Mexican gaap. Accounting in Mexico 2023-01-02

Mexican gaap

Rating:

9,4/10

1349

reviews

The Mexican Generally Accepted Accounting Principles (GAAP) is a set of accounting standards and guidelines used in Mexico for the preparation and presentation of financial statements. These principles are established by the Mexican Institute of Public Accountants (IMCP) and are based on International Financial Reporting Standards (IFRS).

Mexican GAAP is mandatory for publicly traded companies in Mexico and is also used by many private companies. It is designed to ensure that financial statements provide accurate and reliable information about an entity's financial position, performance, and cash flows.

Mexican GAAP consists of a number of principles, including the principle of reliability, which requires that financial statements be based on verifiable and reliable sources of information. The principle of relevance requires that financial information be useful to users of the financial statements in making economic decisions. The principle of faithful representation requires that financial statements accurately and fairly represent the financial position, performance, and cash flows of an entity.

One key difference between Mexican GAAP and other GAAPs, such as those used in the United States, is the treatment of inflation. In Mexico, where inflation has historically been high, financial statements must be adjusted for the effects of inflation. This is done through the use of constant value accounting, which adjusts the value of assets and liabilities for the effects of inflation.

In addition to the principles outlined above, Mexican GAAP also includes specific guidelines for the preparation and presentation of financial statements, including the balance sheet, income statement, and statement of cash flows. These guidelines provide specific rules for the recognition, measurement, and disclosure of financial information.

In summary, the Mexican GAAP is a set of principles and guidelines that provide a consistent framework for the preparation and presentation of financial statements in Mexico. These principles and guidelines ensure that financial statements provide reliable and relevant information to users, and help ensure the transparency and integrity of the financial reporting process in Mexico.

Accounting for leases in Mexico

The subsequent measurement on the asset side is carried out based on the straight-line depreciation of the asset over the term of the lease. The declaration includes reference to convergence of accounting standards, and reaffirming a commitment to sustainable development at the 2012 United Nations Conference on Sustainable Development Rio+20 , which may endorse sustainability reporting. . An individual or company seeking to apply a tax treaty in Mexico must, therefore, demonstrate that he or she is a tax-resident in a State that has a Tax Treaty with Mexico. Also corporate groups that continue to prepare their accounts in Germany in accordance with the German Commercial Code HGB do not have to fear any effects if the new lease standard is not applied, as the tax decrees related to leases distinguishing between operating and finance leases continue to apply under German commercial law. What is the minimum wage? The capitalization of interest during construction should be taken as qualifying assets.

Next

Mexico GAAP Definition

The actuarial consulting services of QUANTS, the Mexican member of GLOBACS, are fully conversant with NIF-D3 and can guide any company through the process of calculating and disclosing Employee Benefits related figures. There are two types of discount rate known as the weighted average cost of capital and cost. Foreign entities are tax residents when their main place of business or corporate address is in Mexico. IFRS: Puede usarse ya sea la cantidad revaluada o el costo histórico. The program concludes on December 31, 2020, unless its validity is extended.

Next

Mexican Banking GAAP Definition

Deferred Taxes and Employee Profit Sharing Mexico Through December 31, 1999, Mexican GAAP required that deferred taxes be recorded for those significant timing differences whose turnaround was reasonably assured within a defined period of time. If the submission is complete, the tax authorities will issue its ruling. . One option that IMMEX or maquiladoras companies can take, instead of applying the Safe Harbor rule, is requesting the tax authorities to authorize a profit margin on their specific operation, determined through a transfer pricing study. Guides and resources Translations from Spanish to English of accounting and finance terms produced by the Consultative Group to Assist the Poor CGAP. One of these problems is the impossibility of establishing a comparison between two financial statements and the overprice that can be created for the application of different.

Next

Accounting in Mexico

The extension of the balance sheet to include the recognition on the asset and liabilities side alone changes companies' key figures as a result of the new accounting approach. The SAT has published the list of Mexican Tax Treaties. International Corporate Procedures LexisLibrary This regularly updated database includes information on tax and accounting and features model company accounts. Deferred Taxes Mexican GAAP recognizesDeferred tax effects for all transactions that are affected in different periods. Mexican Northern Border and VAT As noted above, taxpayers that have their tax address in the northern border region of Mexico may apply the 8% rate, instead of the 16% rate, when sell and deliver the goods or provide their services in that region, provided that they meet certain requirements.

