An online loan management system is a platform that allows lenders and borrowers to manage the entire loan process electronically. This can include applying for a loan, submitting documentation, tracking the status of the loan, making payments, and communicating with the lender. Online loan management systems are becoming increasingly popular as they provide a convenient and efficient way for both parties to handle the loan process.

One of the main benefits of an online loan management system is that it allows borrowers to easily apply for a loan from anywhere with an internet connection. In the past, borrowers had to visit a bank or financial institution in person to apply for a loan, which could be inconvenient and time-consuming. With an online system, borrowers can complete the application process from the comfort of their own home, saving them time and effort.

Online loan management systems also make it easier for lenders to process and approve loans. Lenders can review and verify documentation electronically, which can speed up the loan approval process. This is particularly useful for small business owners who may not have the time or resources to visit a bank in person to apply for a loan.

In addition to making the loan process more convenient and efficient, online loan management systems also provide a high level of security. Sensitive personal and financial information is protected by secure servers and encryption technology, helping to prevent fraud and identity theft.

Another advantage of online loan management systems is that they allow borrowers to easily track the status of their loan and make payments. With a traditional loan, borrowers may have to visit a bank or financial institution in person to make a payment or check on the status of their loan. An online system allows borrowers to do this from anywhere with an internet connection, saving them time and effort.

Overall, an online loan management system offers a convenient and efficient way for lenders and borrowers to handle the loan process. It provides an easy way for borrowers to apply for a loan and track the status of their loan, while also making it easier for lenders to process and approve loans. Additionally, online loan management systems offer a high level of security to protect sensitive personal and financial information.

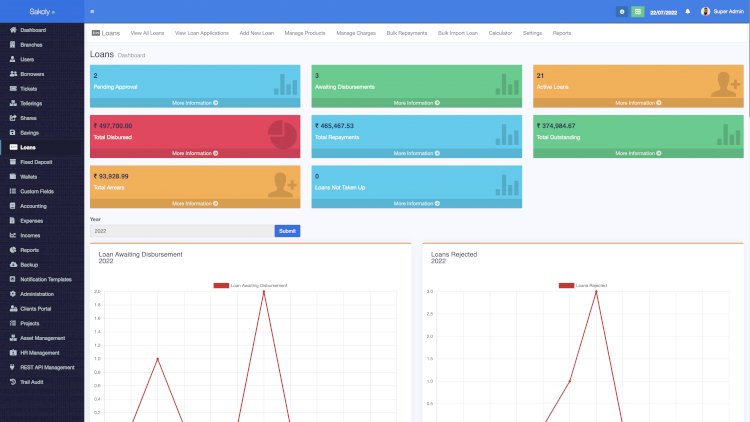

Ultimate Loan Manager

Whenever a customer pays the installment, he must be updated, and through a phone number, it is easy. Calculate and apply late fees to accounts manually or automatically. New and unique ids are given to everyone who gets registered over this system and to the customers who take the loan. Bank staff members like a manager, the cashier can also check the details of their customers like if any customer has not paid the monthly amount from the last three months, then it will notify the user. Loan approval process follows best microfinance standards READ ALSO: Online Exam Android App with Admin Panel FEATURES 1. Also, it gives a complete detailing about the logging of a transaction. This also indicates that you pay for functionalities that you need and not the whole batch.

Best online loan management system software

Servicing a loan does become more complicated with each customer, who will have different terms, different payment dates, etc. These loans are given to individuals with the intent of helping them pay expenses to cover them until their next payday. These loans can be issued by the government as well as private institutions. Admin can manage all type of payments and configure the chart of accounts with GL codes. You can Registered users can log in to the Loan management system using the email id or the user id and password. Collect payments via credit cards, ACH payments, wire transfers, and more. Duty Hours: Duty hours of the guards keep getting changed and it must be updated into the prison management system.

Online Loan Management System with SMS Notification

Mortgages can provide fixed-rates, adjustable-rates, and interest-only. Features of Loan Management Software Loan management software can help you manage a loan throughout the entire cycle, or focus on specific areas. Adding bank branches: this entity is about the details of the bank and its branches who are giving a loan to customers. Customer portals let customers log into your customizable website and look at their balances, make payments, adjust contact details, set up automatic payments, and more. When will the loan be over and what kind of loan is taken by the customer? Which ultimately makes the interface easy to use for a long time.

Online Loan Management System

Loan type: The customer might have taken any type of loans like a study loan, car loan, or home loan. Some of the features of the user areas the following: Primary key User id: The user id is system generated and unique, which can be referenced in any other entity. The system is made properly and all the testing is done as per the requirements. An effective system that lets your employees choose their loan and advance type, category, amount, and date instantly. Student Loans A type of personal loan meant to pay for tuition, housing, and other expenses related to attending an educational institute. Attributes given to the user are: Adding customer: The user can add a new customer and can save it. These attributes are explained below: Bank name: Bank name is taken from the user and fed into this it is properly validated so that no mistake happens.