The National Health Service and Community Care Act 1990 is a significant piece of legislation that was passed in the United Kingdom. It was intended to reform and modernize the National Health Service (NHS) and to provide better community care for people in need.

One of the main objectives of the Act was to provide more choice and control for patients in the NHS. It introduced the concept of fundholding, which allowed GPs to purchase services on behalf of their patients from different providers, including hospitals and other healthcare organizations. This was intended to increase competition and improve the quality of care.

Another important aspect of the Act was the introduction of the internal market within the NHS. This allowed hospitals and other healthcare providers to compete with each other for contracts to provide services to patients. This was seen as a way to increase efficiency and drive down costs, but it also led to some criticism as it was perceived as introducing a more commercialized approach to healthcare.

The Act also established the Department of Health as the central body responsible for the administration and management of the NHS. It also created the position of the Chief Executive of the NHS, who was responsible for overseeing the operation of the service and implementing government policy.

In addition to these changes within the NHS, the Act also introduced significant reforms to community care. It aimed to provide better care for people who needed support to live independently in their own homes, rather than being institutionalized in hospitals or nursing homes. It introduced the concept of community care assessments, which were used to determine the needs of individuals and the type of support that they required.

Overall, the National Health Service and Community Care Act 1990 was a major reform of the NHS and community care in the United Kingdom. While it brought about some significant changes, it also sparked controversy and debate about the direction of healthcare in the country.

