A loan repayment letter is a formal document that is written by a borrower to a lender outlining the terms and conditions of repaying a loan. It should include the amount of the loan, the interest rate, the repayment schedule, and any fees or penalties associated with the loan.

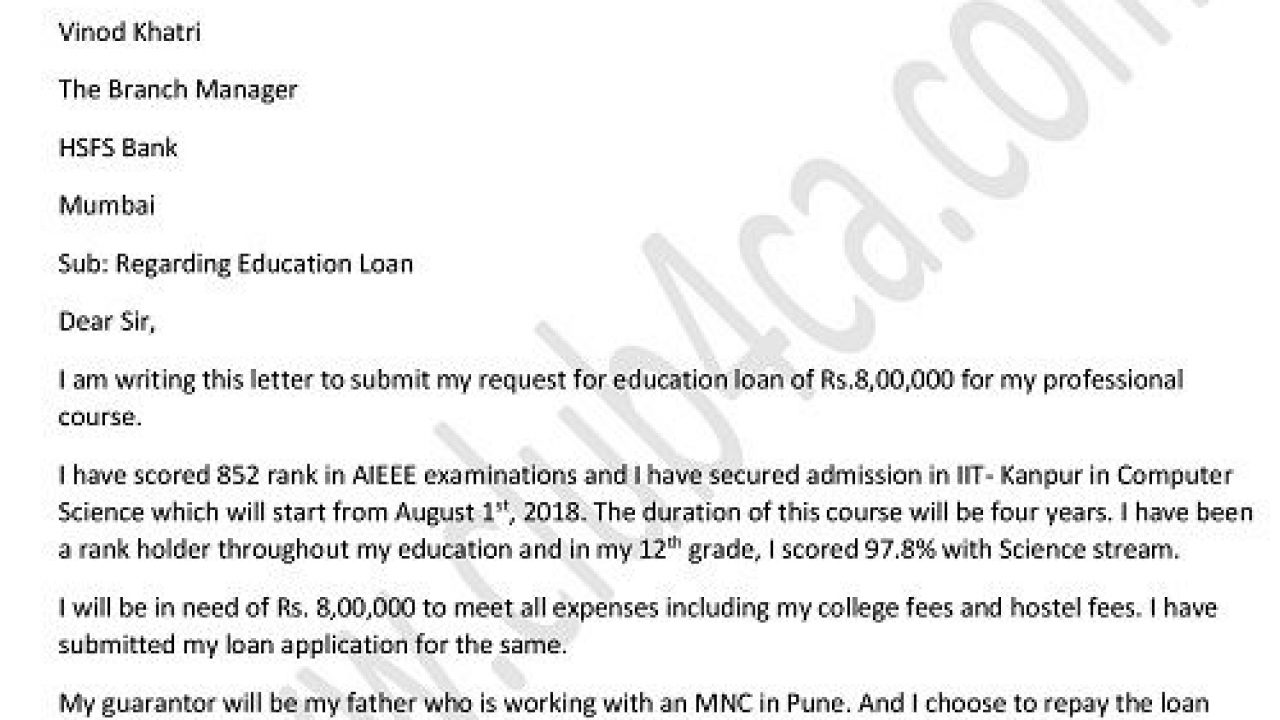

There are a few key elements that should be included in a loan repayment letter. The first is the borrower's personal information, including their name, address, and contact information. This allows the lender to easily identify the borrower and communicate with them about the loan.

Next, the loan repayment letter should include information about the loan itself. This includes the amount of the loan, the interest rate, and the repayment schedule. It is important to clearly outline these details so that both the borrower and the lender are aware of the terms and conditions of the loan.

The loan repayment letter should also include any fees or penalties associated with the loan. These might include late fees for missed payments or prepayment penalties for paying off the loan early. It is important to include this information so that the borrower is aware of any additional costs that may be associated with the loan.

Finally, the loan repayment letter should include a clear statement of the borrower's intention to repay the loan. This can be as simple as a statement that the borrower is committed to making timely payments according to the agreed upon schedule.

In summary, a loan repayment letter is a formal document that outlines the terms and conditions of repaying a loan. It should include the borrower's personal information, information about the loan itself, any fees or penalties associated with the loan, and a clear statement of the borrower's intention to repay the loan. By including these elements, the borrower can clearly communicate with the lender and ensure that the loan is repaid in a timely and satisfactory manner.

