Financial statement analysis is the process of evaluating a company's financial statements to understand its financial performance and position. This can be done for a variety of reasons, including to assess the company's creditworthiness, to make investment decisions, or to identify areas for improvement. A financial statement analysis project involves examining the company's financial statements in detail, comparing them to industry benchmarks and past performance, and making conclusions based on the findings.

One common way to approach a financial statement analysis project is to use a framework or methodology to guide the analysis. One such methodology is the DuPont analysis, which involves breaking down a company's return on equity (ROE) into three components: profit margin, asset turnover, and financial leverage. By analyzing each of these components, the analyst can gain a better understanding of the drivers of the company's ROE and identify areas for improvement.

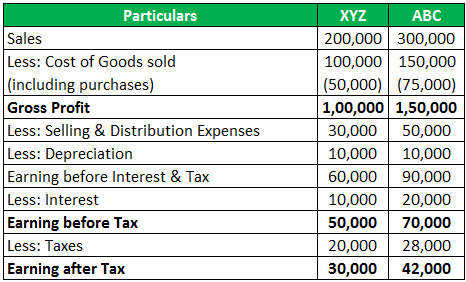

Another common approach is to use financial ratios to compare the company's financial performance to industry benchmarks or past performance. Some commonly used financial ratios include the price-to-earnings ratio, debt-to-equity ratio, and return on assets. By analyzing these ratios, the analyst can gain insight into the company's profitability, liquidity, leverage, and efficiency.

In addition to analyzing the company's financial statements, a financial statement analysis project may also involve analyzing external factors that can impact the company's financial performance. These could include macroeconomic conditions, industry trends, and the company's competitive environment.

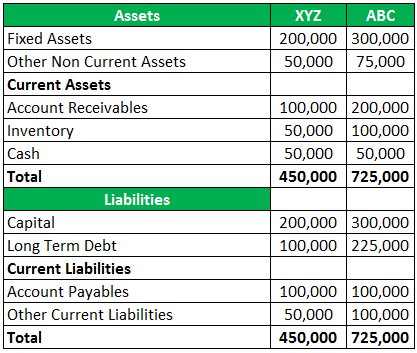

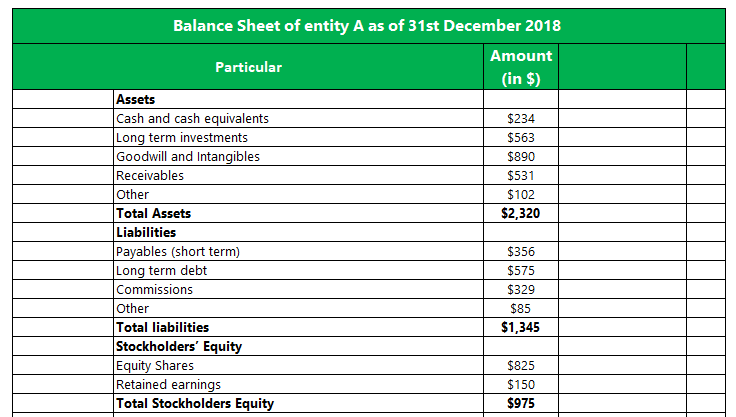

To complete a financial statement analysis project, the analyst will need to gather and review a range of financial data and documents, including the company's income statement, balance sheet, and cash flow statement. The analyst will also need to have a good understanding of accounting principles and financial terminology.

Once the analysis is complete, the analyst will typically present their findings in a written report or presentation. The report should include an overview of the company's financial performance, a summary of the key findings from the analysis, and recommendations for improvement or further action.

Overall, financial statement analysis is an important tool for understanding a company's financial performance and position. By carefully analyzing the company's financial statements and considering external factors, analysts can gain valuable insights that can be used to inform investment decisions, creditworthiness assessments, and strategic planning.