Pricing strategies for pharmaceutical products are an important consideration for any pharmaceutical company. The price of a drug can have a significant impact on its success in the market, as well as on the overall profitability of the company.

There are several factors that companies consider when determining the price of a pharmaceutical product. One of the most important factors is the cost of research and development (R&D). Developing a new drug is a costly and time-consuming process, and companies must recoup these costs through the sale of the product. Additionally, companies must also consider the cost of manufacturing, distribution, and marketing when setting the price of a drug.

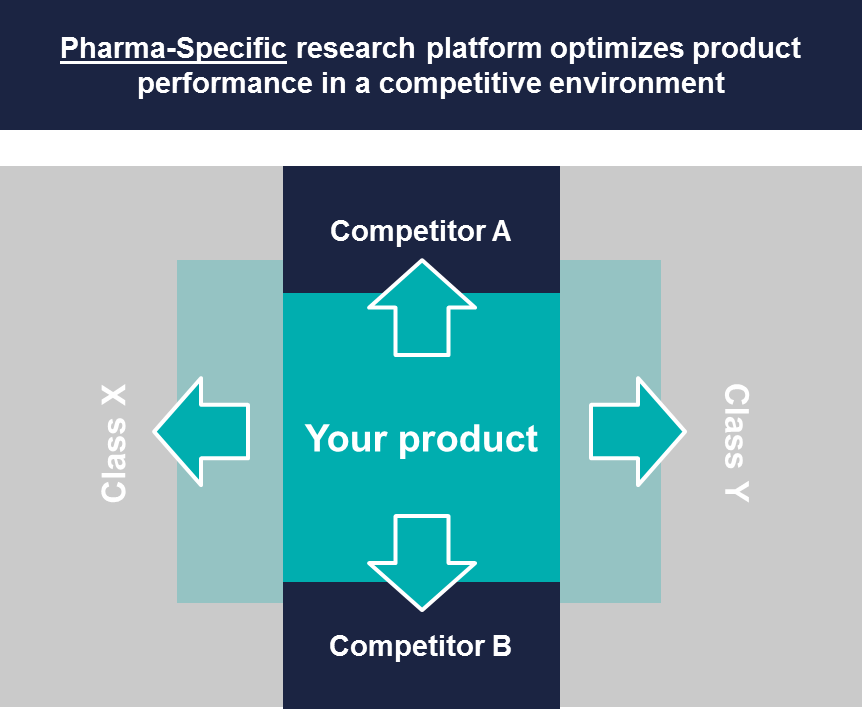

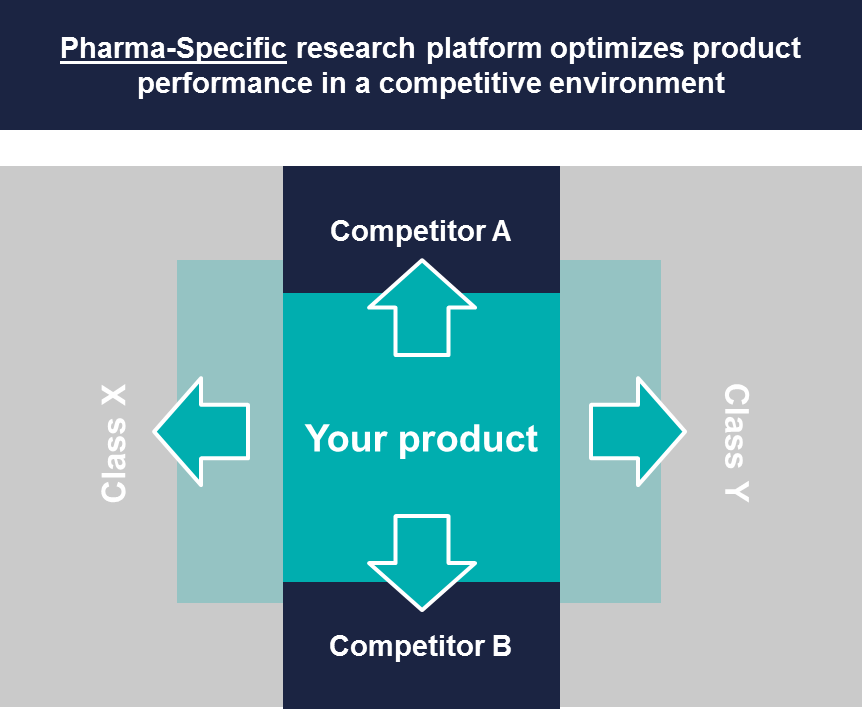

Another important factor that companies consider when pricing pharmaceutical products is the value that the drug provides to patients and healthcare providers. This value can be determined by the effectiveness of the drug, as well as any additional benefits it provides, such as improved quality of life or reduced healthcare costs. Companies may also consider the price of competing drugs when setting the price of their own product, as well as the overall demand for the drug in the market.