Free Loan Agreement Templates (10)

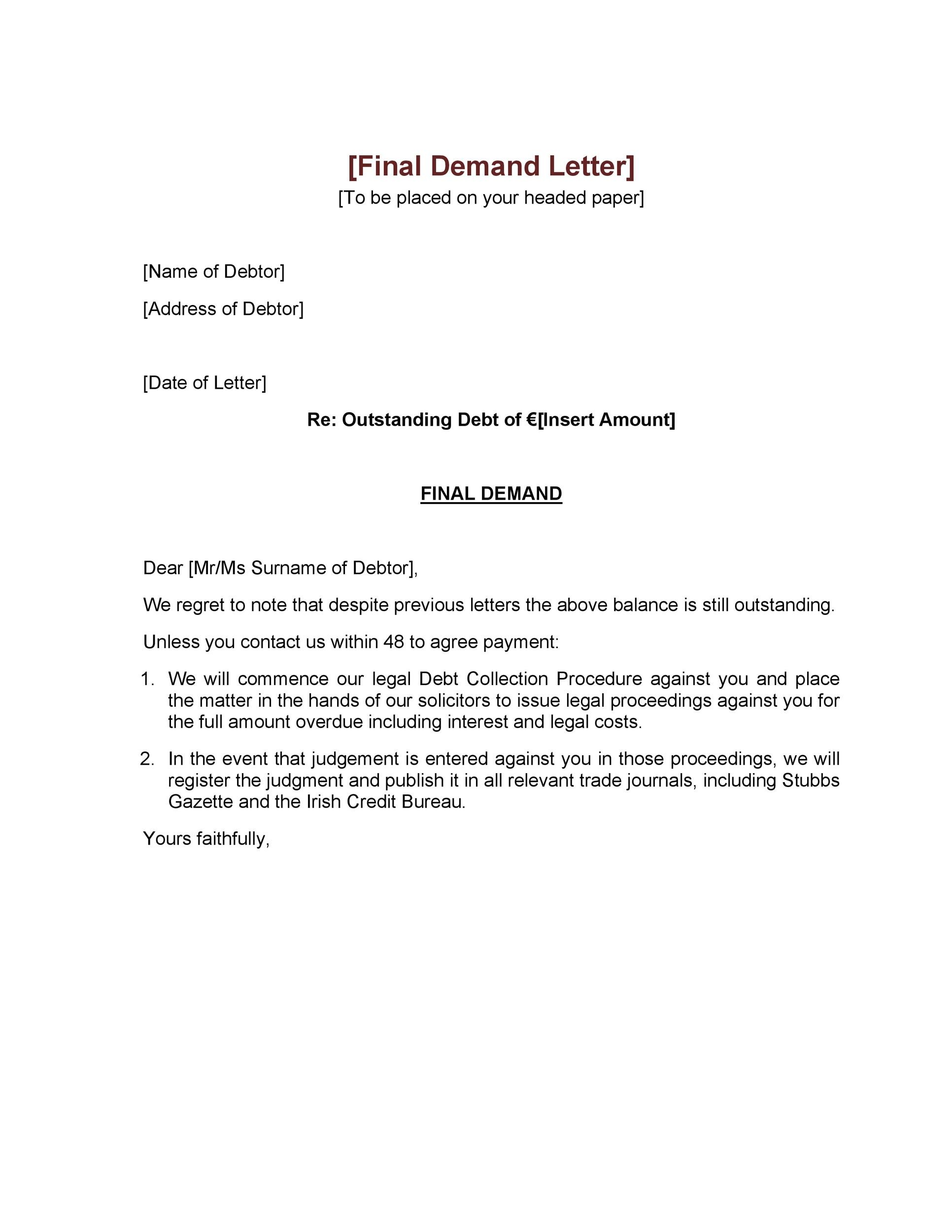

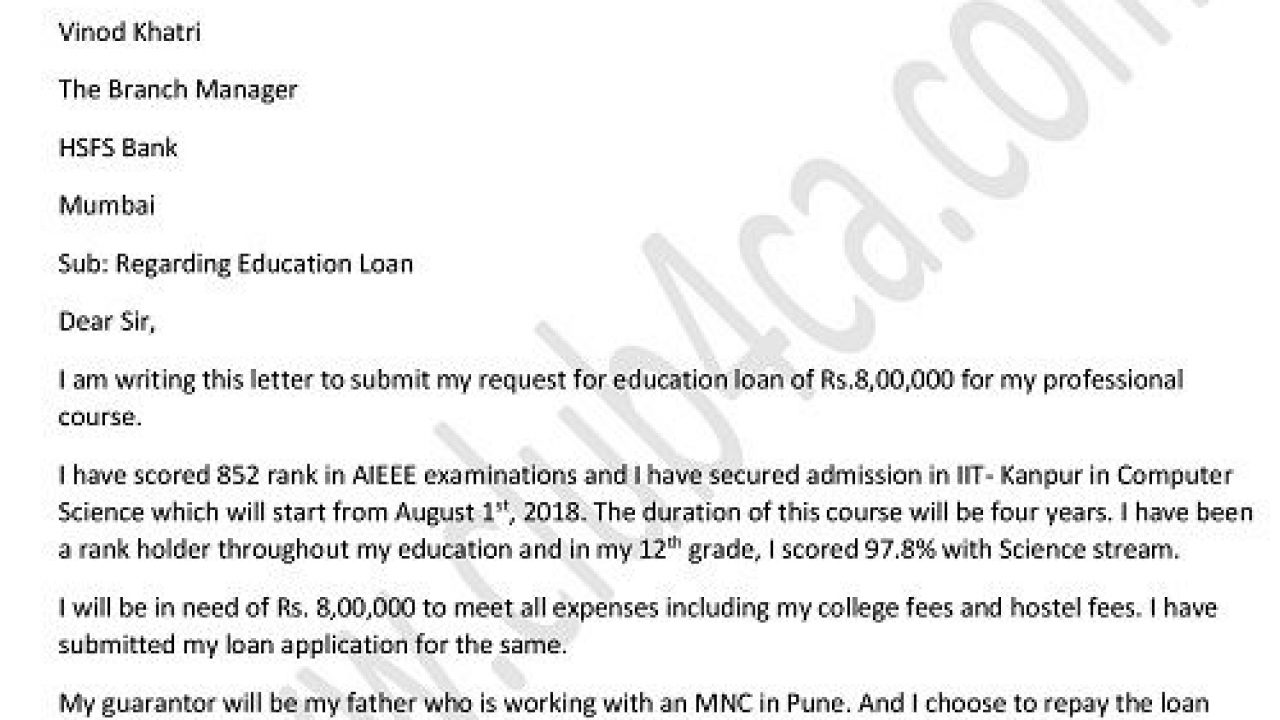

In many cases, the Lender will be a Business i. Below is a sample personal loan repayment letter from the borrower to the lender stating that the loan has been paid in full. For this reason, personal loans, whether from a bank, lending institution or a friend are harder to get and usually have a higher interest rate than a secured loan. This letter uses formal language and informs the borrower that he or she is overdue with repaying a personal loan. If it is not possible for the borrower to repay in one lump sum, the lender can agree to extend the monthly payments.

Loan Repayment Extension Request Letter

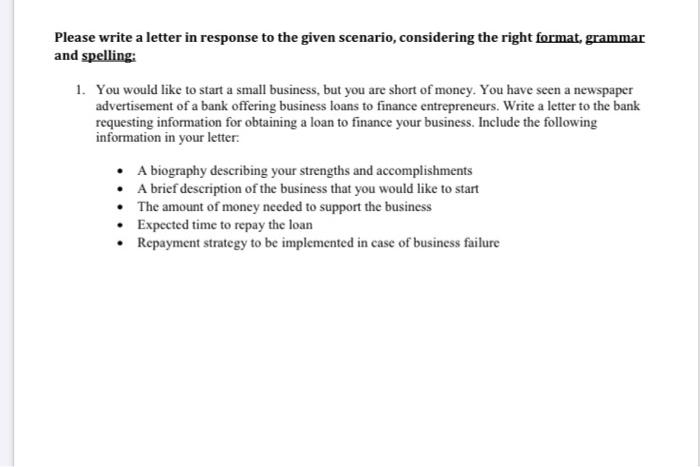

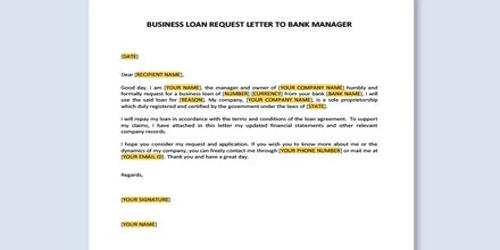

If it is not possible for the borrower to repay in one lump sum, the lender can agree to extend the monthly payments. Is it okay to close a personal loan earlier than the deadline? Nevertheless, this will also free you from the burdens of your debt. Unlike normal loans where there is a penalty for repaying the loan early, this agreement does not contain such language. A revolving credit, in simple terms, is also known