An auditor is a professional who is responsible for examining and verifying the financial records and statements of a company or organization. The main purpose of an audit is to provide an independent and objective assessment of the financial information of a company, in order to ensure that it is accurate, reliable, and in compliance with relevant laws and regulations.

As an auditor, it is important to understand the various liabilities that you may face in the course of your work. These liabilities can arise from a variety of sources, including errors or omissions in your audit work, failure to follow professional standards, or breaches of confidentiality.

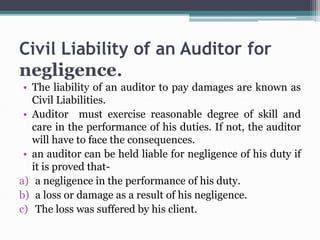

One type of liability that an auditor may face is professional liability, which refers to the risk of being held legally responsible for any mistakes or errors made in the course of an audit. This can include mistakes in the audit process itself, such as failing to detect errors or irregularities in the financial records, or failing to follow proper auditing procedures. It can also include issues related to the presentation of the audit report, such as failing to clearly communicate the results of the audit or making false or misleading statements.

Another type of liability that an auditor may face is liability for breach of contract. This can occur if the auditor fails to fulfill the terms of their contract with the company or organization being audited. For example, if the auditor fails to complete the audit within the agreed-upon timeframe, or if they fail to adhere to the scope of the audit as outlined in the contract, they may be held liable for breach of contract.

An auditor may also face liability for breach of confidentiality, which refers to the risk of disclosing confidential information obtained during the audit process. This can include information about the company's financial performance, business practices, or other sensitive matters. It is important for an auditor to maintain the confidentiality of this information, as a breach of confidentiality can damage the reputation of the company and the auditor, and may even result in legal action.

In addition to these types of liabilities, an auditor may also face personal liability for any intentional or negligent actions taken during the audit process. This can include liability for fraud or misrepresentation, or for failure to follow professional standards.

Overall, it is important for an auditor to be aware of the various liabilities that they may face in the course of their work. By understanding these risks, an auditor can take steps to minimize their exposure to liability and protect themselves and their clients from potential legal and financial consequences. This includes maintaining professional standards, following proper procedures, and carefully considering the risks and implications of any actions taken during the audit process.