Law of one price and ppp. Law of One Price and Purchasing Power Parity 2022-12-16

Law of one price and ppp

Rating:

4,6/10

893

reviews

The pigeonhole principle, also known as the "boxes and pigeons" principle, is a simple but powerful concept in mathematics that states that if there are more objects than available spaces (or "pigeonholes"), then at least one space must contain more than one object. This principle has many applications in various fields, including computer science, economics, and even daily life.

One of the most common applications of the pigeonhole principle is in computer science, specifically in the field of data compression. In data compression, the goal is to represent a large amount of data using a smaller number of bits. One way to do this is by using a technique called "lossless compression," where the original data can be recovered exactly from the compressed version. The pigeonhole principle can be used to prove that certain lossless compression schemes are optimal, meaning that no other scheme can compress the data more efficiently. For example, suppose we have a set of data consisting of the letters A, B, C, and D. If we want to represent this data using only 2 bits per letter, we can use the pigeonhole principle to prove that at least one of the letters must be represented by two different combinations of 2 bits. This means that the data cannot be losslessly compressed using 2 bits per letter, and we must use a different method or a higher number of bits to achieve optimal compression.

Another application of the pigeonhole principle is in economics, specifically in the study of market equilibrium. Market equilibrium occurs when the quantity of a good or service that is being supplied is equal to the quantity that is being demanded. The pigeonhole principle can be used to prove that under certain conditions, market equilibrium is always possible. For example, suppose we have a market for a certain type of good, and there are three sellers who each have a certain number of units of the good to sell. The pigeonhole principle states that if the sellers have a total of more than three units of the good, then at least one of them must have more than one unit to sell. This means that there must be at least one buyer who is willing to purchase more than one unit of the good, which is necessary for the market to reach equilibrium.

In daily life, the pigeonhole principle can also be used to solve practical problems. For example, suppose you have a group of friends who are going on a road trip, and you need to decide which car to take. You have three cars to choose from, each with a different number of seats. The pigeonhole principle states that if you have more friends than the total number of seats in the three cars, then at least one of the cars must have more than one person in it. This can help you decide which car to take, and also serve as a reminder to carpool to save space and reduce environmental impact.

In conclusion, the pigeonhole principle is a simple but powerful concept that has many applications in various fields, including computer science, economics, and daily life. Its versatility and simplicity make it a valuable tool for solving a wide range of problems.

