Management efficiency ratios are a set of financial metrics used to evaluate the effectiveness of a company's management in using its resources to generate profits. These ratios measure how efficiently a company is using its assets, liabilities, and equity to generate sales and profits. In other words, management efficiency ratios show how well a company is able to utilize its resources to achieve its financial objectives.

There are several different management efficiency ratios that can be calculated, each of which measures a specific aspect of a company's management efficiency. Some of the most common management efficiency ratios include the inventory turnover ratio, the accounts receivable turnover ratio, and the fixed asset turnover ratio.

The inventory turnover ratio measures the number of times a company's inventory is sold and replaced over a given period of time. A high inventory turnover ratio indicates that a company is able to quickly sell its inventory and replace it with new products, which can be a sign of efficient inventory management. On the other hand, a low inventory turnover ratio may indicate that a company is having difficulty selling its inventory, which can lead to excess inventory and increased carrying costs.

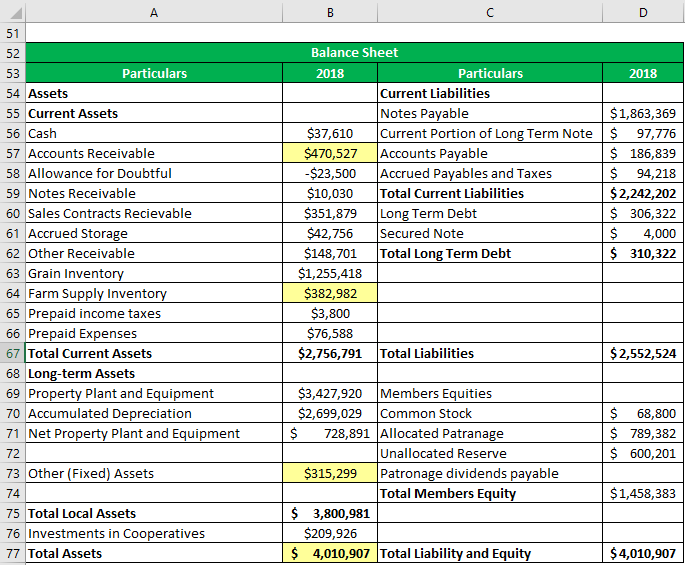

The accounts receivable turnover ratio measures the number of times a company's accounts receivable are collected over a given period of time. This ratio is an indication of how quickly a company is able to collect payments from its customers. A high accounts receivable turnover ratio suggests that a company is able to efficiently manage its accounts receivable and collect payments in a timely manner. A low accounts receivable turnover ratio, on the other hand, may indicate that a company is having difficulty collecting payments from its customers, which can lead to cash flow problems.

The fixed asset turnover ratio measures the amount of sales a company generates per dollar of its fixed assets. This ratio is an indication of how efficiently a company is using its fixed assets, such as machinery, equipment, and buildings, to generate sales. A high fixed asset turnover ratio suggests that a company is able to effectively utilize its fixed assets to generate sales, while a low fixed asset turnover ratio may indicate that a company is not using its fixed assets efficiently.

In conclusion, management efficiency ratios are a useful tool for evaluating the effectiveness of a company's management in using its resources to generate profits. By analyzing these ratios, investors and financial analysts can get a better understanding of a company's management efficiency and make more informed investment decisions.