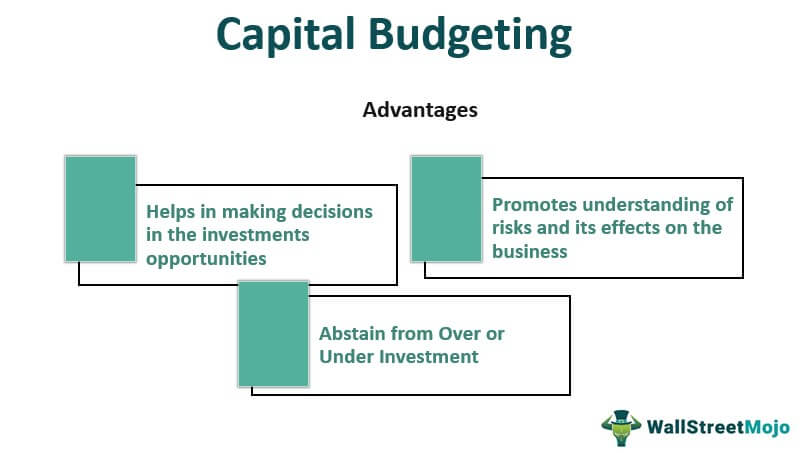

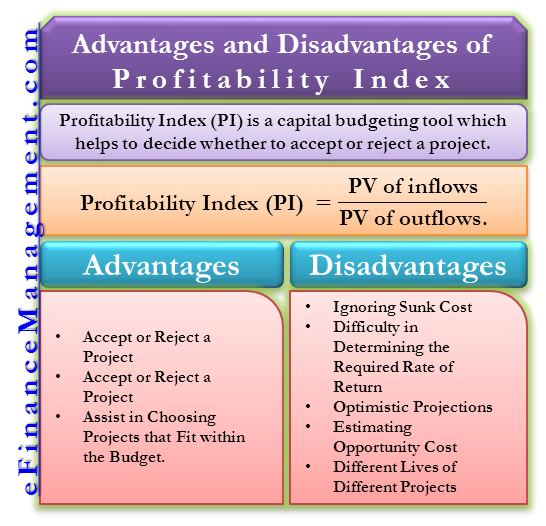

Capital budgeting is a process used by companies to evaluate and prioritize potential investments or projects. These investments can include things like purchasing new equipment, building a new factory, or launching a new product line. While capital budgeting is an important tool for companies to make informed decisions about how to allocate their resources, it does have some limitations that should be taken into consideration.

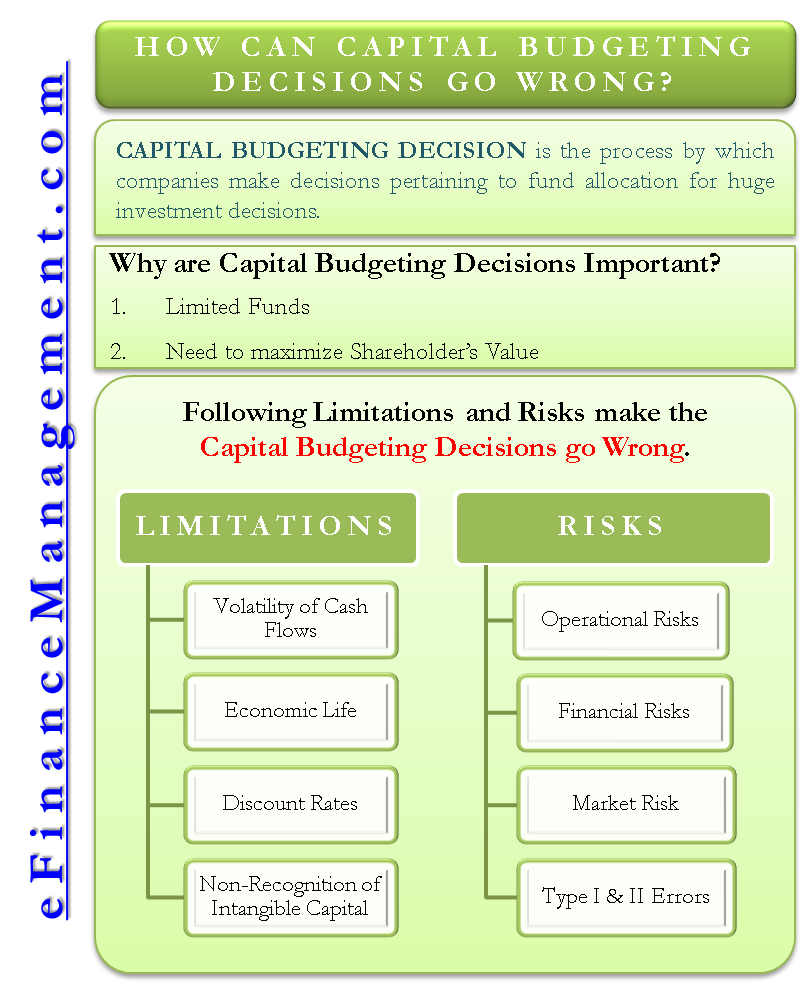

One limitation of capital budgeting is that it relies on forecasting and predictions about the future. This means that it can be difficult to accurately predict the outcomes of a given investment, as there are often many variables at play. For example, a company may forecast that a new product will be a success, but there could be unforeseen market conditions or competition that ultimately affect its performance. As a result, companies need to be aware of the uncertainty inherent in forecasting and be prepared to adapt to changing circumstances.

Another limitation of capital budgeting is that it often focuses on short-term financial outcomes, rather than long-term strategic goals. While it is important for companies to consider the financial implications of an investment, there may be other factors, such as the potential for future growth or the alignment with the company's mission and values, that should also be considered.

Additionally, capital budgeting can be influenced by personal biases and subjectivity. For example, a decision maker may be more likely to favor an investment that aligns with their personal interests or goals, rather than what is in the best interests of the company. This can lead to suboptimal decision making and may not necessarily maximize shareholder value.

A final limitation of capital budgeting is that it does not consider externalities, such as the impact of a given investment on the environment or society. While this may not be the primary focus of a company's decision making process, it is important to consider the potential long-term consequences of an investment.

In conclusion, while capital budgeting is an important tool for companies to evaluate potential investments, it is important to be aware of its limitations. This includes the uncertainty of forecasting, the focus on short-term outcomes, the potential for personal biases, and the lack of consideration for externalities. By taking these limitations into account, companies can make more informed and balanced decisions about how to allocate their resources.

:max_bytes(150000):strip_icc()/GettyImages-485208815-5734c4f65f9b58723d9cfe77.jpg)

:max_bytes(150000):strip_icc()/Capital_Budgeting-v2-ae2dc0edeb8049a79705e2d1a2cb7f05.png)