Bookkeeping and accounting are important functions in any business or organization. They provide a way to track financial transactions, measure the performance of the business, and make informed decisions about the future.

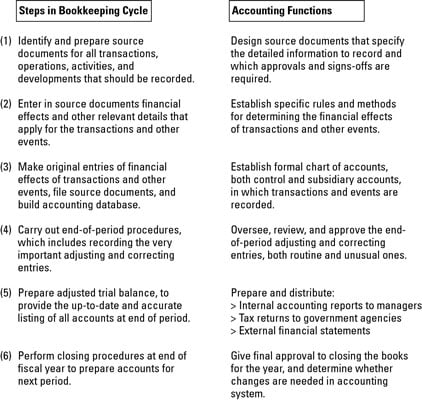

One of the main purposes of bookkeeping is to accurately record all financial transactions that occur within a business. This includes recording the sale of goods or services, the purchase of supplies or equipment, and the payment of salaries and other expenses. By keeping track of these transactions, a business can accurately track its income and expenses, and determine its profitability.

Accounting, on the other hand, is the process of analyzing and interpreting the financial information recorded through bookkeeping. This includes creating financial statements such as the balance sheet and income statement, which provide a snapshot of the financial health of the business. Accounting also involves making decisions about how to allocate financial resources, such as setting budgets and forecasting future financial performance.

One of the main benefits of bookkeeping and accounting is that they provide a way for a business to track its financial performance over time. By regularly reviewing financial statements and other financial information, a business can identify trends and areas for improvement. For example, if a business is consistently spending more money on supplies than it is bringing in through sales, it may need to find ways to reduce costs or increase revenue.

Bookkeeping and accounting also play a critical role in decision-making. By analyzing financial data, a business can make informed decisions about how to allocate its resources, such as deciding whether to invest in new equipment or expand into new markets. This information is also essential for attracting investors, as potential investors will want to see a clear picture of the financial health of the business before deciding whether to invest.

In addition, bookkeeping and accounting are essential for complying with legal and regulatory requirements. Many businesses are required to file financial reports with government agencies, such as the Internal Revenue Service (IRS) in the United States. Accurate and up-to-date financial records are necessary to meet these requirements and avoid penalties.

In conclusion, bookkeeping and accounting are vital functions in any business or organization. They provide a way to track financial transactions, measure the performance of the business, and make informed decisions about the future. By accurately recording and analyzing financial data, a business can ensure its financial health and compliance with legal and regulatory requirements.