A demat account, short for dematerialized account, is a type of account that allows individuals to buy and sell shares and securities in electronic form. It is an essential tool for anyone looking to invest in the stock market, as it offers numerous benefits over traditional methods of holding physical shares. In this essay, we will discuss the various needs and importance of having a demat account.

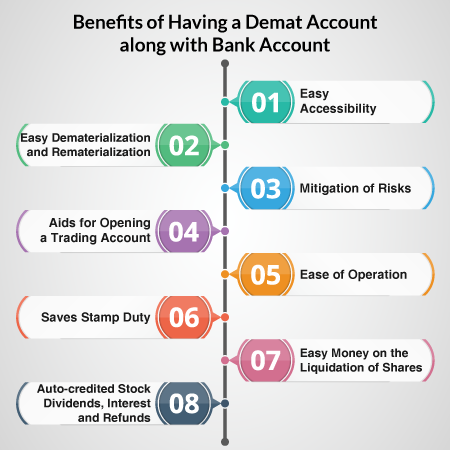

One of the primary needs for a demat account is the convenience it offers. With a demat account, you can buy and sell shares online, eliminating the need for physical paperwork and trips to the broker's office. This not only saves time and effort, but it also reduces the risk of errors and fraud that can occur with manual processes.

Another important need for a demat account is the safe and secure storage of shares. When you hold physical shares, you have to worry about their safekeeping, as they can easily be lost, damaged, or stolen. A demat account, on the other hand, offers a secure and reliable way to store your shares electronically. You can access your account anytime, anywhere, and view your holdings and transactions online.

A demat account also simplifies the process of transferring shares. When you hold physical shares, transferring them to someone else can be a time-consuming and complex process. With a demat account, you can easily transfer your shares to anyone else's account by simply initiating an electronic transfer. This not only saves time and effort, but it also reduces the risk of errors and fraud that can occur with manual processes.

In addition to the convenience and security it offers, a demat account also helps investors save money. When you hold physical shares, you have to pay fees for their safekeeping, such as annual fees for your broker or charges for certificates. A demat account, on the other hand, allows you to avoid these fees and save money on your investments.

Another important aspect of a demat account is that it allows you to diversify your investments. With a demat account, you can invest in a wide range of securities, such as equities, mutual funds, government bonds, and more. This not only helps you spread your risk, but it also gives you the opportunity to maximize your returns by investing in a variety of assets.

In conclusion, a demat account is an essential tool for anyone looking to invest in the stock market. It offers numerous benefits, including convenience, security, cost savings, and the ability to diversify your investments. If you are planning to invest in the stock market, it is highly recommended that you open a demat account.