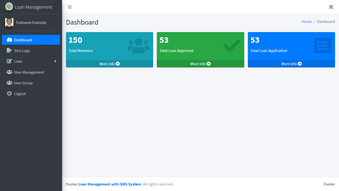

A loan management system is a software application that is used to automate and streamline the process of loan origination, servicing, and collection. It is a comprehensive tool that helps lenders, financial institutions, and other organizations that offer loans to manage the various stages of the loan lifecycle.

The primary objective of a loan management system is to provide a centralized platform for all the activities related to loan management, such as loan origination, disbursement, repayment, and collection. It allows lenders to efficiently track and manage their loan portfolio, and helps them to identify and mitigate potential risks associated with lending.

The loan management system typically includes a variety of features and functionalities that help lenders to automate and streamline their loan management process. These features may include:

Loan origination: The loan origination process involves the creation of a loan application and the evaluation of the borrower's creditworthiness. A loan management system can automate this process by providing a platform for borrowers to apply for a loan and for lenders to evaluate the loan application.

Loan disbursement: Once the loan application is approved, the loan management system can be used to disburse the loan to the borrower. This may involve transferring the funds to the borrower's bank account, issuing a check, or issuing a loan document.

Repayment: The loan management system can also be used to manage the repayment process. It can track the borrower's payments and alert the lender if there are any issues with repayment.

Collection: If a borrower defaults on their loan, the loan management system can be used to initiate the collection process. It can provide tools and resources to help the lender recover the outstanding debt.

In addition to these core features, a loan management system may also include additional functionality to help lenders manage their loan portfolio and reduce risk. This may include features such as credit scoring, risk assessment, and fraud detection.

Overall, a loan management system is a powerful tool that helps lenders to efficiently manage their loan portfolio and reduce risk. It allows them to automate and streamline the loan origination, servicing, and collection process, enabling them to focus on growing their business and serving their customers.