Formal communication in health and social care refers to the structured and professional exchange of information that takes place within an organization. This type of communication typically follows established protocols and procedures, and is used to convey important information, share knowledge, and make decisions.

One key aspect of formal communication in health and social care is that it is typically hierarchical in nature. This means that information is usually passed down from superiors to subordinates, and decisions are made by those in positions of authority. This is particularly important in health and social care settings, where the welfare of patients and clients is at stake, and where clear lines of communication and decision-making are essential to ensure that appropriate care is provided.

Another important feature of formal communication in health and social care is that it is often written, rather than oral. This is because written communication provides a record of what has been said, and can be referred to at a later date if necessary. Written communication can also be more formal and formalized, making it easier to follow established protocols and procedures.

Formal communication in health and social care is also often institutionalized, with established channels of communication and protocols for how information is shared. For example, in a hospital setting, formal communication might take place through meetings, memos, and electronic medical records, while in a social care setting, it might involve written care plans and progress reports.

The importance of formal communication in health and social care cannot be overstated. It is essential for ensuring that the right information is conveyed to the right people at the right time, and that decisions are made in a timely and informed manner. By following established protocols and procedures, organizations can ensure that communication is effective, efficient, and consistent, ultimately leading to better outcomes for patients and clients.

Taxes on tobacco, alcohol, and sugar

Restrictions on hours of sale and alcohol advertising are also very effective in reducing harmful and hazardous alcohol use. Other strategies Restricting the operating hours for off-premise alcohol retailers UK: off-licenses , for example, is one strategy. Guide to Community Preventive Services. Or it could mean that there is an organized effort to buy large quantities of cigarettes in a lower-taxed state, drive them into Arkansas, and sell them illegally on a retail basis. Both products are somewhat disreputable. In most of these governments which operate on the basis of the parliamentary system, the budget approval process is integrated with tax rate adjustments. There has been an increase in the smuggling rate since 2006, which is reasonable since the state increased its tobacco tax during this period.

