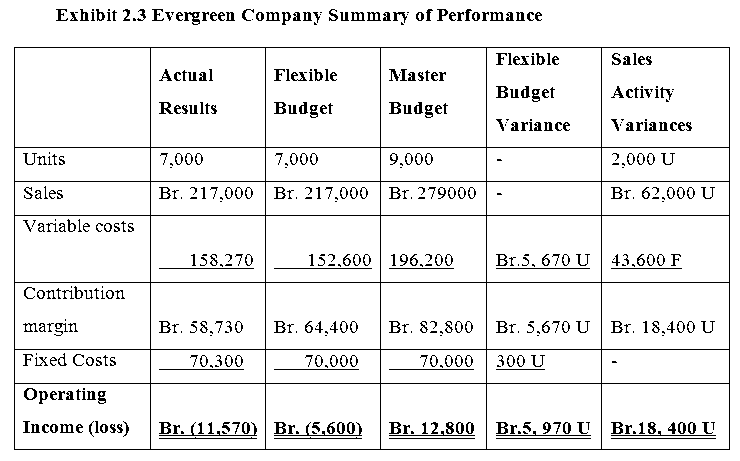

A flexible budget is a budget that adjusts to changes in the level of activity within a business. It is a useful tool for analyzing the performance of a company, as it allows managers to see how well they are meeting their budgeted goals. One way to analyze the performance of a flexible budget is to calculate the flexible budget variance, which is the difference between the actual results and the budgeted results. In this essay, we will discuss how to calculate flexible budget variance.