There are several different pricing strategies that companies may use when pricing pharmaceutical products. One common strategy is called value-based pricing, in which the price of the drug is based on the value it provides to patients and healthcare providers. This can be an effective strategy for drugs that provide significant benefits to patients, as it allows companies to charge a higher price while still offering value to customers.

Another common pricing strategy is cost-based pricing, in which the price of the drug is based on the cost of production and distribution. This can be an effective strategy for drugs with relatively low production costs, as it allows companies to price the drug competitively while still generating a profit.

Finally, companies may also use market-based pricing, in which the price of the drug is based on the overall demand for the product in the market. This can be an effective strategy for drugs with a high level of demand, as it allows companies to maximize their profits by charging a higher price.

Overall, pricing strategies for pharmaceutical products are an important consideration for any company in the industry. By carefully considering the costs of production and the value provided to patients and healthcare providers, companies can effectively price their products to maximize profits and provide value to customers.

Pricing Of Pharmaceuticals Products In The United Arab Emirates

Just as likely, however, a price band strategy increases the relevance of each negotiation, effectively increasing the bargaining power of regulators, many of whom already enjoy significant advantages as near-monopoly purchasers. While value-based pricing is used in one form or another by most drug companies, the use of pharmacoeconomic data is not common. The moderated panel will be asked to. Under the Inflation Reduction Act, drug companies would have to negotiate with Medicare on the prices of some high-cost drugs that have been on the market for a certain number of years. A rising tide Specialty drugs are expensive and will continue to be. In Europe, single-payer health systems and managed entry agreements pushed drugmakers to participate in risk-based or outcomes-based contracts several years ago, and those practices are being adopted in other geographies, especially for innovative specialty drugs and orphan products.

Understanding Drug Pricing

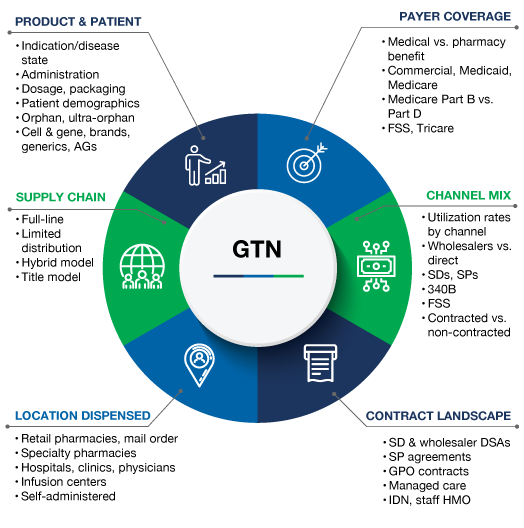

In the case of drug pricing, there are several factors that have complicated this particular market. Pharmaceutical manufacturers have two strategic choices affected by reference pricing, assuming that the necessary clinical and regulatory information is available. This is driven by the much higher incidence of diabetes as compared to cancer types. Instead, pricing scenarios should be coupled with other demand factors, including reimbursement issues, treatment regimens, patient severity and characteristics of available alternatives. The main pharmaceutical companies in the USA are Jonson and Jonson, Pfizer, Merck and Co. As the largest market and a relatively high-priced market, the US likely supplies even more than 50% of total pharmaceutical profits.

Is the Price Right? An Overview of US Pricing Strategies

What agreement exists seems to be confined to below-cost predatory pricing practices, price-fixing, and exploiting buyers who are in a particularly vulnerable position. One debate on drug pricing centers around the rebate exchanges between PBMs, private companies that negotiate drug prices on behalf of payers, and drug manufacturers. In addition, extreme turbulence in the competitive environment is continuously affecting the relative bargaining positions of buyers and sellers in many markets. But regardless of the finger pointing, the share of drug expenditures in overall healthcare costs is still relatively small and is likely to remain that way even if it inches up slightly. Firms operating on a full-costing basis may be especially vulnerable in this regard Kraus 527. The EAC is meant to reflect the cost of the drug to the provider from the wholesaler, but is not a published figure. They often total 10% or more of the price of branded drugs.

How Pharmaceutical Companies Price Their Drugs

In metabolic, the examples that we are seeing are primarily for new drug classes that are leveraging value-based contracts as a way to demonstrate value and encourage greater use. The extent to which clinical trials and health outcomes analysis anticipates global launches and incorporates this information into the structure of the studies e. Interestingly, we found that formulary positioning appears to be driven by competition in some TAs metabolic, cardiovascular, central nervous system, and gastrointestinal , but not others oncology, infectious disease, immunology, and respiratory. We analyzed the relationship between competitive intensity and formulary positioning by therapeutic area, focusing on the top-selling branded drugs of the top 19 biopharma companies by their revenue for 2016. The competition will come from completely unanticipated sources. The Pricing Resolution applies to both prescription pharmaceutical products and pharmaceutical products which are available over the counter.