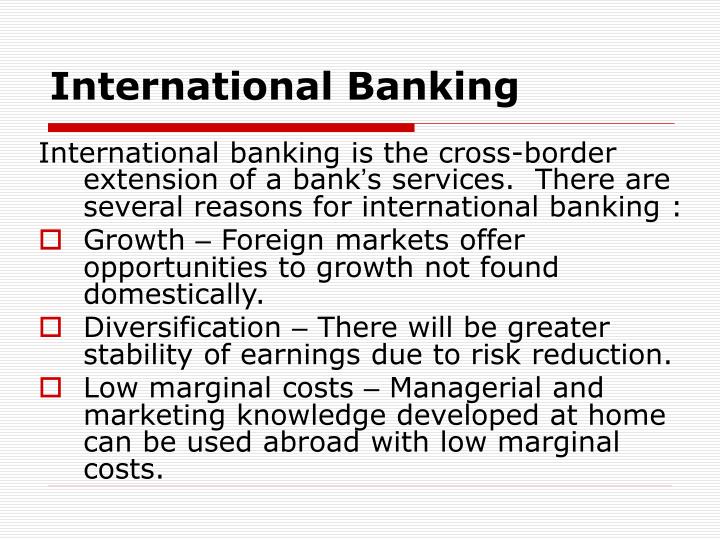

International banking refers to the practice of banks operating in multiple countries, either through branches or subsidiaries. Over the past few decades, international banking has grown significantly, with banks increasingly establishing a presence in multiple countries in order to tap into new markets and diversify their operations. There are several factors that have contributed to this growth.

One factor that has led to the growth of international banking is the increasing globalization of the world economy. As countries have become more interconnected, there has been a corresponding increase in cross-border trade and investment. This has created demand for financial services that can facilitate these transactions, such as foreign exchange and trade finance. As a result, banks have sought to establish a presence in countries where there is demand for these services, in order to capture a share of this business.

Another factor that has contributed to the growth of international banking is the liberalization of financial markets. Over the past few decades, many countries have relaxed regulations on the operations of banks and other financial institutions, allowing them to more easily enter and operate in new markets. This has made it easier for banks to establish a presence in other countries and offer their services to a wider range of customers.

In addition, advances in communication and transportation technology have made it easier for banks to operate internationally. The internet and other digital technologies have made it easier for banks to communicate with and serve customers in other countries, while advances in transportation have made it easier to move people and goods between countries. This has made it easier for banks to set up branches and subsidiaries in other countries and offer their services to a wider range of customers.

Finally, the growth of international banking has also been driven by changes in consumer behavior. As people have become more mobile and more connected, they have increasingly sought out financial services that can meet their needs when they are abroad. This has created demand for banks that can offer services in multiple countries, and has contributed to the growth of international banking.

In conclusion, the growth of international banking has been driven by a combination of factors, including the increasing globalization of the world economy, the liberalization of financial markets, advances in communication and transportation technology, and changes in consumer behavior. These factors have contributed to the growth of international banking and have made it easier for banks to establish a presence in multiple countries and offer their services to a wider range of customers.

:max_bytes(150000):strip_icc()/World_Bank_Final-f8fd38b9721e4772970ed192fa21fdba.png)