BCG model

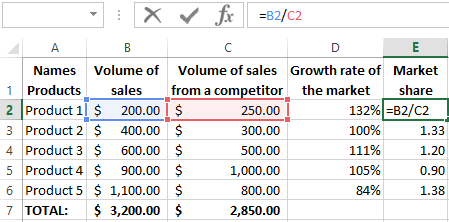

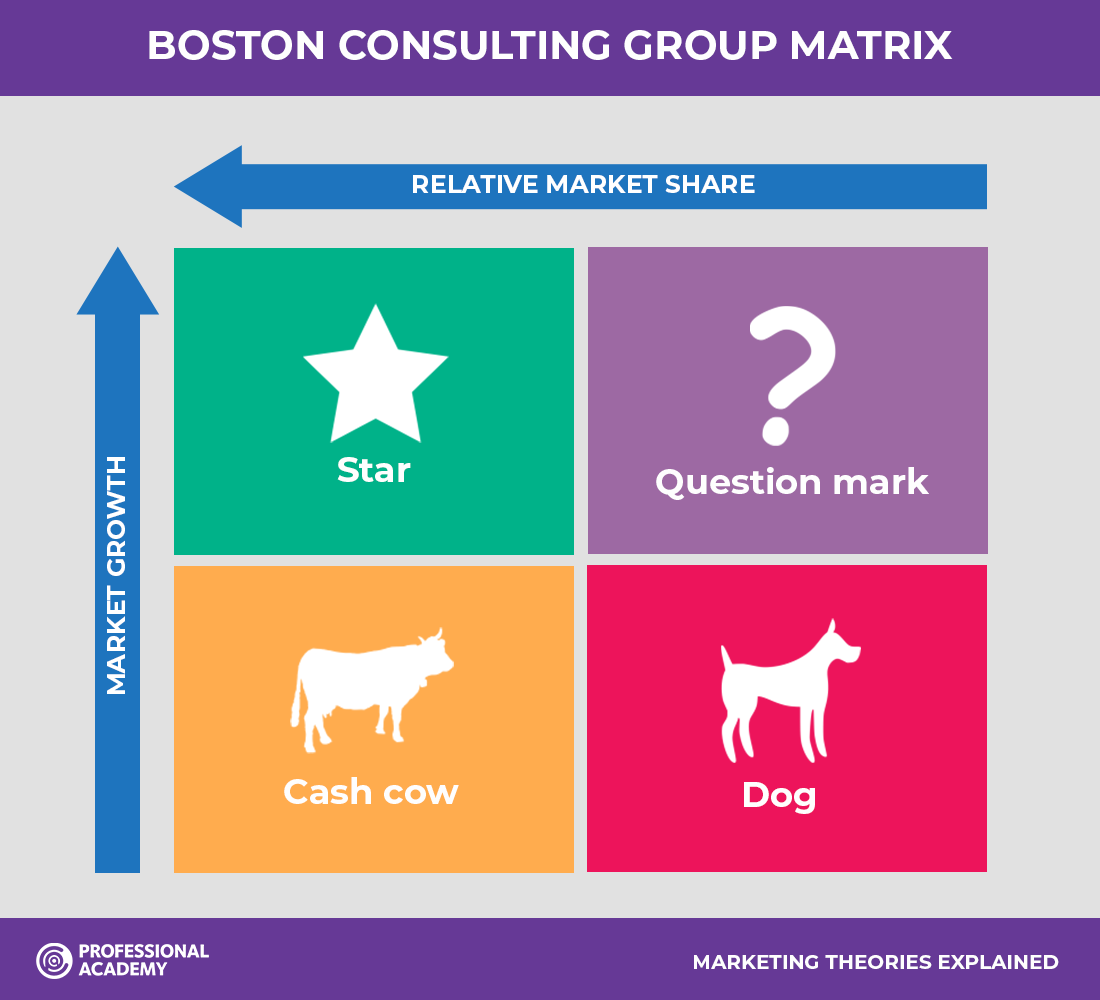

According to the logic of the bcg matrix, as an industry grows, all investments become cows or dogs. The area of the diagram is divided into 4 identical quadrants: Central value for the growth market rate is 80%. Step 4— Calculate Market Growth Rate: The growth rate of an industry can be retrieved from industry reports available for free online. For example, Apple in the smart phone market primarily competes at the premium end and do not offer budget based mobile phones. Calculate the company's market share After determining the type of market share you want to calculate, you can determine its absolute market share.

What Is BCG Matrix?

