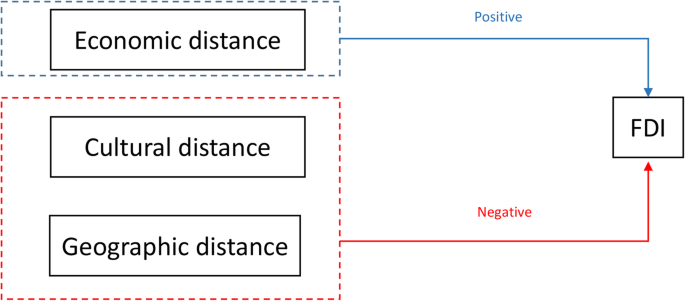

Foreign direct investment (FDI) refers to the process by which a company based in one country invests in and establishes operations in another country. FDI can take many forms, including the establishment of a new business, the acquisition of an existing company, or the expansion of existing operations in a foreign market.

There are several potential benefits of FDI for both the host country and the investing company.

One of the primary benefits of FDI for the host country is the influx of capital. When a foreign company invests in a new market, it typically brings with it a significant amount of financial resources. This capital can be used to fund new infrastructure projects, create new jobs, and stimulate economic growth.

FDI can also bring new technology and expertise to the host country. Many foreign companies are at the forefront of their respective industries and have access to the latest technological innovations. By establishing operations in a foreign market, these companies can transfer their knowledge and expertise to local workers, helping to modernize and improve the host country's industry and infrastructure.

In addition to the economic benefits, FDI can also bring cultural exchange and understanding. When a foreign company establishes operations in a new market, it often brings with it a diverse group of employees from different cultural backgrounds. This can lead to increased cultural understanding and exchange, as local workers and foreign employees learn from one another and work together to achieve shared goals.

For the investing company, FDI provides an opportunity to expand into new markets and access new customers. By establishing a presence in a foreign market, a company can take advantage of new business opportunities and potentially tap into a larger pool of consumers. In addition, FDI can also help to diversify a company's revenue streams, reducing its reliance on any one particular market.

In conclusion, FDI can bring a range of benefits to both the host country and the investing company. It can bring much-needed capital and expertise to the host country, stimulate economic growth, and facilitate cultural exchange. For the investing company, FDI provides an opportunity to expand into new markets and access new customers, helping to diversify revenue streams and reduce reliance on any one particular market.

Foreign Direct Investment: Definition, Example, Pros and Cons

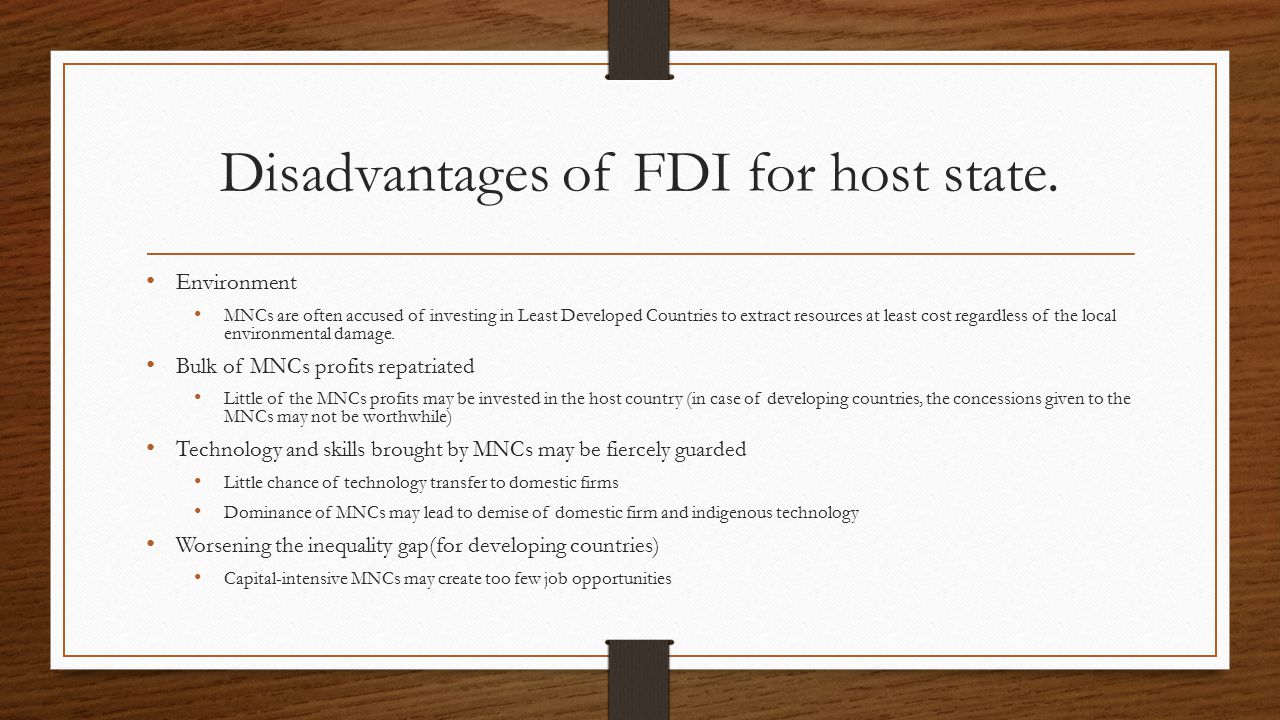

Like other investment avenues, FDI also has advantages and disadvantages, primarily geo-political. During last few years fresh FDI investment in not taking place. The only statistics it doesn't capture are those between the emerging markets themselves. A series of policy incentives, investment sovereignty has been offered to the FDI investors including tax holiday for several years, duty free facility for importing capital machinery, 100% foreign ownership, 100% profit repatriation facility, reinvestment of profit or dividend as FDI, multiple visa, work permit to foreign executives, permanent resident or even citizenship for investing a specific amount, Export Processing Zone EPZ facility, and easy hassle free exit facility. The approaches to balanced federal budget are to raise additional revenue or to cut spending. By adopting these practices, they enhance their employees' lifestyles.

17 Big Advantages and Disadvantages of Foreign Direct Investment

FDI in a country leads to the building of new factories and expansion of existing operations utilizing local resources that creates more employment opportunities, especially in service and manufacturing sectors. Hence, it is an attractive mode of investment. The higher goods and service are imported than exported, the more Disadvantages Of Economic Growth 1571 Words 7 Pages Along these lines, unemployment may decrease, as this has different favorable circumstances, for example, lower government using on profits and less social issues. It also helps improve the standard of living of the people. FDI refers to the initial investment that is made to reach the 10% threshold. All of the good and services can be found on international market.

(DOC) FDI

The strength of this objection really rests on the nature of political set up. The recent Mexico and South East- Asian countries experience has shown how a country can be driven to a crisis when foreigners resort to a massive withdrawal of funds. A series of policy incentives, investment sovereignty has been offered to the FDI investors including tax holiday for several years, duty free facility for importing capital machinery, 100% foreign ownership, 100% profit repatriation facility, reinvestment of profit or dividend as FDI, multiple visa, work permit to foreign executives, permanent resident or even citizenship for investing a specific amount, Export Processing Zone EPZ facility, and easy hassle free exit facility. For this purpose, every firm invests in the development of human resources. Mankiw 2004 stresses that international trade affects economic growth and can indeed to be regarded as a type of technology in that it converts non-specialized production into specialized production. Also, in case of a loan inflow, the productive use is the responsibility of the host country, while in case of FDI the productive use is ensured automatically.