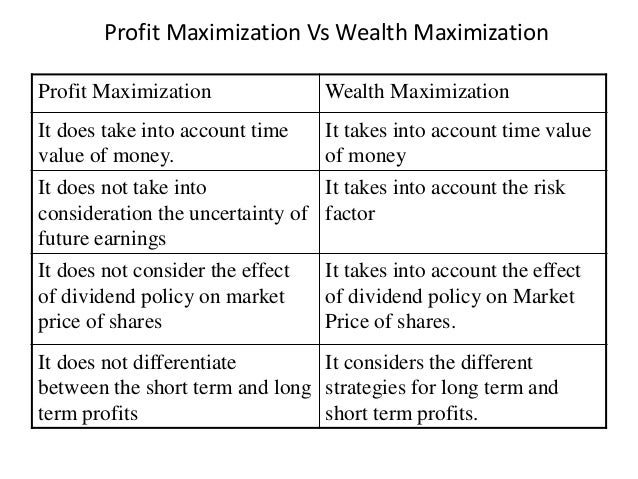

Profit maximization is a common goal for businesses, as it is seen as a way to maximize shareholder value and ensure the long-term viability of the company. However, there are several limitations to this approach that can ultimately be detrimental to both the company and society as a whole.

One limitation of profit maximization is that it can lead to unethical or irresponsible behavior. In an effort to maximize profits, companies may cut corners and engage in practices that are harmful to the environment, employees, or consumers. For example, a company may choose to use cheaper, but more harmful, materials in their products, or may exploit workers by paying low wages and providing poor working conditions. This can have negative consequences for both the individuals and communities affected, as well as for the company's reputation and long-term success.

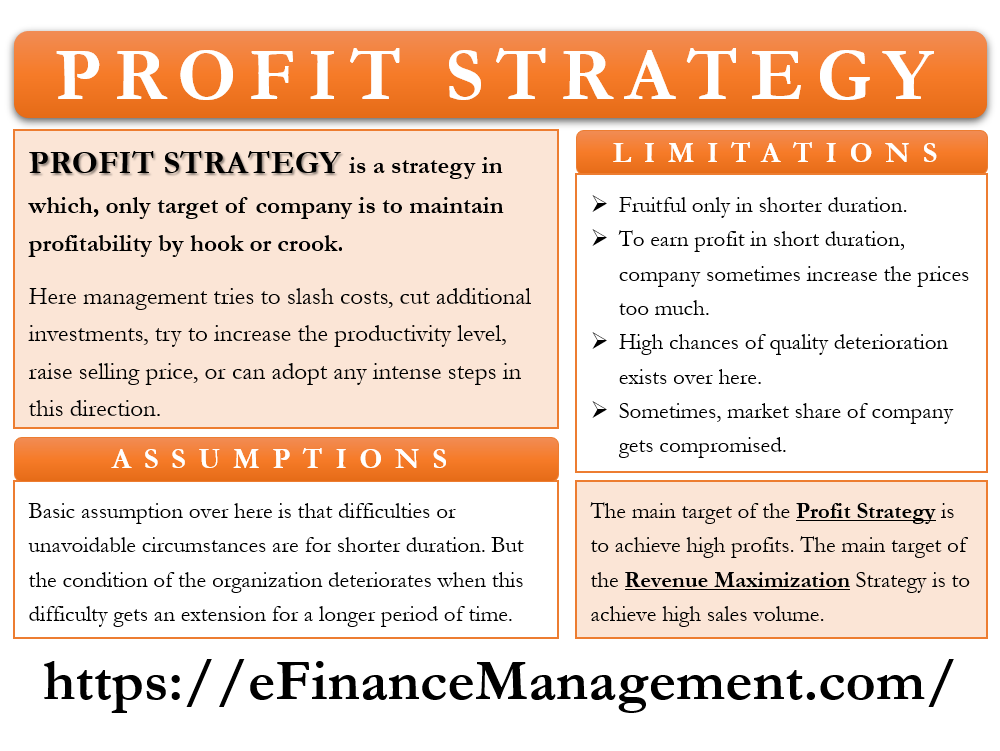

Another limitation is that profit maximization can create a narrow focus on short-term gains, rather than considering the long-term sustainability of the company and its impact on society. This can lead to decisions that prioritize immediate profits over the well-being of the company and its stakeholders in the long run. For example, a company may choose to outsource jobs to countries with lower labor costs, which can lead to job loss and economic instability in the company's home country.

Additionally, profit maximization can lead to a lack of innovation and a failure to adapt to changing market conditions. This is because companies that are solely focused on maximizing profits may be less likely to invest in research and development, or to take risks on new ideas that may not have an immediate financial return. This can result in a failure to keep up with changing consumer demand or technological advancements, ultimately leading to a decline in the company's market share and profits.

Finally, profit maximization can contribute to income inequality and social unrest. When companies prioritize profits above all else, it can result in a concentration of wealth among a small group of individuals, while the rest of society may be left behind. This can lead to social and political tensions and can ultimately harm the overall stability and prosperity of society.

In conclusion, while profit maximization is an important goal for businesses, it is important to recognize the limitations of this approach. Companies must consider the ethical and social implications of their actions and strive to balance their pursuit of profits with the well-being of their employees, communities, and the environment.