The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) are the two main organizations responsible for setting accounting standards in the United States and internationally, respectively. In 2002, the FASB and IASB embarked on a convergence project with the goal of bringing their respective standards closer together in order to reduce the differences between them and create a single set of high-quality, globally accepted accounting standards.

The convergence project has had a number of significant achievements. One of the most notable is the issuance of a new standard on revenue recognition, which replaces multiple industry-specific guidance with a single, principles-based approach. This standard has been adopted by both the FASB and the IASB, and has been widely praised for its clarity and simplicity.

Another important achievement of the convergence project has been the issuance of a new standard on lease accounting. This standard requires companies to recognize leases on their balance sheets, which provides a more accurate representation of their financial position. Both the FASB and the IASB have adopted this standard, and it has been implemented in many countries around the world.

Despite these successes, the convergence project has also faced some challenges. One issue has been the complexity of the standards, which has made it difficult for some companies to implement them. Another challenge has been the different cultural and legal contexts in which the FASB and IASB operate, which can make it difficult to reach a consensus on certain issues.

Despite these challenges, the FASB and IASB have made significant progress in bringing their standards closer together, and their convergence project has had a significant impact on the global accounting landscape. By working together, the FASB and IASB have been able to create a single set of high-quality, globally accepted accounting standards that are used by companies around the world. This has helped to improve the transparency and reliability of financial information, which is essential for the proper functioning of capital markets.

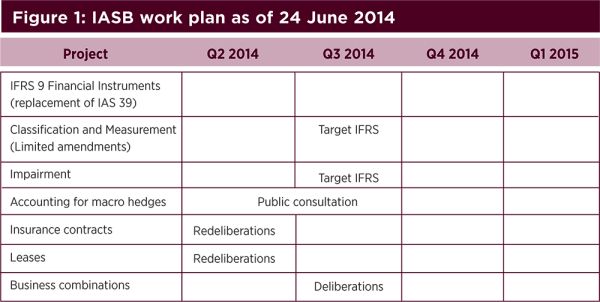

The sate of major FASB IASB convergence projects.

The decisions made in this session will be accommodated in the next phase of this project, which is an exposure draft due later in 2009. Which approach a lessee would use depends on whether the lessee acquires and consumes more than an insignificant portion of the underlying asset over the term of the lease. Firstly, the FASB focuses mainly on setting standards and rules for accounting firms and individual certified public accountants practising in the United States. The boards may have joint projects, like the short-term convergence project, and share research to discuss the same issues. As an overarching mission, the IASB works to improve and harmonize accounting standards, regulations, and procedures as it relates to financial statements. They are taking the necessary steps to be sure all stakeholders have an opportunity to participate in the process and to be responsive in considering stakeholder feedback.

What’s the Relationship Between IASB and FASB?

Hans Hoogervorst, IASB chairman, commented: "This is the right timing to come on board and participate in shaping the future of global accounting. The GAAP does not have one accounting standard but consist of multiple standards for accounting transactions. Stay Tuned The boards believe that though delays in completing their projects on leasing, revenue recognition and financial instruments are unfortunate, it is more important to ensure changes are operational and result in improved financial reporting. BusinessWorld New Report from Fitch Ratings Indicates Incorporation of IFRS into U. For nearly 40 years, the International Accounting Standards Board IASB and its predecessor, the International Accounting Standards Committee IASC , have been working to develop a set of high-quality, understandable, and enforceable International Financial Reporting Standards IFRS to serve equity investors, lenders, creditors, and others in globalized capital markets. Redeliberations began in June and the boards hope to issue final standards early in 2013.

FASB, IASB Make Progress in Convergence Project on Leasing

The project, which is being done jointly by FASB and IASB, grew out of an agreement reached by the two boards in October 2002 the 'Norwalk Agreement'. In their April 5 update on convergence efforts to the Financial Stability Board, the boards explained that while they were working expeditiously, "that work is being undertaken at a pace that enables thorough consultation to be undertaken with a particular focus on ensuring that potential solutions are operational. The renewal is only considered as part of the lease term when and if the renewal option is exercised. Such standards are essential because donors, investors, creditors, auditors and others rely on credible, transparent and comparable financial information. An IOSCO statement released in We observe that when the requirements under U. These international accounting standards help set a unified code of financial ethics that countries can follow despite cultural differences. The staff summary is available in Agenda Paper 4 for this meeting.

FASB removes goodwill project from its technical agenda

The financial crisis heightened criticism of the current incurred loss model for recognizing impairment of financial assets. Given the importance of the revenue number to all companies and their investors, and to avoid unintended consequences, the boards have moved very cautiously on this project. Deliberations will continue with FASB expected to issue a revised exposure draft on classification and measurement during the fourth quarter of 2012. Retrieved Dec 31 2022 from While FASB's mission is to improve U. Generally Accepted Accounting Principles U. The two boards approached the issues separately, reaching differing conclusions on matters such as the number of classification categories for financial instruments, which should be measured at fair value, and where fair value changes should be recognized.