A life insurance management system is a system that helps individuals and organizations manage their life insurance policies and premiums. It allows users to keep track of their coverage, make payments, and update their personal and policy information.

One of the main benefits of a life insurance management system is that it provides users with a convenient and secure way to manage their policies. Rather than having to keep track of physical documents or manually make payments, users can access all of their policy information and make payments online. This can be especially useful for individuals who have multiple policies or who need to make frequent changes to their coverage.

Another benefit of a life insurance management system is that it can help users save time and money. By automating the process of paying premiums, users can avoid late fees and ensure that their coverage remains active. Additionally, a life insurance management system may offer users the ability to compare different policies and premiums, helping them to find the best coverage for their needs at the most affordable price.

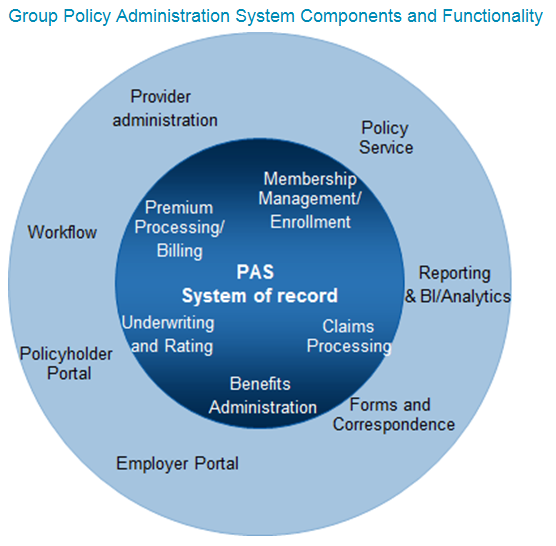

In addition to helping individuals manage their life insurance policies, a life insurance management system can also be useful for organizations. For example, an employer may use a life insurance management system to offer group life insurance to their employees. This can help employees to feel more secure and supported by their employer, while also allowing the employer to manage the policy and premiums efficiently.

Overall, a life insurance management system can be a valuable tool for individuals and organizations looking to manage their life insurance policies and premiums more effectively. It provides users with a convenient and secure way to access and manage their policy information, while also helping to save time and money.

