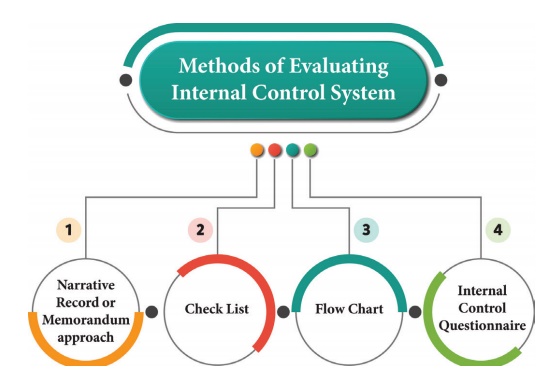

Internal control evaluation is a crucial aspect of any organization's financial management process. It involves assessing the effectiveness of the internal controls in place to ensure that financial transactions are accurately recorded, assets are safeguarded, and financial reporting is reliable. An internal control evaluation checklist can be used as a tool to help organizations identify and evaluate the strengths and weaknesses of their internal controls.

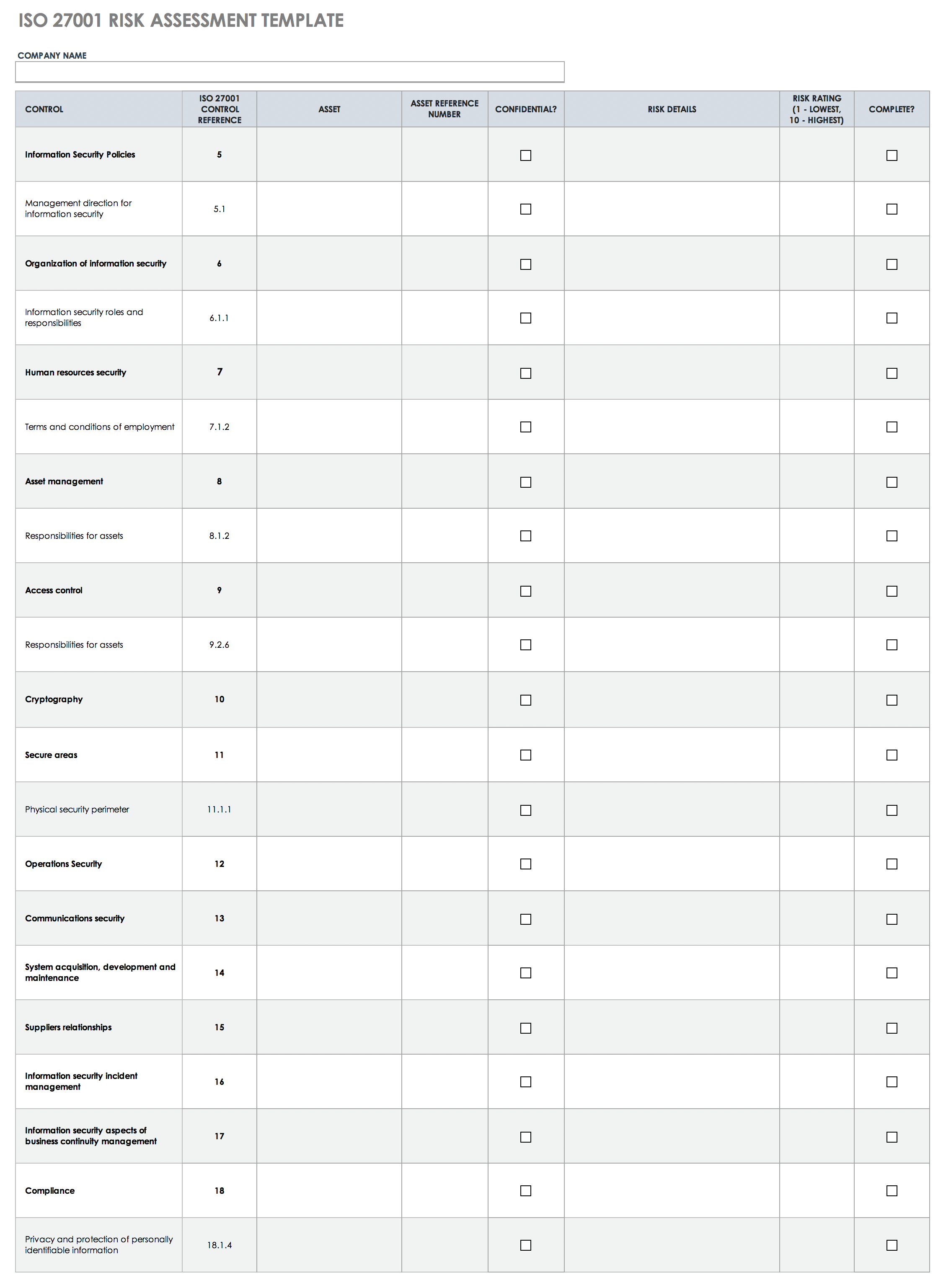

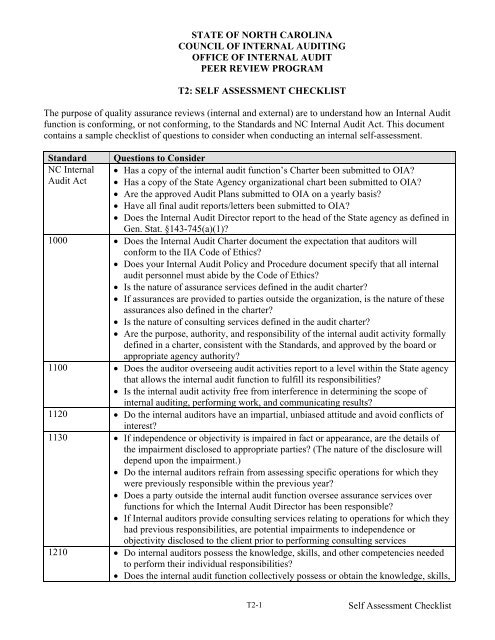

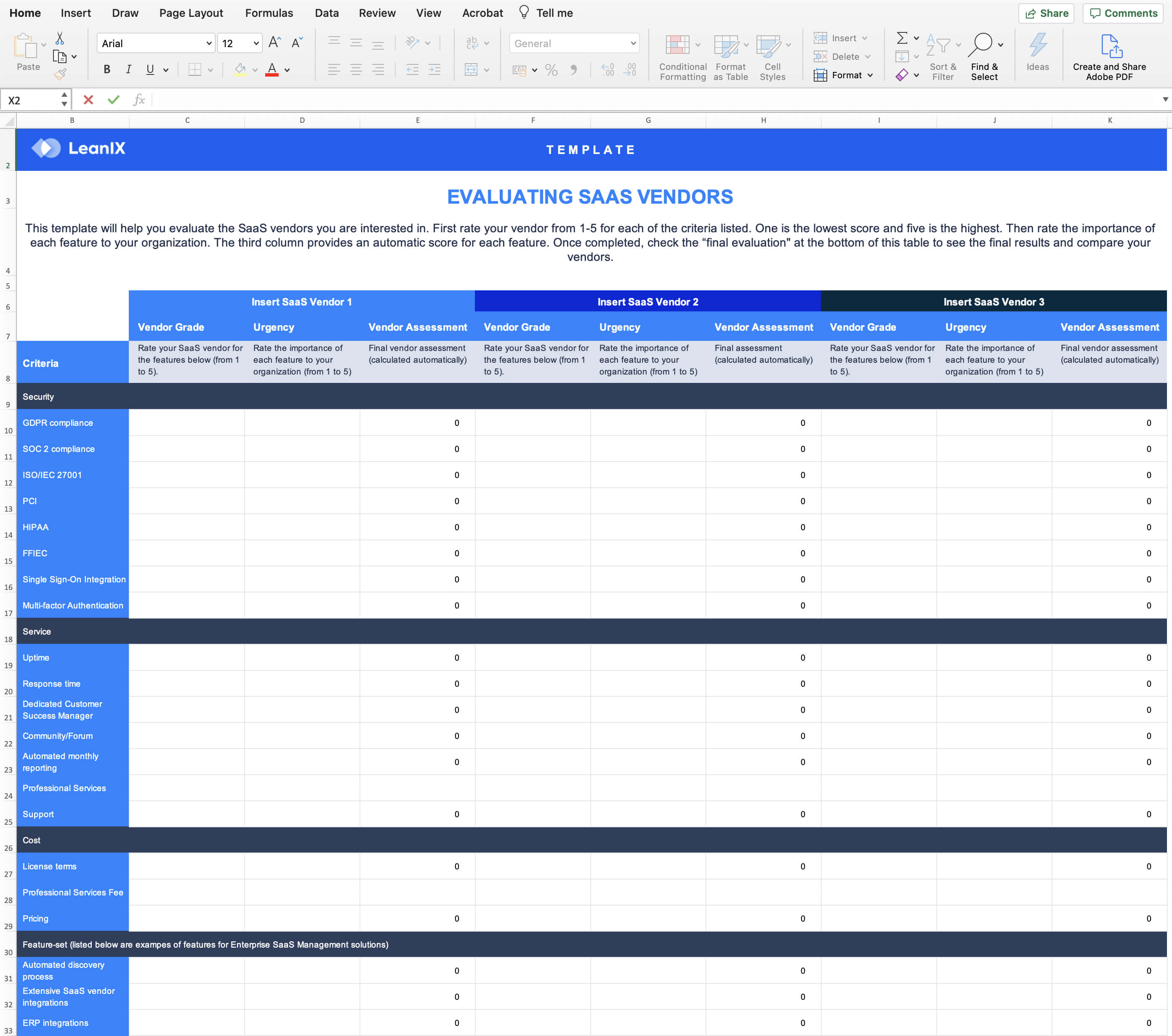

One of the key components of an internal control evaluation checklist is the identification of financial risks. This involves identifying the potential risks that could impact the organization's financial performance, including fraud, errors, and misstatements. By identifying these risks, the organization can take steps to mitigate them through the implementation of appropriate internal controls.