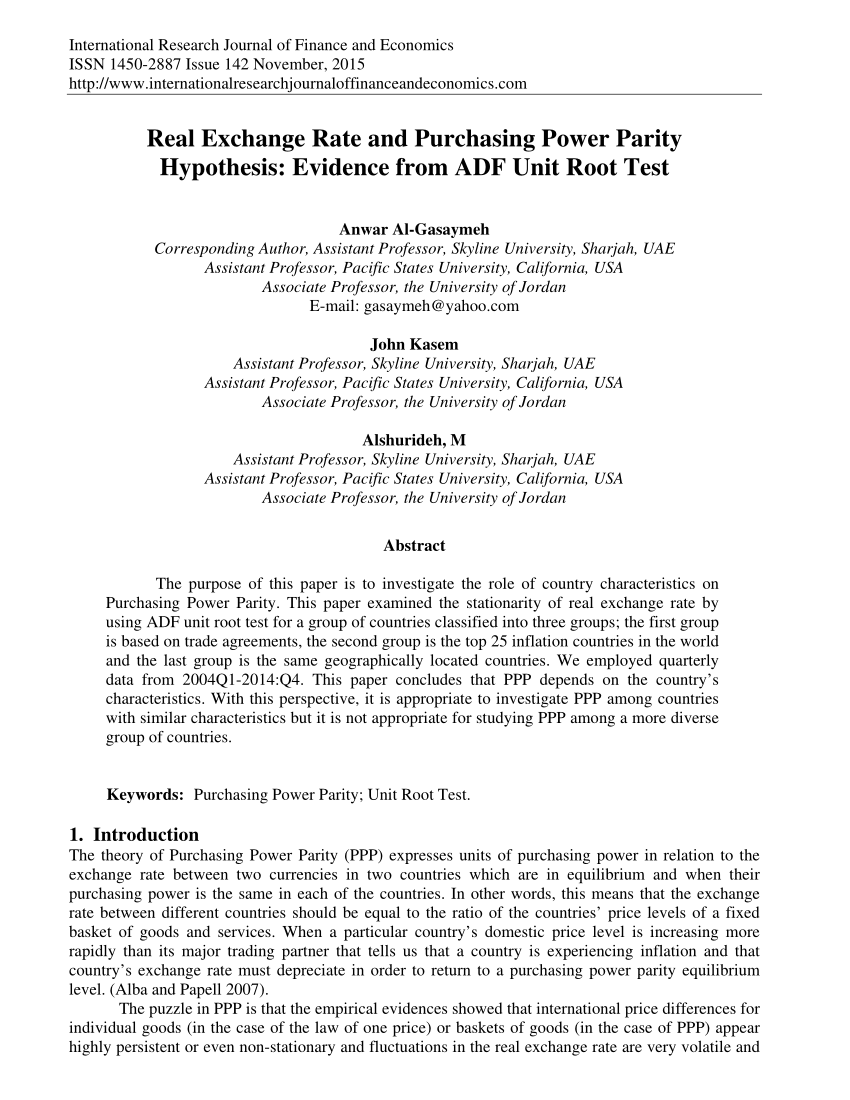

Purchasing Power Parity and the Law of One Price: Evidence from Commodity Prices in Asian Countries

The Theory of Political Economy, ed. The EMS, the EMU, and the Transition to a Common Currency, Macroeconomics Annual, NBER, 269-327. Flexible Exchange Rates and Oligopoly Pricing: A Study of Canadian Markets, Journal of Political Economy, 78: 140-151. Abnormal deviations in international exchanges, The Economic Journal, 28: 413-415. Tests for unit root versus threshold specification with an application to the PPP, Journal of Business and Economic Statistics 22 4 : 382-395.

Next

THE LAW OF ONE PRICE: SURVEY OF A FAILURE

Consequently, trading across countries has been prominent among businesses in order to seek higher growth opportunities available in the international markets Michie, 2011. However, this scenario might contradict with the results and findings from Figure 1 and figure 2 as both the figures proposed that in the short run, PPP does not hold, whereas in the long run, the law of one price will prevail and PPP is therefore determinable. Price Discrimination by US and German Exporters, American Economic Review, 79 1 : 198-210. Relative Labour Productivity and the Real Exchange Rate in the Long Run: Evidence for a Panel of OECD Countries, NBER WP 5676. Therefore, the investigation has been kept intentionally separate from PPP- related debate. The Economics of Foreign Exchange and Global Finance.

Next

Law of One Price: Definition, Example, Assumptions

Export Price Discrimination in Europe and Exchange Rates, Review of International Economics, Blackwell Publishing, Vol. If the difference in transportation costs does not account for the difference in commodity prices between regions, it can be a sign of a shortage or excess within a particular region. Authors may reproduce or authorize others to reproduce the above Paper for the Author's personal use or for internal company use, provided that the source and The Publisher copyright notice are mentioned, that the copies are not used in any way that implies The Publisher endorsement of a product or service of an employer, and that the copies are not offered for sale as such. Adjustment Costs and Pricing To Market: Theory and Evidence, Journal of International Economics, 32: 1-30. How Wide is the Border? Intermediate Microeconomics: Neoclassical and Factually-oriented Models. Understanding International Price Differences Using Barcode Data, NBER w. Hence, it often suggested that the PPP theory of exchange rates will hold at least approximately because of the possibility of international goods arbitrage.