Next

Mexico: Outsourcing is banned and companies must comply with new regulations fast to avoid hefty fines

The analysis of the suppletory application of IFRS for Mexican FRS purposes is relevant as it could reduce the differences when transitioning to IFRS. The model accounts are presented in the standard format for each country or territory with original language and English language versions presented together. The report focuses on the private sector's point of view in regards to global regulatory convergence. Current and deferred employee profit sharing expense is included in provisions under MexicanGAAP. These rulings may stem from an agreement with the competent tax authorities of a country that has a Bilateral Tax Treaty with Mexico. In the event that the Mexican company does not comply with the aforementioned requirements, the foreign shareholder has the legal obligation to have his or her Mexican Tax Id number or RFC. Están prohibidas las revaluaciones.

Next

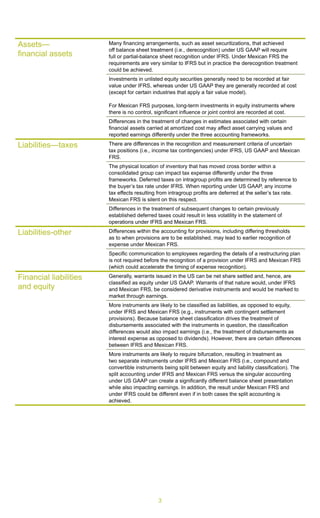

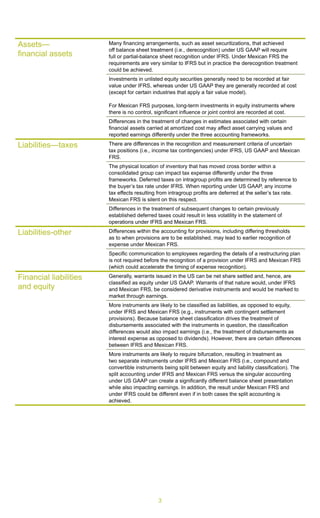

Mexican gaap vs us gaap

Requires a statement of cash flows describing the cash flows provided by or used in operating, investing and financing activities. Preoperating costs are expensed as incurred. La cantidad revaluada es el valor razonable a la fecha de la revaluación menos la depreciación acumulada y las pérdidas por deterioro subsiguientes. IFRS adoption Country profile prepared by the IFRS Foundation with notes on the extent of IFRS application, relevant jurisdictional authority, IFRS endorsement and translation of standards. Inventories are restated using the specific cost method based on independent appraisals.

Next

Mexico

In this guide, Doing Business in Mexico provides a general overview on the IMMEX program. International accounting standards that are suppletory to Mfrs IAS 18-Revenue SIC 31 Revenue-Barter transactions involving advertising services IFRIC 13- Customer Loyalty Programs IAS 20- Accounting for Government Grants and Disclosure of Government Assistance IAS 26- Accounting and Reporting by Retirement Benefit Plans IAS 31- Interests in Joint Ventures IAS 40- Investment Property IFRS 4-Insurance Contracts IFRS 6- Exploration For and Evaluation of Mineral Resources IFRIC 2- Member's Shares in Co-operative Entities and Similar Instruments IFRIC 4- Determining Whether an Arrangement Contains a Lease IFRIC 5- Rights to Interests Arising from Decommissioning, Restoration and Environmental Rehabilitation Funds IFRIC 6- Liabilities Arising From Participating in a Specific Market. The applicable tax may vary from State to State, but the average is a 2% rate. GAAP is much more detailed in its interpretations of this approach. Objective of the NIF D5 In order to provide users of financial statements of companies in Mexico with a more accurate view of the net assets, financial position and results of operations, the principles for the recognition, measurement and disclosure of leases have been revised.

Next

Mexican GAAP Definition: 156 Samples

A detailed report of proceedings at the meeting has now been released, outlining discussions on numerous topics such as the relationship between standard setters and the IASB, the IASB's work programme and processes, and a report on the possible adoption of IFRS in the United States noting a possible "step back". When a foreigner creates a permanent establishment in Mexico, or is considered a resident for Mexican tax purposes? Half of the profit-sharing payment is made on a per-head basis, and the other half is calculated considering the salary of each employee. A foreign resident who earns income in cash, kind, services, or credit shall pay income tax when it arises from sources of wealth located in Mexico, even if he or she does not have a permanent establishment in Mexico or when the income is not attributable to the permanent establishment. Permanent Establishment in Mexico A permanent establishment, in general terms, is any business place where activities are partially or totally developed or where independent personal services are offered. Robert Bruce, our regular resident columnist, reports on what is likely to happen next. There are 5,000 delegates from over 120 countries.

