Paradox of thrift meaning. Paradox of thrift financial definition of paradox of thrift 2022-12-20

Paradox of thrift meaning

Rating:

9,8/10

1697

reviews

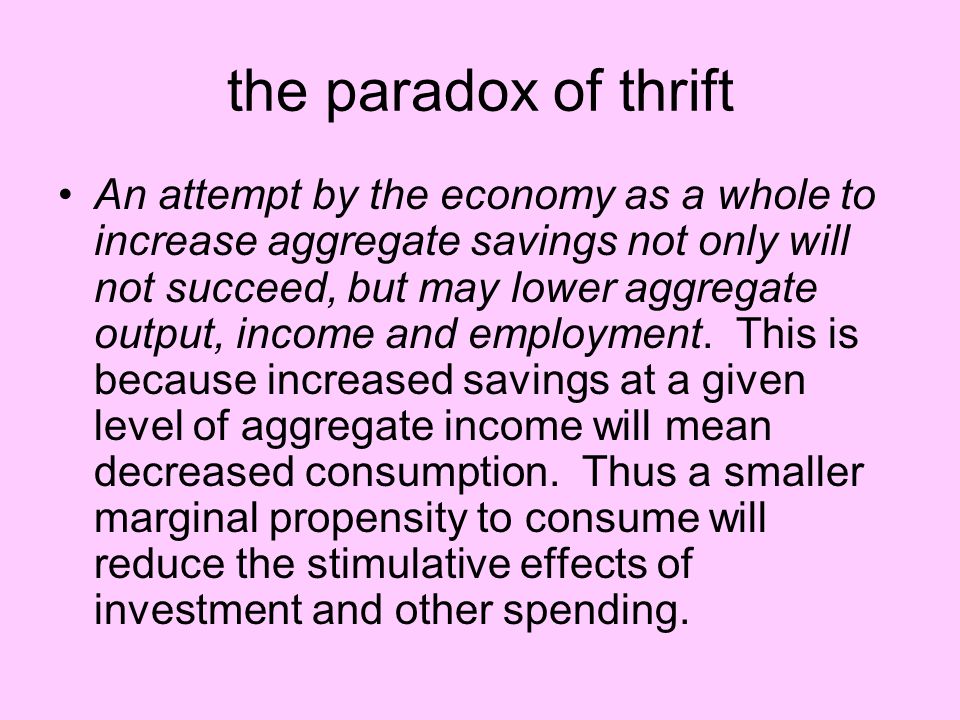

The paradox of thrift, also known as the paradox of saving, is an economic concept that describes the negative consequences of individuals or households trying to save more money. It is based on the idea that when people save more, they are also reducing their consumption of goods and services, which can lead to a decrease in overall demand in the economy.

At its core, the paradox of thrift is a macroeconomic concept that looks at the overall behavior of households and businesses in an economy. When people save more money, they are less likely to spend it on goods and services, which can lead to a decrease in demand for these goods and services. This, in turn, can lead to a decrease in production, as businesses may not see a need to produce as many goods if there is less demand for them.

As production decreases, businesses may need to lay off workers or reduce their hours, leading to an increase in unemployment. This can further decrease demand as people have less money to spend on goods and services. The cycle continues as businesses struggle to sell their products and people continue to save more money in an effort to be financially secure.

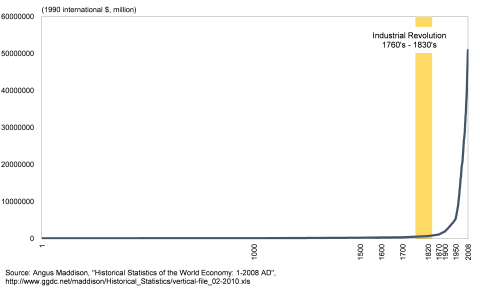

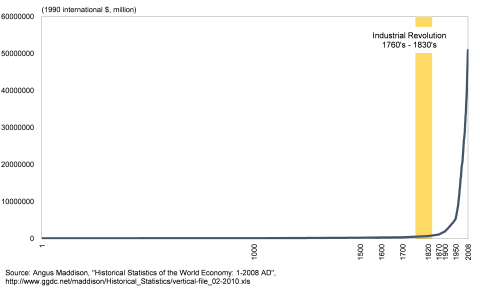

The paradox of thrift can also have negative consequences for the overall economy. If demand for goods and services decreases, it can lead to a decrease in GDP, which is a measure of the total economic output of a country. This can result in a recession or a slowdown in economic growth.