Excise taxes on tobacco, beverages benefit health and public budgets

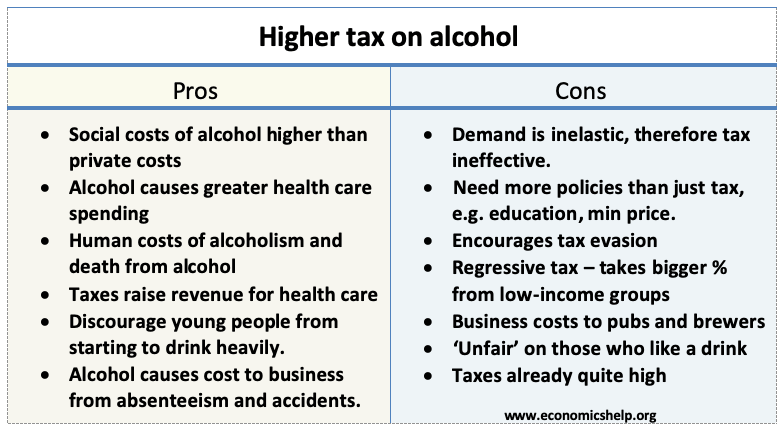

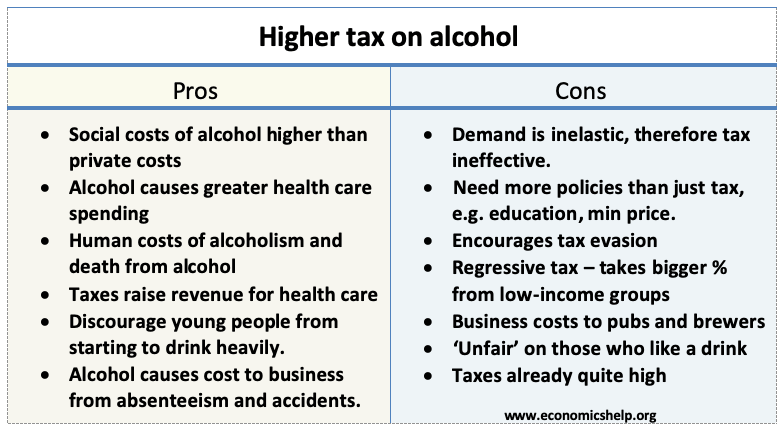

Abante cited data from the Department of Finance DOF showing the potential of sin taxes in offsetting the possible losses that could be incurred from suspending or reducing excise taxes on fuel. A progressive tax on alcohol will raise revenue, but more importantly, it will improve public health and promote public safety. Or which kind of charities to support? Journal of Studies on Alcohol and Drugs, 79 4 , 514—522 2018. Problems with Raising Taxes on Alcohol and Tobacco Health care insurance has been an ongoing issue of concern for the national Government who hopes to provide coverage for all of its citizens regardless of means. It is generally smallest in countries where economic freedom is greatest, and becomes progressively larger in those areas where corruption, regulation The Health Care System Of The United States As A Whole Essay system in the United States as a whole.