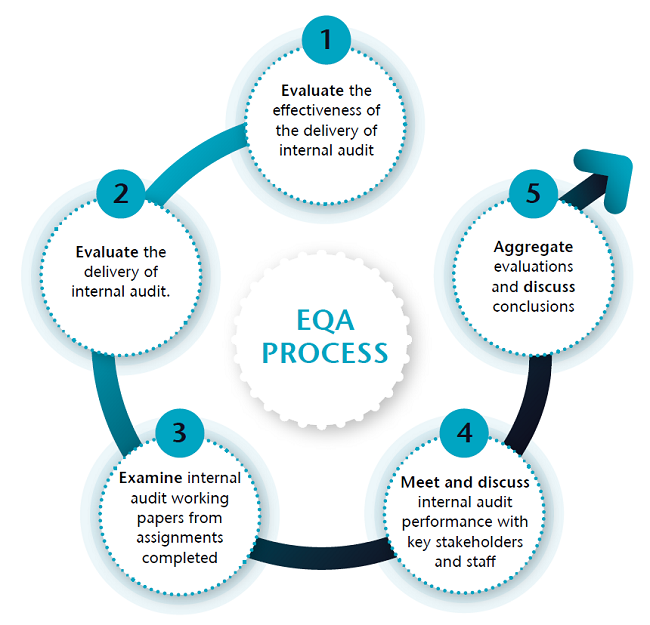

The next step in the internal control evaluation process is to assess the effectiveness of the controls in place to mitigate these risks. This includes evaluating the design and implementation of the controls, as well as their ongoing effectiveness. For example, an organization may have controls in place to prevent fraud, but if those controls are not being properly followed or monitored, they may not be effective in preventing fraud.

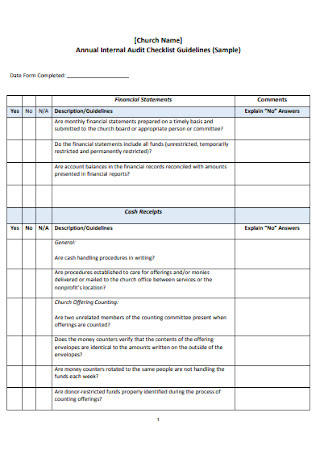

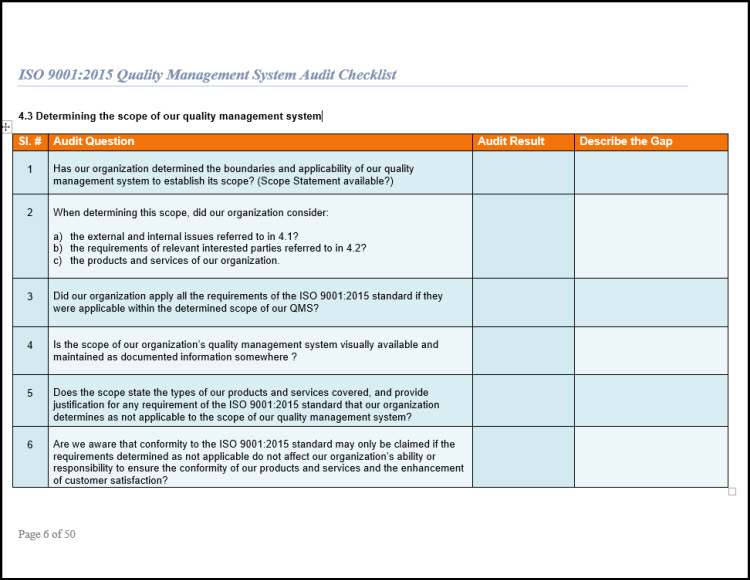

An internal control evaluation checklist should also include a review of the organization's financial reporting processes. This includes evaluating the accuracy and reliability of financial statements, as well as the processes in place to ensure that financial transactions are recorded accurately. It is important for organizations to have robust financial reporting processes in place to ensure that stakeholders, including shareholders and regulatory authorities, have access to accurate and reliable financial information.

Finally, an internal control evaluation checklist should include a review of the organization's compliance with relevant laws and regulations. This may include reviewing the organization's compliance with tax laws, financial reporting requirements, and other regulations that impact the organization's financial operations. Ensuring compliance with these laws and regulations is crucial for maintaining the integrity and reputation of the organization.

In conclusion, an internal control evaluation checklist is a valuable tool for organizations to use in assessing the effectiveness of their internal controls. By identifying financial risks, evaluating the effectiveness of controls in place to mitigate those risks, reviewing financial reporting processes, and ensuring compliance with relevant laws and regulations, organizations can ensure that their financial operations are running smoothly and efficiently.