There are several ways in which the paradox of thrift can be addressed. Governments can use fiscal policy, such as increasing government spending or cutting taxes, to stimulate demand and encourage people to spend more. Central banks can also use monetary policy, such as lowering interest rates, to encourage borrowing and spending.

In conclusion, the paradox of thrift is an important economic concept that highlights the potential negative consequences of individuals or households trying to save more money. It is important for policymakers to understand this concept and take appropriate measures to stimulate demand and avoid negative economic outcomes.

Paradox Of Thrift

It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue. But equally she may not. This criticism is not very controversial, and is generally accepted by Keynesian economists as well, every nation can increase net exports. Brexit refers to the possibility of Britain withdrawing from the European Union EU. .

Next

The Paradox of Thrift

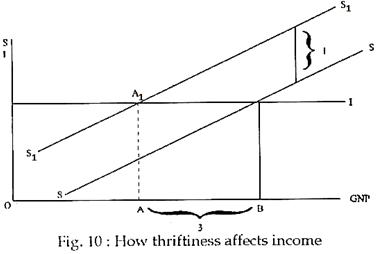

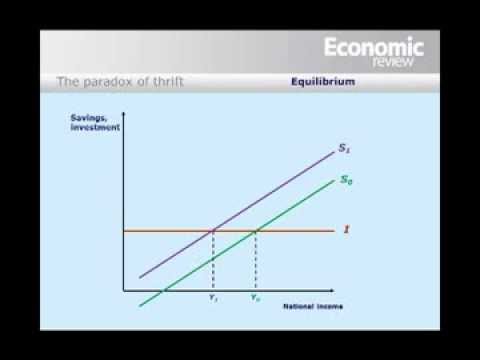

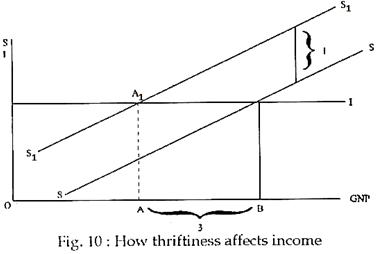

And, perhaps, even usually she is not. The withdrawal function will rise from w1to w2. Meanings of Paradox of Thrift. There will thus be a multiplied fall in income. It is, of course, just as impossible for the community as a whole to save less than the amount of current investment, since the attempt to do so will necessarily raise incomes to a level at which the sums which individuals choose to save add up to a figure exactly equal to the amount of investment. Saving and investment are equal at point OT.

Next

Paradox of Thrift Definition & Example

Firstly, if savings are held as cash, rather than being loaned out directly by savers, or indirectly, as via bank deposits , then loanable funds do not increase, and thus a recession may be caused — but this is due to holding cash, not to saving per se. In simple words, any exchange of goods and services for other goods and services wi Base rate is the minimum rate set by the Reserve Bank of India below which banks are not allowed to lend to its customers. Description: Keynes further said that such a mass increase in savings eventually hurts the economy as a whole. Subsequently, there will be decline in employment, declining saving itself. Both the narrow and broad claims are paradoxical within the assumption underlying the fallacy of composition, namely that what is true of the parts must be true of the whole.

Next

Paradox of Thrift

Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. The reason for bailout is to support an industry that may be affecting millions of people in According to the RBI, balance of payment is a statistical statement that shows 1. Also See: Base Rate, Call Money Rate the hard currency came into existence, the most common form of trade was bartering. When one person saves, the income of another person declines. If the spending is less, the firms will be able to produce less. When the aggregate saving increases, the saving curve shifts upwards from SS to S 1S 1.