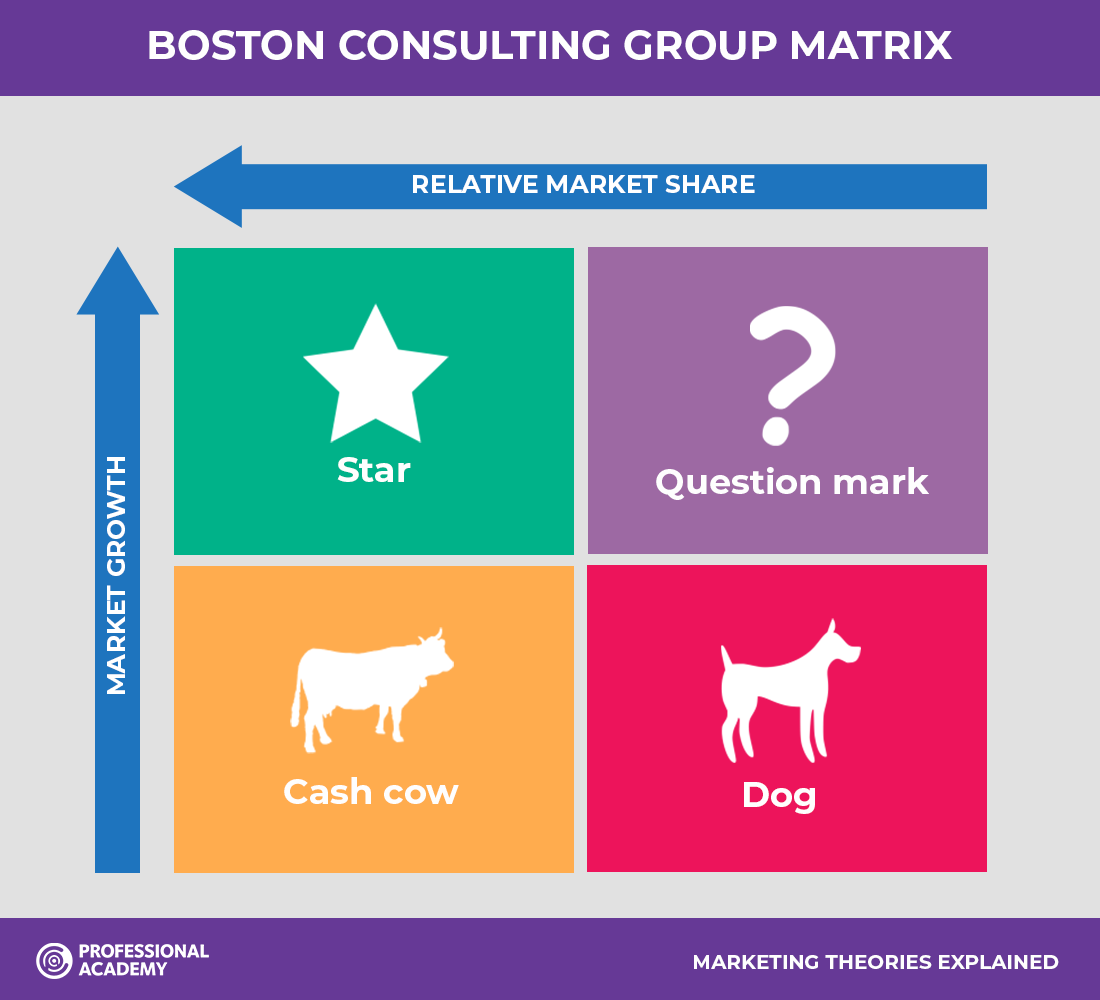

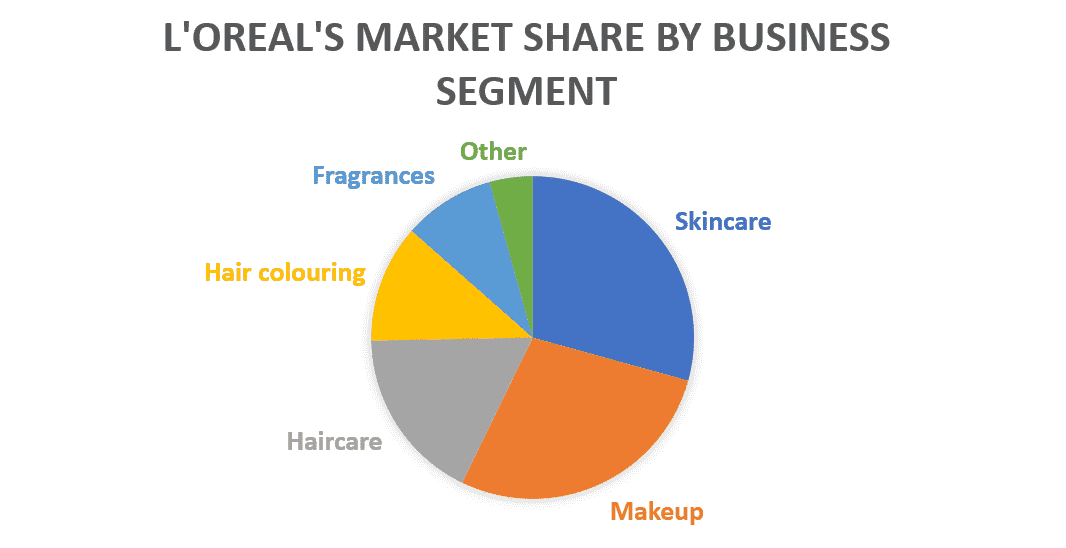

There are a plethora of market research firms that sell industry. The BCG Matrix, also known as the Boston Consulting Group Growth-Share Matrix, is a model that helps organizations analyze their product portfolios and make resource allocation decisions. If companies are to keep up, they need to be agile, flexible, but most of all, adaptable to this constant change. The low performance can be because of inferior quality, high performance and lack of effective marketing and implies that companies may want to liquidate the products or reposition them to ensure minimising losses. This typically means that they can generate significant revenue without the main organization needing to invest great amounts to keep up with the competition. It requires relatively low levels of investment to maintain its commanding position largely due to its loyal following of iOS supporters. Backward Integration: What's the Difference? This is important because it also allows the tracking of the portfolio over time.

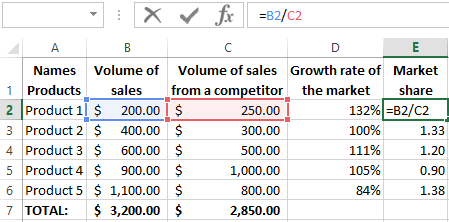

BCG Matrix Formulas and Calculations

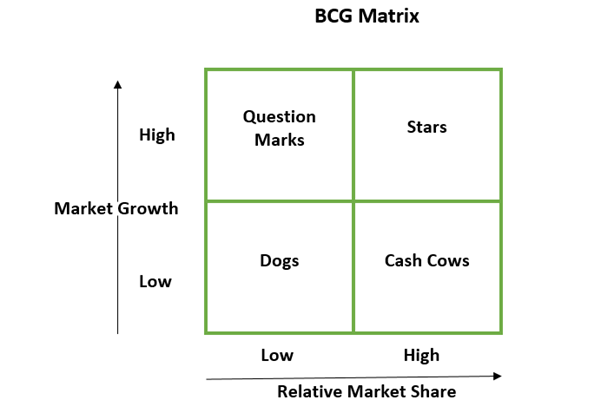

It takes the form of a chart, where the y-axis represents the rate of market growth and the x-axis represents market share. Use the formula There are two principal formulae to calculate the company's relative share. So, Cash Cows themselves need support to innovate. Similar to the ansoff matrix, the portfolio matrix consists of four areas, which in turn result from the combination of four different factors. Determining the relative market share in bcg matrix. Step 2: Define the market An incorrectly defined market can lead to a poor classification of products. Market share is the level of the entire market taken into account by your company, estimated either in income terms or unit volume terms.

BCG Matrix: How to Improve Your Product Portfolio (2023)

Each quadrant is classified as low or high performance, depending on the relative market share and market growth rate. Here, 40% of the market share may seem impressive to the other two competitors, making brand A the leading industry performer in the particular niche. The Growth Share Matrix table is split into four quadrants. For example, in the aforementioned case of charter, it may be. Learning about relative market share can help improve your skills and allow you to seek more effective solutions for a business. They require very little investment. It is a simple and intuitive tool for portfolio analysis.

How To Calculate Relative Market Share In Bcg Matrix

However, the matrix does have certain limitations. These products are already profitable with little growth potential in the market. Related: Understanding Market Penetration Strategies: With Examples 4. These figures also can help you determine an industry average, which you can use as a benchmark to understand the company's position in the industry. But what is the BCG matrix, and what do these terms mean? There are several online tools you can use as a BCG matrix template, or you can create your matrix from scratch, with competitive advantage of online tools is that you can use colors, stickers, and images to highlight key elements of the diagram.