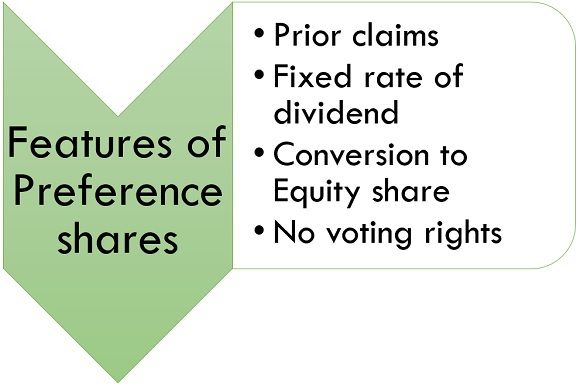

Preference shares, also known as preferred stock or preferred shares, are a type of equity ownership in a company that gives shareholders certain privileges over common shareholders. While common shareholders may have voting rights and the potential to earn dividends on their investment, preference shareholders typically do not have voting rights and are entitled to receive a predetermined level of dividends before common shareholders.

Preference shares are a hybrid form of ownership, combining elements of both debt and equity. Like debt, preference shareholders have a priority claim on the company's assets and earnings, which means they are paid before common shareholders in the event of a liquidation. However, unlike debt, preference shares do not have a fixed maturity date and do not require regular interest payments. Instead, preference dividends are paid at a fixed rate or as a percentage of the preference share's face value.

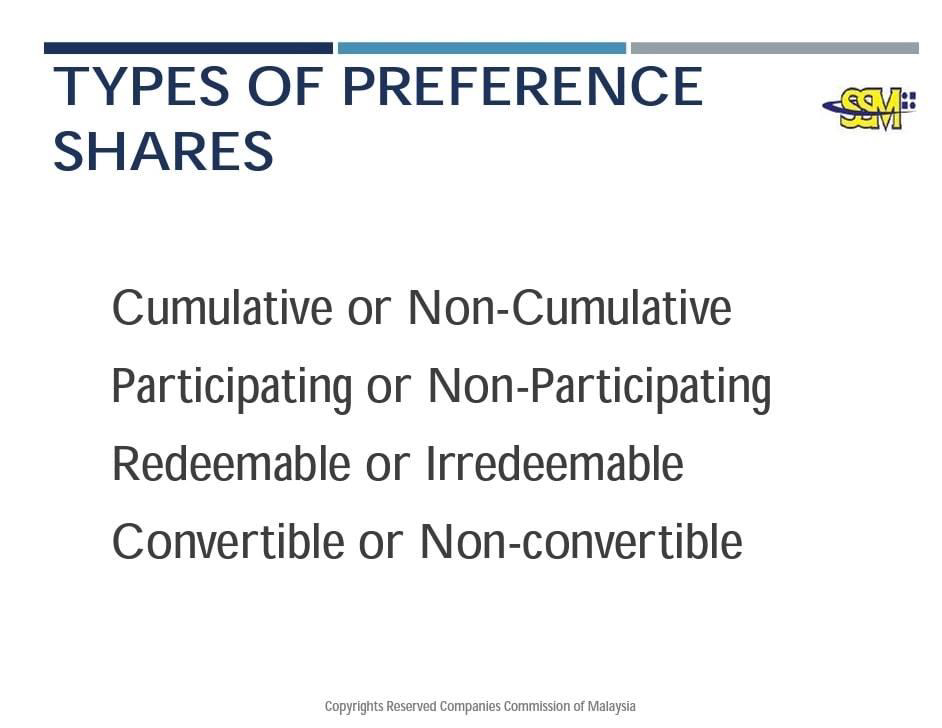

There are several types of preference shares, each with its own unique set of features and benefits. Some examples include:

Cumulative preference shares: These shares entitle the shareholder to receive any unpaid dividends before common shareholders receive any dividends. If the company misses a dividend payment, the unpaid amount must be paid before any dividends are paid to common shareholders.

Non-cumulative preference shares: These shares do not entitle the shareholder to receive any unpaid dividends. If the company misses a dividend payment, the shareholder does not have a right to receive the unpaid amount in the future.

Participating preference shares: These shares entitle the shareholder to receive a fixed dividend as well as a share of any additional profits the company generates.

Convertible preference shares: These shares can be converted into a specified number of common shares at the shareholder's discretion.

Preference shares offer several benefits to both companies and investors. For companies, issuing preference shares can be a way to raise capital without taking on additional debt. This can be particularly useful for companies with high levels of debt or those that may not qualify for traditional financing. Preference shares also allow companies to retain more control over their operations, as preference shareholders do not have voting rights.

For investors, preference shares offer the potential for a steady stream of income, as the dividends are typically fixed and paid on a regular basis. Preference shares may also offer some protection against inflation, as the dividends are often tied to the face value of the shares. Additionally, preference shares may offer some downside protection in the event of a company's financial difficulties, as preference shareholders have a priority claim on the company's assets and earnings.

While preference shares offer several benefits, they also come with some risks and limitations. For example, preference shareholders may not have the same potential for capital appreciation as common shareholders, as the value of preference shares is typically tied to the company's dividends rather than its overall performance. Additionally, preference shareholders may not have the same level of control over the company as common shareholders, as they do not have voting rights.

In conclusion, preference shares are a type of equity ownership that offers certain privileges to shareholders, including a predetermined level of dividends and a priority claim on the company's assets and earnings. While preference shares offer some benefits to both companies and investors, they also come with some risks and limitations.