Finance is a broad field that encompasses a wide range of topics and issues related to the management, creation, and study of money and financial assets. It is an essential component of business and plays a crucial role in the functioning of economies at all levels, from individual households to large corporations and governments. Within finance, there are several main areas of focus that are important for professionals to understand and master.

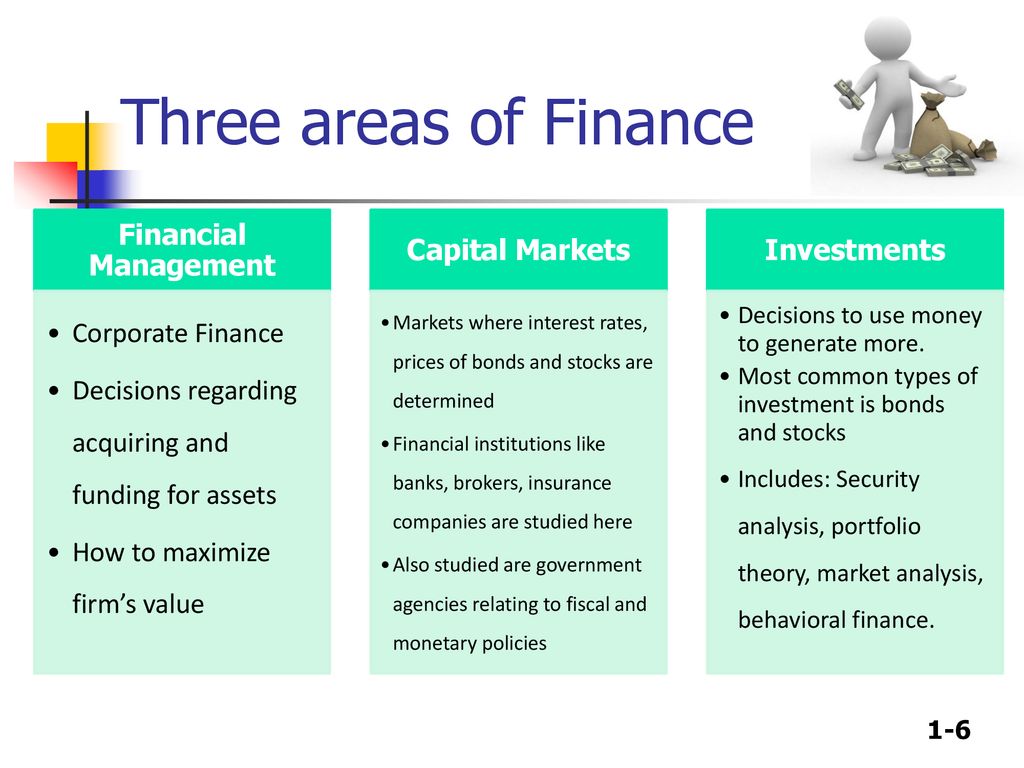

One of the most fundamental areas of finance is corporate finance, which deals with the financial decisions and activities of businesses. This includes financial planning, budgeting, and forecasting, as well as the management of a company's financial resources, such as its cash flow and capital structure. Corporate finance also involves the raising of capital through various means, including the issuance of debt or equity securities, as well as the use of financial instruments such as derivatives.

Another important area of finance is investment, which involves the process of evaluating and selecting assets to purchase or sell in order to generate returns. This can include the buying and selling of stocks, bonds, and other securities, as well as the management of investment portfolios. Investment professionals, such as financial analysts and portfolio managers, use a variety of tools and techniques to evaluate the potential risks and returns of different investments and make informed decisions about where to allocate their assets.

A third key area of finance is banking, which involves the creation, distribution, and management of financial products and services. This includes traditional banking activities such as accepting deposits, making loans, and facilitating the transfer of funds, as well as more specialized activities such as investment banking, asset management, and wealth management. Bankers work to understand the financial needs and goals of their clients and provide appropriate financial products and services to meet those needs.

In addition to these three core areas, finance also encompasses a number of other subfields, such as personal finance, public finance, and international finance. Personal finance involves the management of an individual's financial resources, including budgeting, saving, and investing for the future. Public finance, on the other hand, focuses on the financial activities and decisions of governments, including the taxation and expenditure of public funds. International finance, meanwhile, deals with the financial transactions and exchanges that occur between countries, including the movement of capital, exchange rate fluctuations, and trade imbalances.

Overall, finance is a diverse and multifaceted field that plays a critical role in the functioning of the economy. Whether working in corporate finance, investment, banking, or one of the many other areas of finance, professionals are responsible for managing and directing the flow of financial resources in a way that maximizes value and supports the growth and stability of organizations and economies.