Next

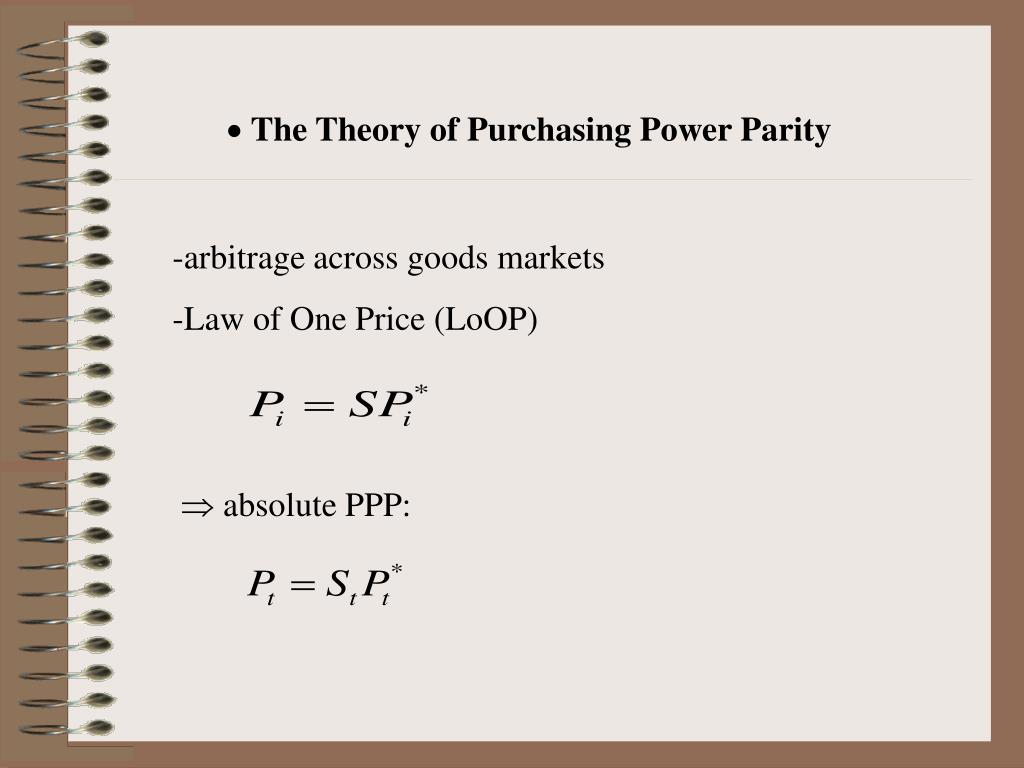

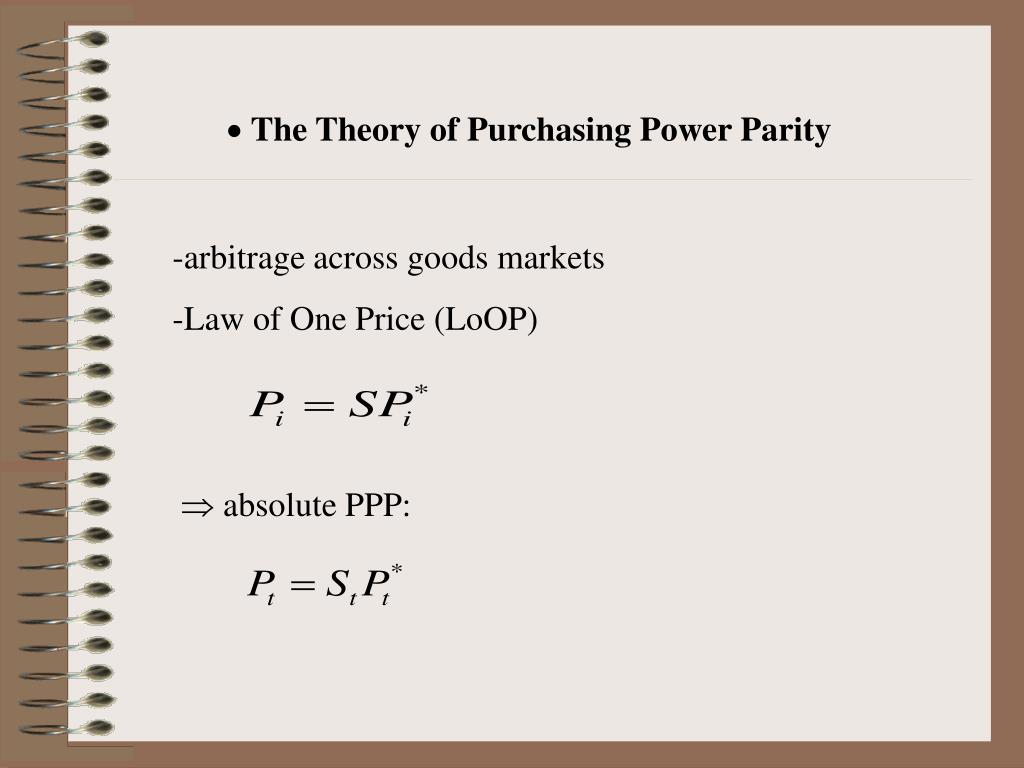

The Law of One Price & Purchasing Power Parity

To consider whether the theory of perfect commodity arbitrage applies in the real world to create the law of one price, consider Figure 1 and Figure 2 which illustrate the notion of absolute PPP and relative PPP. As more investors sell into Market A, competition will ensue, and prices will be driven down. Absolute purchasing power parity relates to the circumstances when the purchasing power of a unit currency is converted into foreign currency at the exchange rate in market, it is directly equal in the domestic and foreign economy Taylor and Taylor, 2004. The Law of One Price sometimes referred to as LOOP is an economic theory that states that the price of identical goods in different markets must be the same after taking the Understanding the Law of One Price The Law of One Price is based on several assumptions, which include free competition in the markets, the absence of trade restrictions, and The LOOP primarily holds due to arbitrage opportunities. The Purchasing Power Parity Debate. Purchasing Power Parity You are free to use this image on your website, templates, etc. Ultimately, when the law of one price plays out correctly, the result is purchasing power parity.