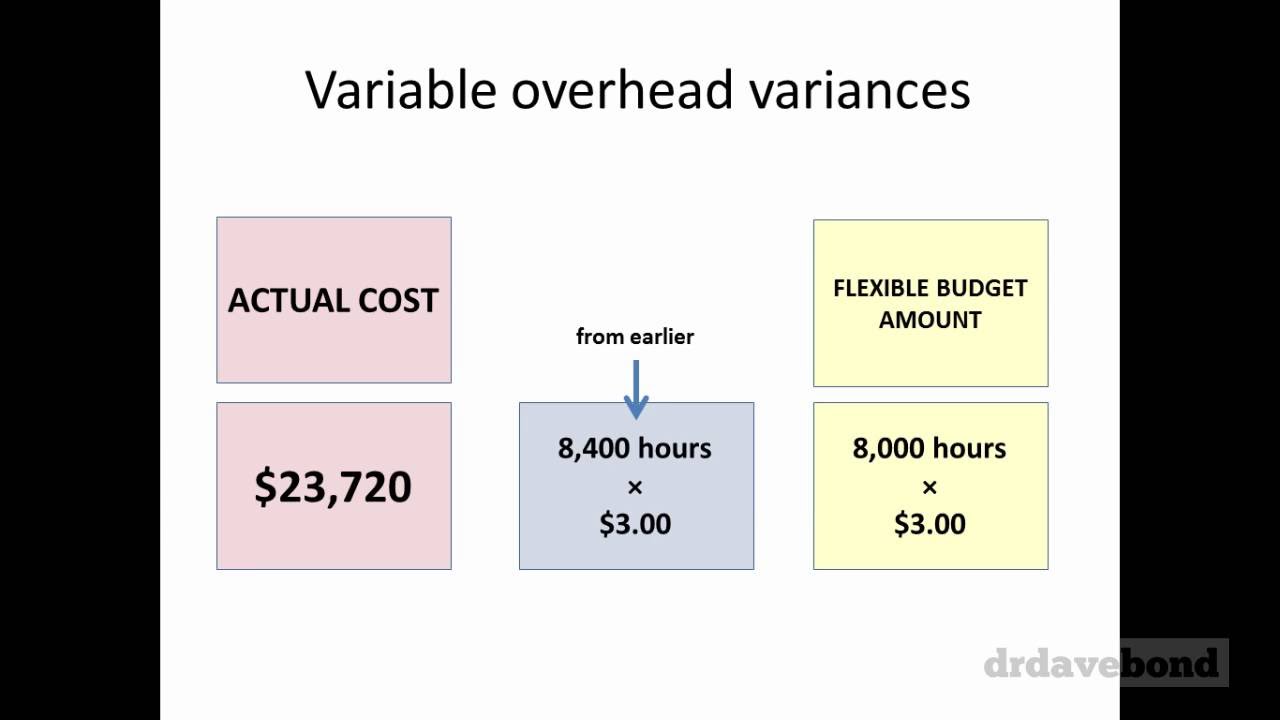

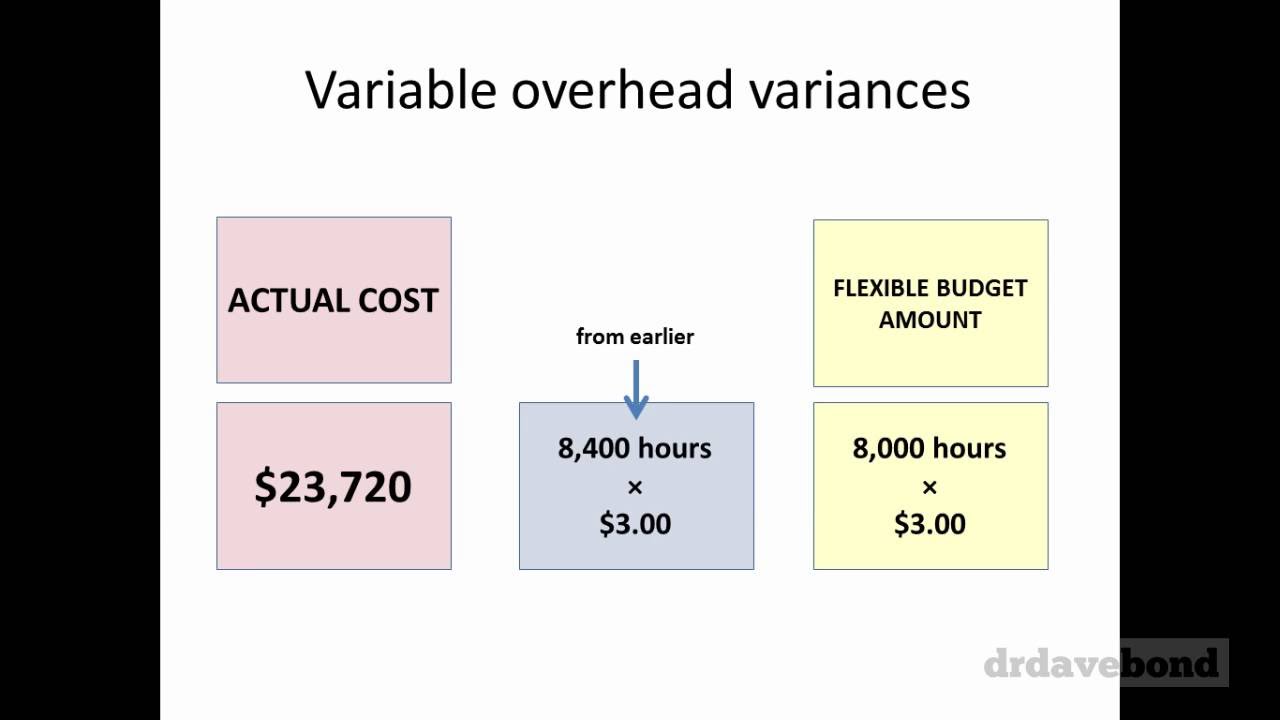

To calculate flexible budget variance, you will need to first determine the budgeted amount for each variable cost and fixed cost. This can be done by multiplying the budgeted level of activity by the budgeted cost per unit of activity. For example, if the budgeted level of activity is 1000 units and the budgeted cost per unit is $10, then the budgeted variable cost will be $10,000.

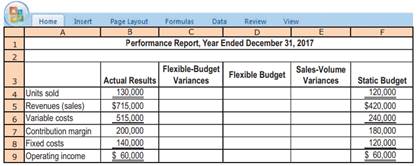

Once you have determined the budgeted costs for each variable and fixed cost, you can then calculate the flexible budget variance by comparing the actual results to the budgeted results. To do this, you will need to determine the actual level of activity and the actual cost per unit of activity. You can then multiply these amounts by each other to get the actual costs for each variable and fixed cost.

For example, let's say that the actual level of activity was 1100 units and the actual cost per unit was $11. The actual variable cost would be $12,100 (1100 x $11). To calculate the flexible budget variance for the variable cost, you would subtract the budgeted amount of $10,000 from the actual amount of $12,100, resulting in a variance of $2,100.