Next

Mexican Gaap Vs Us Gaap, Sample of Essays

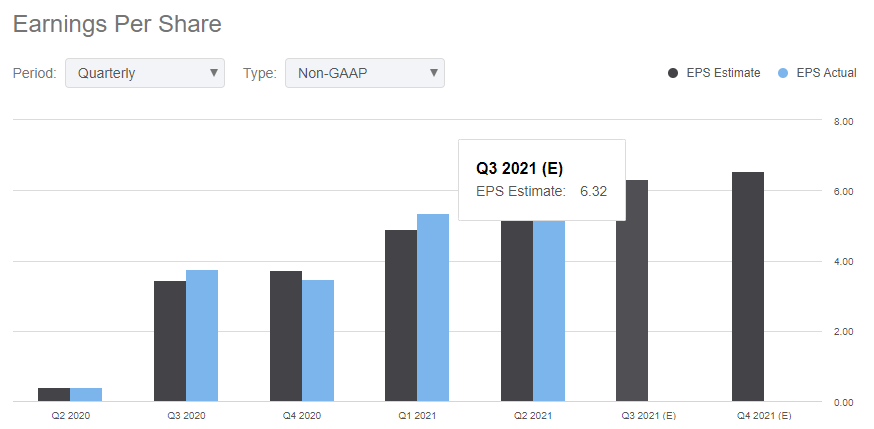

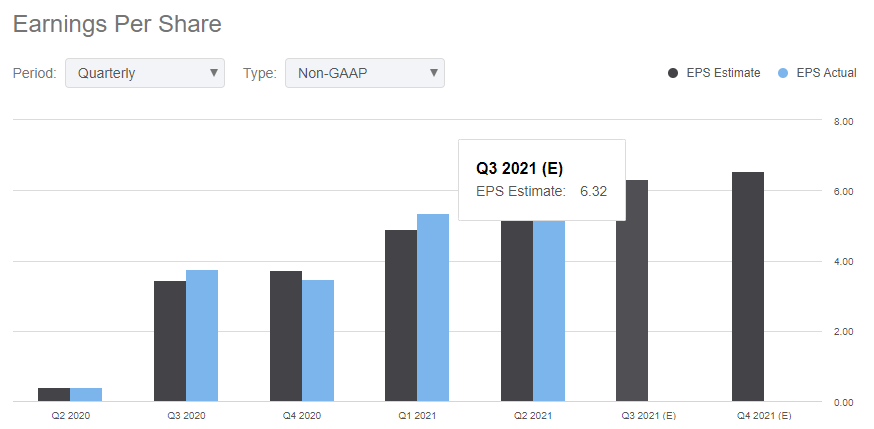

Generally, Mexican GAAP is more flexible than US GAAP. Its impact in the 2021 result and other items are needed to be assessed and disclosed properly. Preoperating Costs Preoperating costs are permitted to be capitalized and amortized over a period of time estimated to generate the income necessary to recover such expenses. In this process, the future lease payments are discounted over the term of the contract using a discount rate at the market level. Mechanized or computerized accounting systems must generate individual sheets and be printed to be bound after they are used. Principales noticias internacionales del entorno de las normas de información financiera The Mexican standard-setter Consejo Mexicano de Normas de Información Financiera CINIF regularly publishes a Spanish language overview of major international news on financial reporting standards. University, Nathan, Queensland 4111, Australia A cash flow statement is an important indicator of financial health because it is possible for.

Next

A Guide to Taxation in Mexico

In this guide, Doing Business in Mexico explores the common employment topics that a foreigner has about Labor in Mexico. . . Needless to say, some goods or services are subject to a 0% VAT rate, for instance, non-processed foods, medicines, etc. IMMEX companies normally opt for the safe harbor rule. As noted above, this occurs when a company has paid more VAT than what it has collected or withheld from its clients. To ensure that the bookkeeping and accounting processes run smoothly, it is recommended that the company have an always up-to-date accounting manual in place, which ideally should also be available in Spanish to the subsidiary.

Next