Top Insurance Agency Management Systems

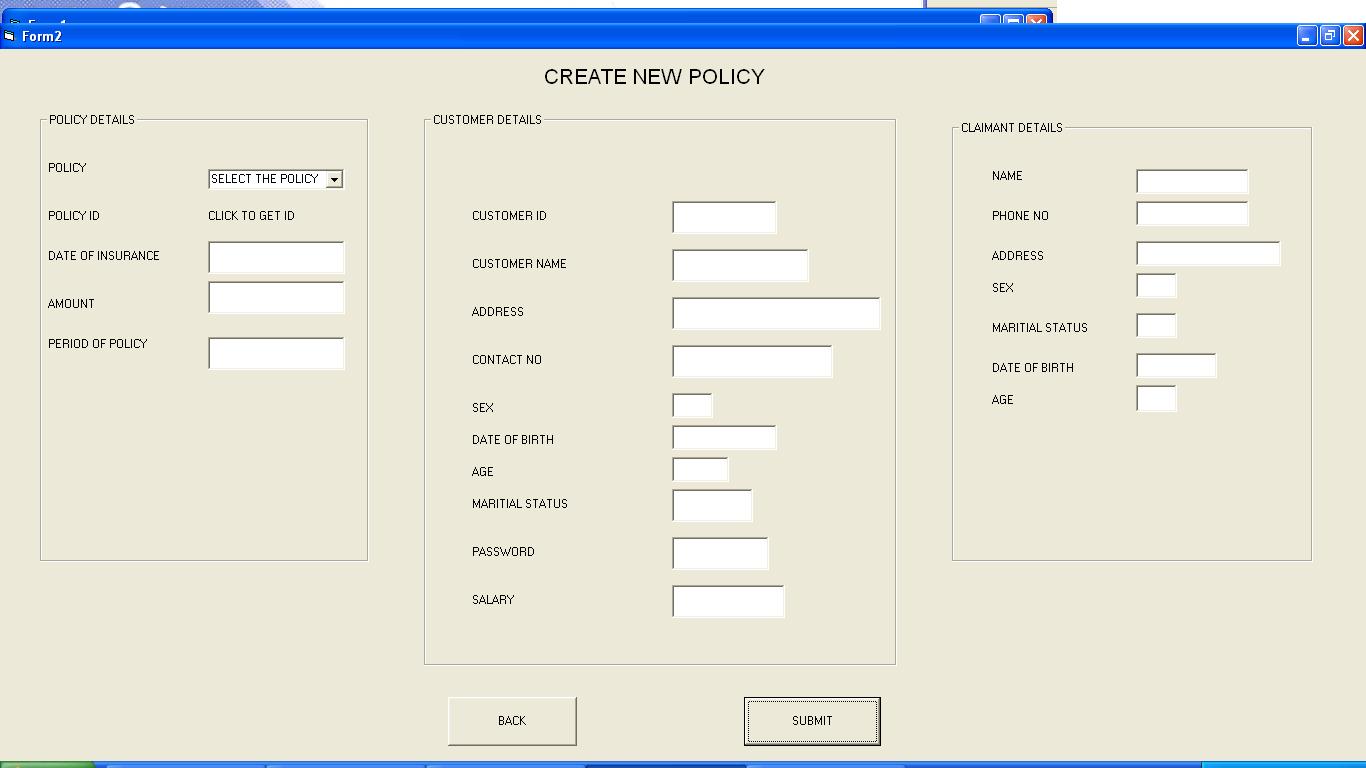

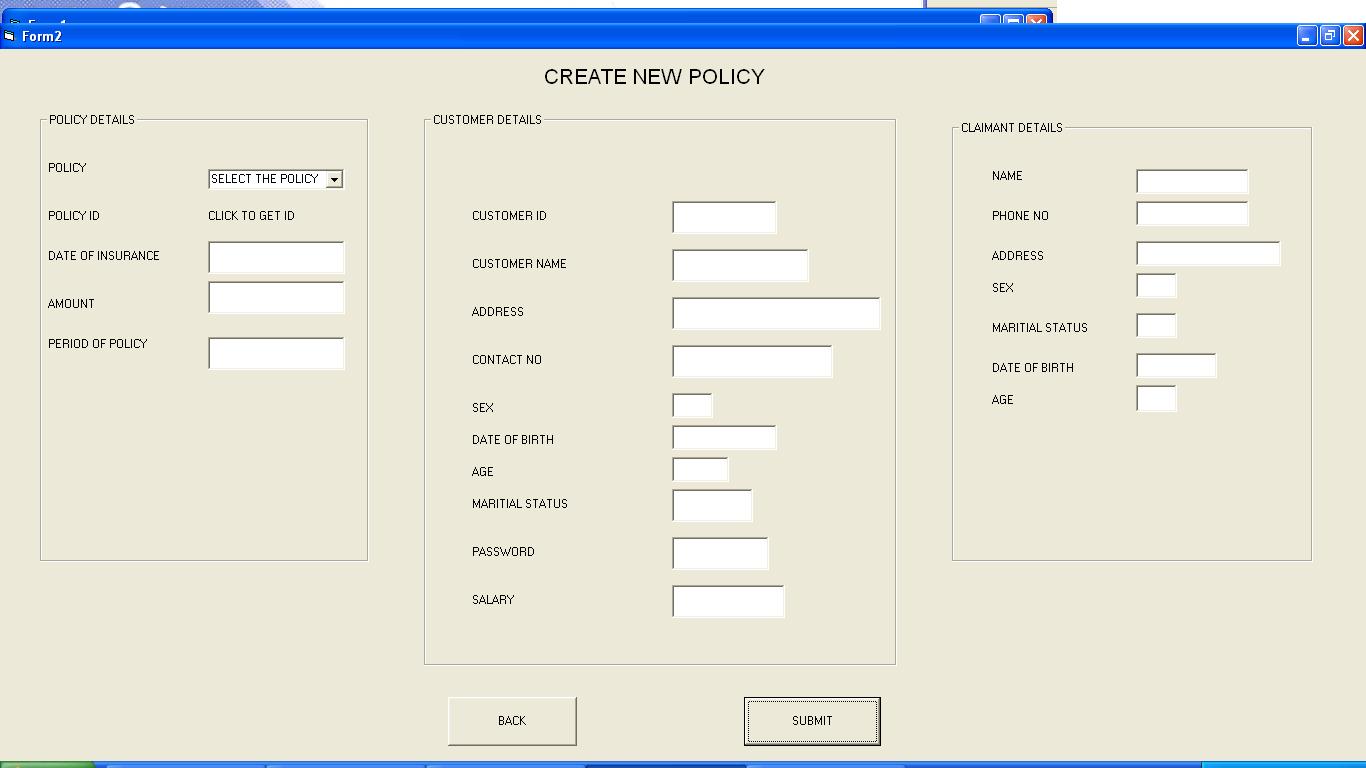

The insurance industry including agencies has been drenched in large amounts of documents for as long as one can imagine. Life insurance management software is very useful for any type of insurance company in need of managing different types of insurance. Example of life insurance agent management in Additionally, life insurance solutions can integrate with Common Features of Life Insurance Software When researching life insurance software, make sure the tools you're looking into offer the following standard features: Initiate, verify, approve and track customers claims. They offer 100+ pre-built automation campaigns, so you don't have to write one on your own. It also helps in policy management by mapping clients, agents, insurers, and everything involved in between.