as your credit limit. This type of loan will only be granted if a businessman has an official business plan. Pointing out your financial problems works against you — instead, point out your qualifications as a borrower. A person who needs cash immediately because of an emergency can apply for a cash advance through a credit card.

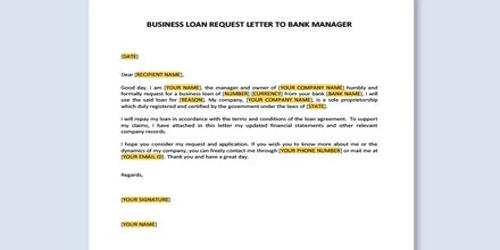

Loan Repayment Letter

Should a Representative have signed this paperwork on behalf of the Borrowing Business, then his or her full name must be printed as well as the title he or she holds with the Borrower. Moreover, a score that is greater than 800 is even better. Therefore, my loan is paid in full according to the payment agreement terms, and I request that you acknowledge that the loan is fully repaid by signing an enclosed copy of this letter and returning it to me. Remember that knowingly providing false information on a loan application, including falsifying documents, not reporting your current debts, exaggerated income, misrepresented purpose, undervaluing assets, inaccurate residency, among others, qualifies as lying and is considered a crime. An effective loan application letter should only be one page long and contain six or fewer paragraphs.