The national debt is the total amount of money that a country's government owes to its creditors. It is a measure of the financial health of a nation and is an important indicator of a country's economic stability. The national debt can be financed through the sale of government bonds, which are essentially loans made to the government by private investors.

The national debt can have both positive and negative impacts on a country's economy. On the positive side, the national debt can be used to fund important government programs and initiatives, such as infrastructure projects, education, and healthcare. This can help to stimulate economic growth and improve the standard of living for the country's citizens.

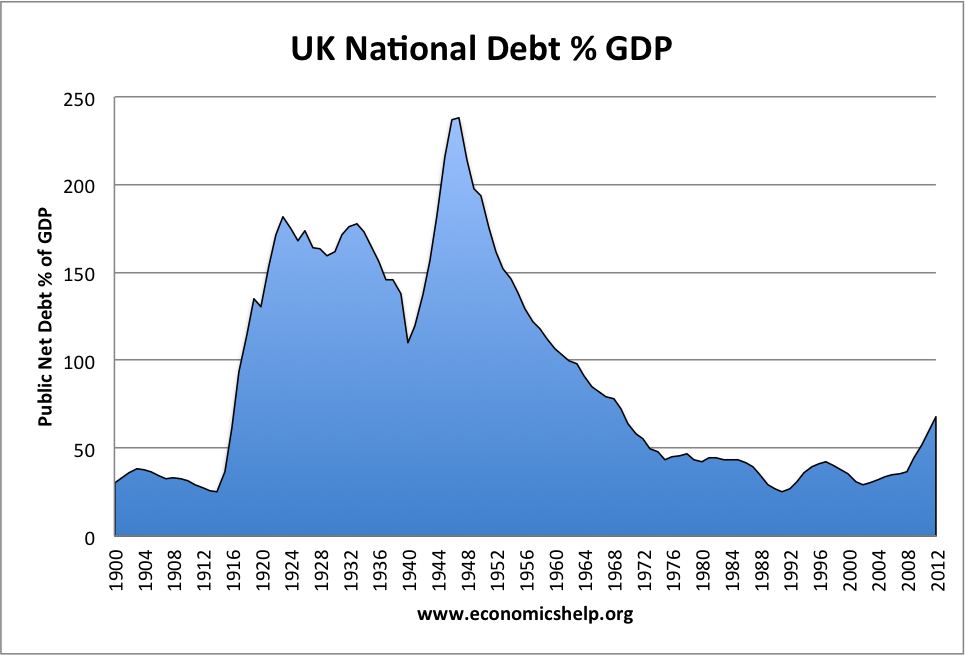

However, the national debt can also have negative consequences if it becomes too large. When a country has a high level of national debt, it may struggle to make interest payments on its bonds, which can lead to a loss of confidence in the government's ability to pay back its debts. This can result in higher borrowing costs for the government, which can ultimately lead to higher taxes for citizens.

In addition, a large national debt can also put pressure on a country's currency and lead to inflation. This is because the government may need to print more money to pay off its debts, which can lead to a decrease in the value of the currency.

One way that countries can reduce their national debt is through fiscal responsibility, which involves careful budgeting and the reduction of unnecessary spending. This can help to reduce the amount of money that the government needs to borrow and ultimately lower the level of national debt.

Overall, the national debt is an important factor to consider when evaluating the financial health of a country. While it can be used to fund important programs and initiatives, it is important for governments to manage their debt levels responsibly to avoid negative consequences for the economy and its citizens.

The national debt is the total amount of money that a country owes to its creditors, including foreign governments, businesses, and individuals. It is a crucial economic indicator that reflects the financial health of a nation, as well as its ability to pay back its debts and meet its future financial obligations.

In the United States, the national debt has grown significantly over the past few decades, reaching a record high of over $28 trillion in 2021. This increase has been driven by a variety of factors, including rising healthcare costs, military spending, and tax cuts.

One of the main concerns about the national debt is its potential impact on the economy. When a country has a high level of debt, it may be forced to devote a large portion of its budget to paying off its creditors, rather than investing in important priorities such as education, infrastructure, and research and development. This can lead to slower economic growth and a weaker standard of living for citizens.

Additionally, a high national debt can also make a country more vulnerable to economic crises. If investors lose confidence in a country's ability to pay back its debts, they may be less likely to lend it money in the future. This could lead to higher borrowing costs and a further increase in the national debt.

There are a few different approaches that countries can take to address their national debt. One option is to implement fiscal austerity measures, such as cutting government spending or increasing taxes. This can help reduce the deficit and slow the rate of debt growth, but it may also have negative consequences, such as reduced social services or lower economic growth.

Another approach is to stimulate economic growth through targeted investments in areas such as education, infrastructure, and research and development. This can help increase productivity and generate additional revenue, which can be used to pay down the national debt over time.

Ultimately, addressing the national debt is a complex and multifaceted challenge that requires a combination of short-term and long-term strategies. It will likely require difficult decisions and sacrifices from both the government and citizens, but taking action to address the national debt is crucial for the long-term stability and prosperity of a country.