Next

The Big Mac Index: Law of One Price Vs. PPP

Inflation, Money Demand, and Purchasing Power Parity in South Africa. In practical applications this seems rather convincing as due to the matter of time, equilibrium will kick in and adjust the prices accordingly to the LOP. If the prices of identical goods diverge from each other across the markets, arbitrage opportunities arise since a trader may purchase a good in a market at a lower price and immediately sell it in another market at a higher price for a net profit. Dynamic Equilibrium and the Real Exchange Rate in a Spatially Separated World, Review of Financial Studies, 5: 153-180. The Law of One Price in Scandinavian Duty-Free Stores, American Economic Review, vol. Violating purchasing power parity, W. Nonetheless, where does all the disputation arise concerning the practicality of LOP and PPP in reality? These studies have mostly used data from industrial countries.

Next

What is the difference between "the law of one price" and "PPP?"

:max_bytes(150000):strip_icc()/fruitsandvegetabledisplayedwithprices-2faa202fccd24373a114f9e036319b54.jpg)

He suggested that the purchasing power of two nations is determined using the exchange rate between any two nations that, in turn, depends on the comparative purchasing power of the respective countries currencies. J, The effects of Exchange Rate Adjustments; US Government Printing Office, Washington. Get Help With Your Essay If you need assistance with writing your essay, our professional essay writing service is here to help! Sectoral Productivity, Government Spending and Real Exchange Rates: Empirical Evidence for OECD Countries NBER WP 6017. PPP and the Balassa-Samuelson effect: The Role of the Distribution Sector, DNB Staff Reports. Aggregate Dynamics and Staggered Contracts.

Next

Law of One Price and Purchasing Power Parity

On the Stability of Variance Decompositions of the Real Exchange Rate Across Exchange-Rate Regimes: Evidence from Mexico and the United States, NBER WP n. Still, the base price of these items before shipping should be nearly identical under the law of one price. Purchasing power parity is just a fancy way of saying that buyers have equal power to each other because the price remains the same across markets. The transactions costs consist mainly of tariffs, taxes, duties and non-tariff barriers costs. For example, a Commodities remain the most notable example of the law of one price in financial markets. Some buyers are limited in their access to goods and services, and this makes purchasing power parity very difficult to achieve in the real world.

Next

Purchasing Power Parity (PPP)

A few recent studies, have, therefore used commodity prices in different countries and have provided strong support for the theory. However, various crucial obstacles have been encountered in real life despite the concreteness of the proposed theories and one of the projected main concerns is to determine the price for a similar product across different markets and continents Wang, 2009. Its calculation helps to compare the economic wealth and Gross Domestic Product or cost of living of any two countries globally using the basket of goods approach. The Author s warrants that The Paper is based on their original work and that the undersigned has the power and authority to make and execute this assignment. Share this: Facebook Facebook logo Twitter Twitter logo Reddit Reddit logo LinkedIn LinkedIn logo WhatsApp WhatsApp logo Introduction The gradual emergence of globalisation in businesses has contributed towards a significant rise in international trade. Nevertheless, the application of LOP is considerably difficult and would not prevail in certain predicaments across different economies and countries despite the supportive underlying theories Mezzera, 1990.

Next

international economics

The Law of One Price Over 700 Years, NBER WP n. The concept of LOP indicates that the prices for the identical products are the same across two countries, but this has not been the case in actual situation proposed by numerous scholars and researchers. On the contrary, the same burger costs 5. In efficient markets, the law of one price should dominate. The Purchasing Power Parity Debate. The applications and conversions of currencies have become vitally important in international businesses in order to obtain or forecast the substantial costs and revenues for the purpose of financial information. Ultimately, this keeps markets more fair, balanced and efficient.

Next

Law of One Price

Thanks for contributing an answer to Economics Stack Exchange! Abstract This paper aims to survey the literature about the Law of One Price in order to document its failure in terms of actual application. Definition of the Law of One Price The concept behind the law of one price is pretty simple. Monopoly Profits and the Law of One Price: The Cost of Misapplied Theory, Volume 146. Border Effects Within the NAFTA Countries, International Finance Discussion Papers, n. In addition, the transportation costs will increase due to the driving supply of arbitragers participating to transfer the commodity from one location with lower price to another with higher price, and the resulting impact would be differences in price disrupting the adjustment of arbitrage equilibrium Clark, 2002. The case of imported beer, Federal Reserve Bank of New York, Staff Reports 179.

Next

:max_bytes(150000):strip_icc()/fruitsandvegetabledisplayedwithprices-2faa202fccd24373a114f9e036319b54.jpg)