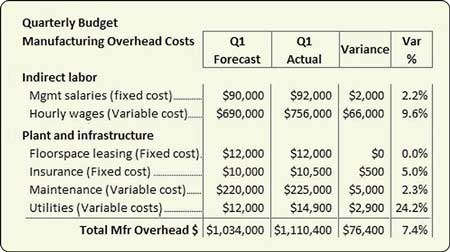

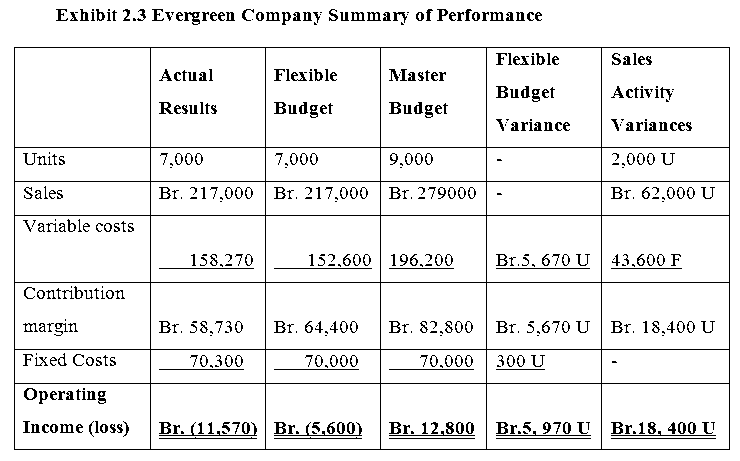

You can repeat this process for each variable and fixed cost to calculate the total flexible budget variance. Once you have calculated the total variance, you can then analyze it to see if the actual results were better or worse than the budgeted results. If the variance is positive, it means that the actual results were better than the budgeted results. If the variance is negative, it means that the actual results were worse than the budgeted results.

In conclusion, calculating flexible budget variance is a useful tool for analyzing the performance of a business. It allows managers to see how well they are meeting their budgeted goals and to identify areas where they may need to make changes in order to improve their performance. By following the steps outlined above, you can easily calculate flexible budget variance and use it to better understand the financial performance of your business.

Budget Variance

The Finmark Blog is here to educate founders on key financial metrics, startup best practices, and everything else to give you the confidence to drive your business forward. In contrast, a static budget uses standard figures for a financial period to determine spending and income, offering minimal flexibility. What is a variance report? Related: Variance Analysis: Definition, Types, Formulas and Examples Disadvantages of a flexible budget A flexible budget also has some potential disadvantages. How do you prepare a flexible budget report? A flexible budget is a budget that accounts for an increase or decrease in expenses and revenue. During a financial period, a company has many consistent expenses. Learn How To Budget With A Variable Income Conversely, if revenue didn't at least meet the targets set in the static budget, or if actual costs exceeded the pre-established limits, the result would lead to lower profits.

🌈 Variable budget. Flexible Budget Variance: Definition, Benefits and Example. 2022

The flexible budget variance will throw triggers and cautions about the area, requiring proper attention and improvements. A variance analysis report is used to measure actual performance against your budgeted or planned performance. In this article, we explore what a flexible budget is, its types, its advantages and disadvantages, how to create a flexible budget and an example to reference when creating your own. Companies create planning budgets in order to forecast their financial position for some period in the future. In the example, the company may have set a 90% target production rate, changed it to 85%, and still possibly achieved only a 75% production level. One tool that's helpful for companies that experience frequent variations in cost-related activities throughout the year is a flexible budget. Financial professionals are familiar with the fact that real-world results almost never align perfectly with the budget, even when careful steps are taken to account for variables.

Flexible budget variance definition — AccountingTools

The resulting flexible budget summary is: Fixed expenses salaries, utilities, etc. How to Budget for Variable Expenses When using a static budget, some managers use it as a target for expenses, costs, and revenue while others use a static budget to forecast the company's numbers. The difference between the actual quantity of materials used in production and budgeted materials that should have been used in production based on the standards. Positive Variance Many companies report a positive budget variance. How can you tell if a flexible budget variance is favorable or unfavorable? Subscribe to the Finmark Blog Historically financial modeling has been hard, complicated, and inaccurate.