Next

What is Paradox Of Thrift? Definition of Paradox Of Thrift, Paradox Of Thrift Meaning

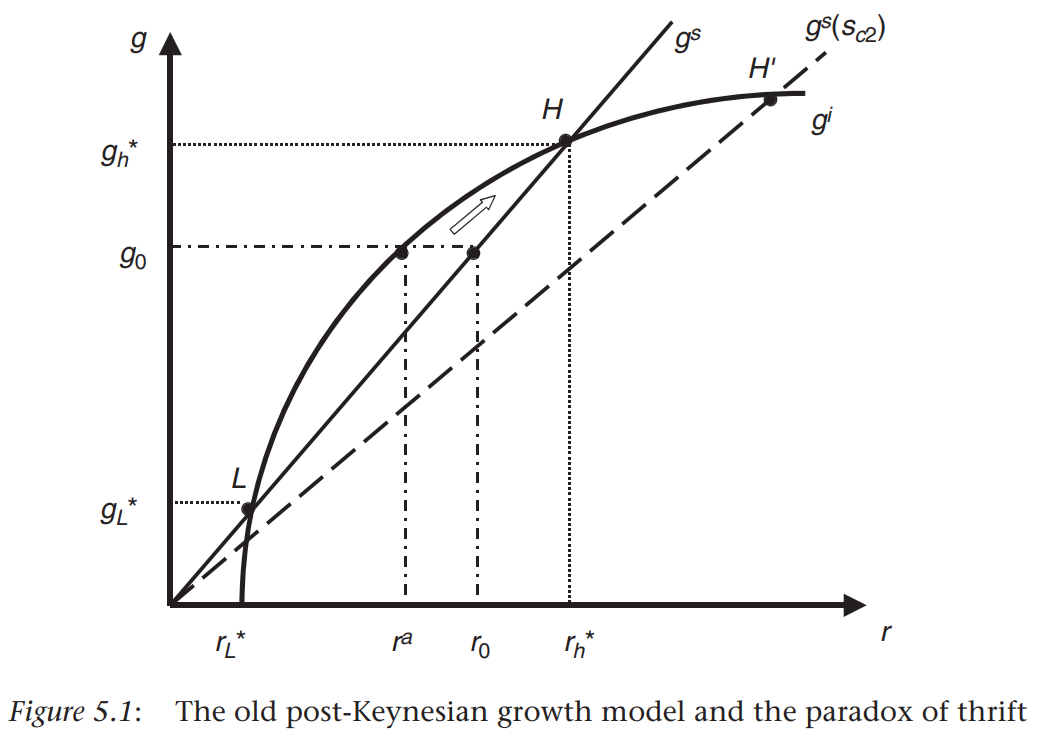

In essence, the lack of consumption forces the market to optimize and does not, as Keynes suggested, reduce future output. The paradox of thrift also ignores the ability of banks to lend out consumer savings to stimulate demand in the economy. This theory says an increase in current spending drives future spending. And, perhaps, even usually she is not. . Keynes said that such thrift or conservative saving behaviour would accentuate the recession. Thus, while the paradox may hold at the global level, it need not hold at the local or national level: if one nation increases savings, this can be offset by trading partners consuming a greater amount relative to their own production, i.

Next

What Is The Meaning Of Paradox Of Thrift?

Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. Framed by a committee of elite central bankers, the accord provides the guidelines for prudent supervision of banks all over the world and sets the standard for such supervision. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Thus, while the paradox may hold at the global level, it need not hold at the local or national level: if one nation increases savings, this can be offset by trading partners consuming a greater amount relative to their own production, i. This phenomenon is called the paradox of thrift. As people save more, they will spend less. Both the narrow and broad claims are paradoxical within the assumption underlying the fallacy of composition, namely that which is true of the parts must be true of the whole.

