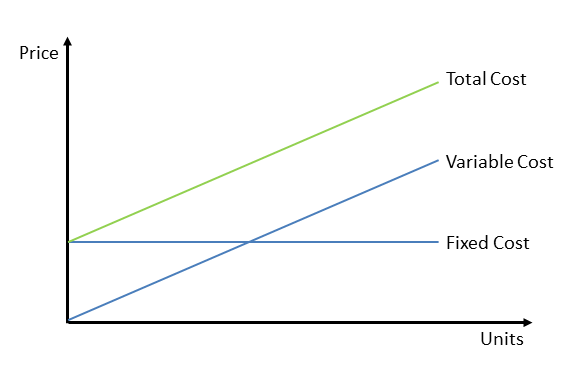

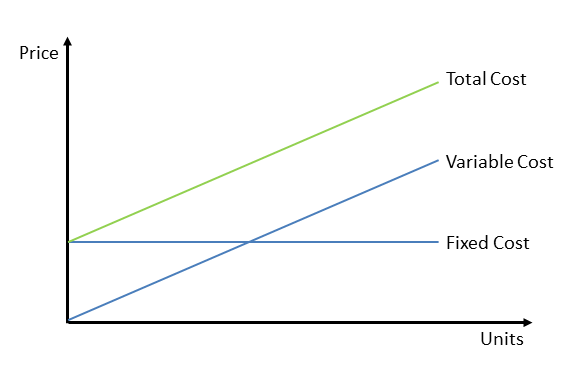

Fixed and variable are terms that are commonly used to describe different aspects of a business or organization. In general, fixed costs are expenses that do not change over time, while variable costs are expenses that fluctuate in response to changes in business activity. Understanding the difference between fixed and variable costs is important for businesses, as it can help them to better manage their expenses and make informed decisions about how to allocate their resources.

Fixed costs are expenses that are constant, regardless of the level of production or sales. These costs are generally related to the infrastructure of a business, such as rent, salaries, and utilities. Fixed costs are typically necessary for a business to operate, and they do not change based on the volume of goods or services produced. For example, a company may have a fixed cost of $10,000 per month for rent, regardless of whether it produces 1,000 units or 10,000 units in a given month.

Variable costs, on the other hand, are expenses that fluctuate in response to changes in business activity. These costs are typically related to the production of goods or services, such as raw materials and labor. The amount of variable costs incurred by a business depends on the level of production or sales. For example, a company may incur variable costs of $1 per unit for raw materials, and $2 per unit for labor. If the company produces 1,000 units, it will incur variable costs of $3,000 ($1 x 1,000 units + $2 x 1,000 units). However, if the company increases production to 10,000 units, it will incur variable costs of $30,000 ($1 x 10,000 units + $2 x 10,000 units).

Businesses need to carefully manage both fixed and variable costs in order to stay profitable. Fixed costs are often considered sunk costs, as they cannot be recovered once they have been incurred. However, businesses can often negotiate or reduce fixed costs through long-term contracts or by optimizing their use of resources. Variable costs, on the other hand, can be more easily controlled by adjusting the level of production or sales. By understanding the difference between fixed and variable costs, businesses can make informed decisions about how to allocate their resources and maximize their profitability.

Fixed and Variable Costs

After lenders consult these benchmarks, they'll add a margin to calculate your rate. The interest rate on your loan is subject to a few outside influences. This system defines variables that can be measured, manipulated, or combined to produce results. If you're going to compare the variable costs between two businesses, make sure you choose companies that operate in the same Companies may also have Fixed Costs Fixed costs remain the same regardless of whether goods or services are produced or not. These include but are not limited to: land, labor, natural resources, and market prices. Costs remain fixed even if no production occurs.

What's the Difference Between a Fixed Rate and a Variable Rate?

Before joining Dotdash, she consulted for a global financial institution on cybersecurity policies and conducted research as a Research Analyst at the Belfer Center for Science and International Affairs. The IRS Most companies looking to implement FAVR or other mileage reimbursement methods turn to professionals for support. That, of course, can be either good or bad, and it could result in interest rate increases, making variable-rate loans the more risky option. What Is A Fixed Annuity? Finance, MSN, SmartAsset, Entrepreneur, Bloomberg, The Simple Dollar, U. Still, some employers prefer a simpler mileage-based system instead of a highly flexible FAVR plan. Rosemary Carlson is a finance instructor, author, and consultant who has written about business and personal finance for The Balance since 2008. In short, when it is easier for banks to borrow money, i.

Fixed and Variable Costs When Operating a Business

Fixed and Variable Rate Allowance: What to Know For a company that has employees across the country, what makes sense as an allowance for fuel and other costs in Texas, where fuel is relatively cheap, may not make sense for employees in New York or California, where fuel and related costs are comparatively more expensive. The IRS has set the standard mileage rate for business use of an automobile at 58. If rates fall, you do have the option to Pros and Cons of Variable Rate Home Equity Loans The main attraction of a variable-rate loan is that it can save the borrower quite a bit of money. Amounts are updated annually to reflect changing transportation costs. Variable APR can be better for those who are comfortable with the additional risk, while fixed rates are better for those who want stability and predictability. How Do I Implement a FAVR Program? In order to produce more efficiently using Variable Factor Of Production VFP , businesses must identify which resources and technologies will be most profitable in the future and allocate these resources accordingly. Do credit card rates change? Since fixed expenses typically represent the biggest chunk of your budget, the money you save in this category can be quite substantial.

Are Fixed or Variable Home Equity Loans Better?

Variable terms, there are a few key distinctions to make. If, for instance, you're buying production materials in greater volume you may be able to buy them at lower price points. Developing a FAVR program can be a months-long process. In the following month, the company receives a large order whereby it must produce 20,000 toys. What are the examples of fixed and variables? The Federal Reserve can control this rate through the Federal Open Market Committee, and the interest rate changes are readily available online with a simple search or by looking through Does credit score play a role in interest rates? The Annuity Expert is an online insurance agency servicing consumers across the United States. Examples of Variable Rate Loans Some types of loans are available with either a variable rate or a fixed rate, so in the following examples, you'll see some overlap.

Fixed and Variable Rate (FAVR) Reimbursement Explained

A standard mileage plan can not only put the employee at a disadvantage. This is a reimbursement plan meant for companies with their workforce spread across different regions. In turn, this affects credit cards, mortgages, student loans, and many other types of loans. Numeric variables are usually associated with numbers, such as these: int, float, and double. It is possible for borrowers to have have a mix of variable and fixed rates if they have several student loans. Fixed Overhead Costs Fixed overhead costs are coststhat do not change even whilethe volumeof production activity changes. Launch our Financial Accounting vs.

:max_bytes(150000):strip_icc()/variable-overhead-Final-7d7b982929df458a9967f55b222a8290.png)