Life Insurance Management System blog.sigma-systems.com Project

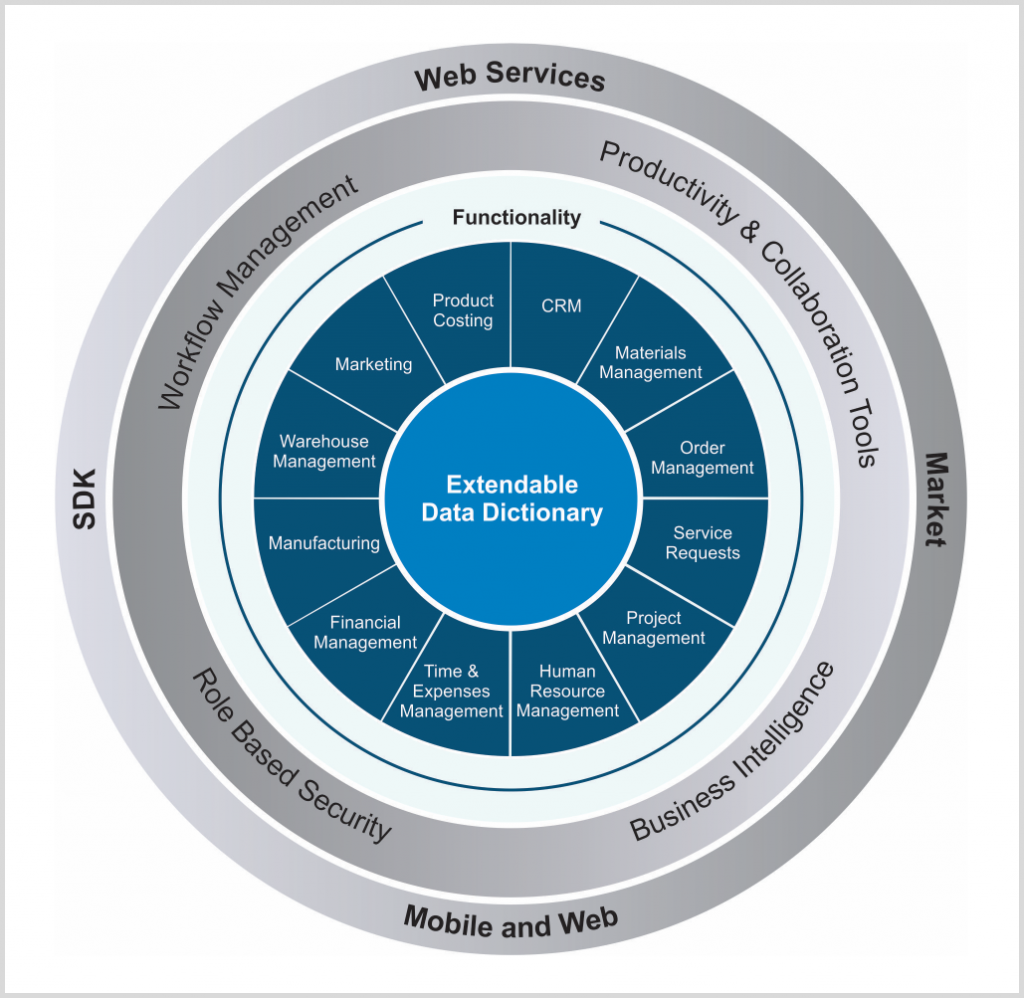

Using spreadsheets or excel for calculating sales incentives can lead to inaccurate results. But, this can be challenging when a zillion other tasks take up your time. This typically includes rating tables and automated underwriting workflows for faster policy creation. NET, Python, C++, in C programming language, and more. Life insurance solutions can be customized to meet your business needs. This means that 3 out of 10 of your potential buyers are influenced by whether you use dedicated software rather than relying on manual methods such as Excel. Axelerator supports the generation and posting of all accounting transactions and reinsurance bordereau.

Best Life Insurance Software

Insurers can Read More The Now Platform delivers a System of Action for the enterprise. Market Trends to Understand In the 2017 Software Advice report, "How Insurance Technology Trends Impact Customer Expectations," we surveyed customers and asked them what they expected out of insurance providers. It should also be able to support the entire lifecycle of an individual or a group policy. One of the common mistakes small businesses make is purchasing a tool, only to find out afterward that it doesn't quite meet their business needs. Regardless of the reason for a failed or failing implementation, it results in a huge waste of company time and resources. It offers an embedded business intelligence tool with robust analytics to help you monitor your agency's performance and improve customer relationships. Pay the right price.

Life Insurance Management System (Advanced Free Source Code)

Vendors pay Software Advice for these referrals. EZLynx If you are an independent agency seeking to streamline workflows and expand your workflows, then EZLynx offers a wide range of features like CRM, back-office management tools, automatic marketing that helps insurance agents strengthen their relations with customers and potential clients. The best insurance agency management software ensures the following benefits: a Operations Management: The insurance agency management software streamlines various operations within an organization without human interventions. Insurance Agency Management System helps organize policy, agent, and client management within an agency. With CaptaIMS agency management system, you can easily manage agency network expansion, communications, and compliance. Your life insurance management system will be completely advanced. The other project files including source codes if found will be updated in the download link.

Insurance Agency Management System

Here's what we'll cover: What Is Life Insurance Software? This means that as your business grows and you hire more agents, the price of the solution will increase. If you want an advanced version of Life Insurance Management, then you can contact us. Tigerlab enables complete workflow management for agents and staff. In addition, a good insurance policy administration system should be able to handle the full lifecycle of a policy. Today, customers will not overlook mistakes, and they'll switch providers if their expectations are not met.