Next

Paradox of thrift : definition of Paradox of thrift and synonyms of Paradox of thrift (English)

The unemployed people, who now are out their income, stop spending altogether, which worsens the problem even more. It has formed part of mainstream economics since the late 1940s. This theory was heavily criticized by non-Keynesian economists on the ground that an increase in savings allows banks to lend more. Assuming that saving rises faster as a function of income than the relationship between investment and output, then an increase in the In this form it represents a This paradox can be explained by analyzing the place, and impact, of increased savings in an economy. Description: Bank rates influence lending rates of commercial banks. The paradox is, narrowly speaking, that total saving may fall because of individuals' attempts to increase their saving, and, broadly speaking, that increase in saving may be harmful to an economy.

Next

Paradox of thrift financial definition of paradox of thrift

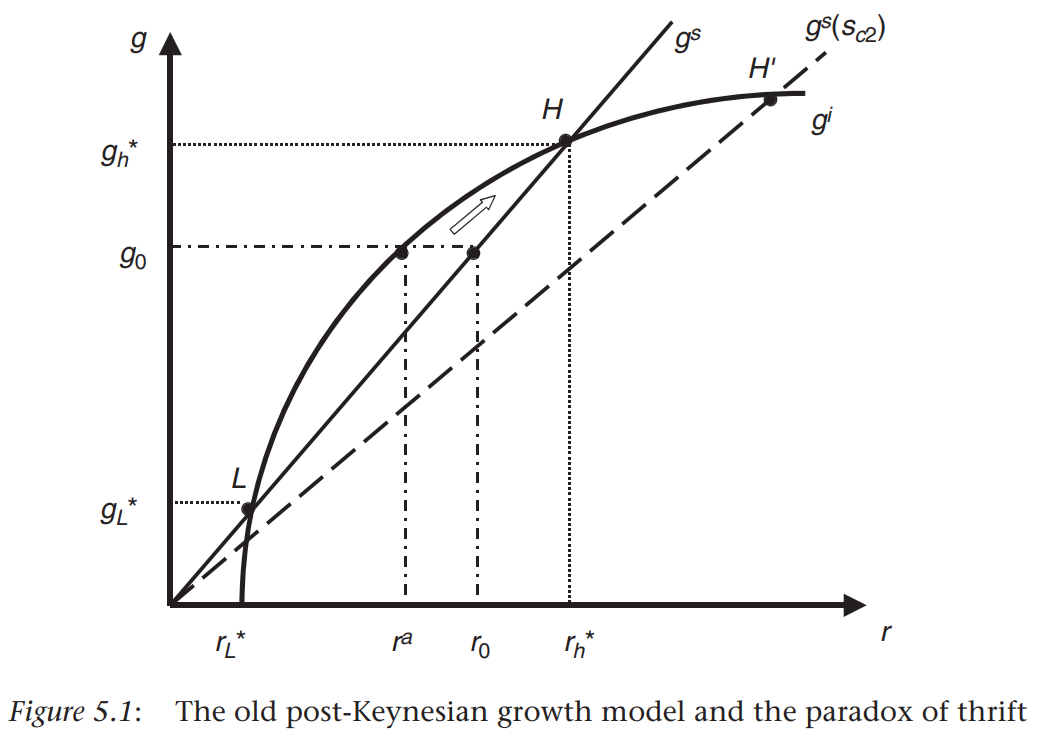

Once the new, more productive structure of capital has reorganized inside of the current structure, the real costs of production is reduced for most firms. If Enterprise is afoot, wealth accumulates whatever may be happening to Thrift; and if Enterprise is asleep, wealth decays whatever Thrift may be doing. The figure below provides a clearer description of the concept In the figure, the point of equilibrium is at E where the saving curve SS and investment curve II intersect each other. Firms will therefore produce less, and labour hiring will, as a result, fall, leading to a decline in incomes. It states that individuals try to save more during an economic recession, which essentially leads to a fall in aggregate demand and hence in economic growth. It is based on a circular flow of the economy in which current spending drives future spending. The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower total saving.

Next