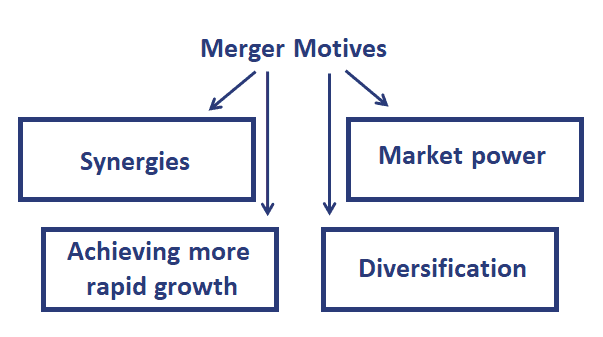

A merger is the combination of two companies into a single entity. This can be accomplished through a variety of methods, including acquisition, amalgamation, consolidation, and merger. There are several motives that may drive a company to pursue a merger.

One common motive for a merger is to achieve economies of scale. This refers to the cost savings that can be achieved by producing goods or services on a larger scale. For example, a company that manufactures automobiles may merge with a company that produces car parts. By combining the two operations, the combined company can take advantage of bulk purchasing discounts and other cost savings opportunities.

Another motive for a merger is to increase market power. By combining with another company, a firm can gain a larger market share and potentially exert more influence over pricing and other market factors. This can be especially attractive for companies operating in oligopolistic markets, where a few firms control a significant portion of the market.

A company may also seek a merger as a way to diversify its product or service offerings. For example, a company that primarily sells software may merge with a company that sells hardware. By combining their product lines, the merged company can offer a more comprehensive range of products and potentially reach a wider customer base.

Acquiring new technologies or expertise is another motive for a merger. By merging with a company that has a different area of expertise, a company can gain access to new technologies or knowledge that can help it stay competitive in its industry.

Finally, a company may pursue a merger as a way to increase shareholder value. This can be achieved through cost savings, increased revenues, or other factors that lead to increased profits and a higher stock price.

In summary, there are several motives that can drive a company to pursue a merger, including achieving economies of scale, increasing market power, diversifying product offerings, acquiring new technologies or expertise, and increasing shareholder value.

:max_bytes(150000):strip_icc()/merger-4192955-01-final-68045c2263684cbba5a2f2dfd29cee84.png)