Analysis Of Raising Taxes On Alcohol And Tobacco

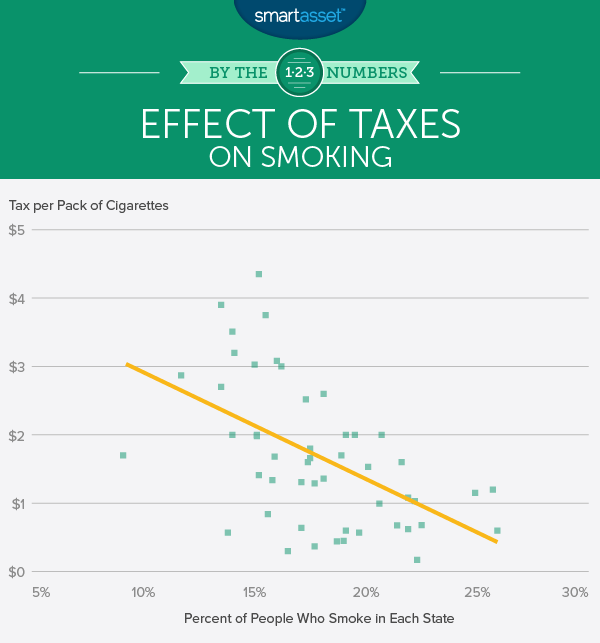

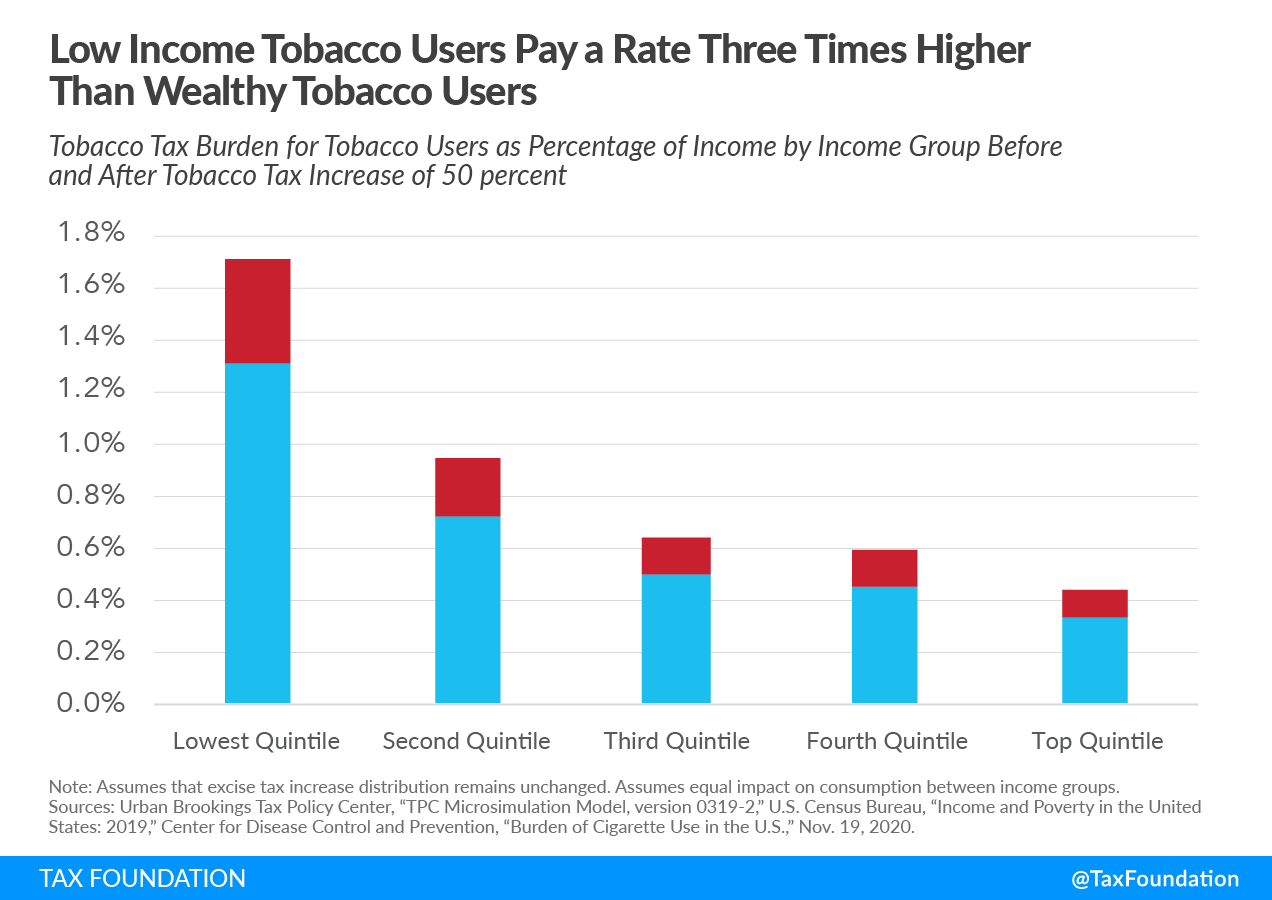

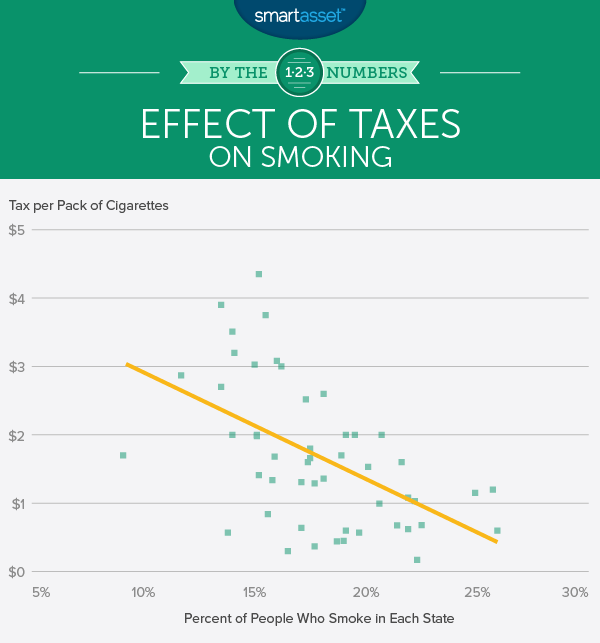

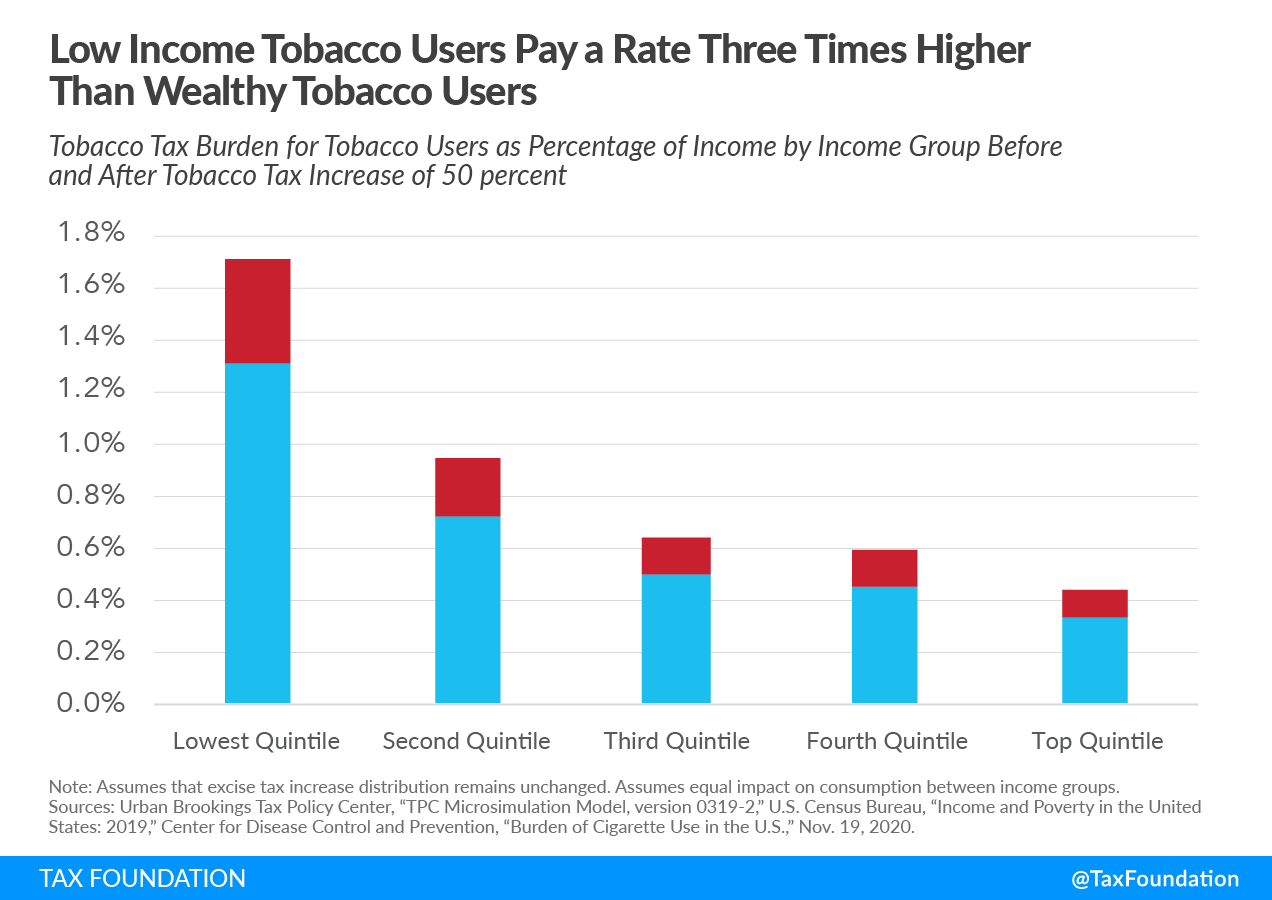

Efficacy and the strength of evidence of US alcohol control policies. After all, alcohol users do not commit all the crime that occurs, so they should not pay all the governmental costs to deal with crime. Alcohol taxes are implemented at the state and federal level, and are beverage-specific i. She added that the tax would disproportionately target people with low incomes and those coping with addiction. With less money and lobbying going to individual cities, counties, and states, these lower levels of government could be more receptive to a concerted advocacy effort than federal lawmakers. Tobacco Evidence suggests that increasing the unit price of tobacco through taxes is effective in reducing tobacco use among adolescents and adults and in reducing population consumption of tobacco products Guide to Preventive Services, 2007.

Tax Increase on Alcohol and Tobacco January 1st 2023 • Nica

Mauricio Cárdenas, the minister of finance of Colombia from 2012 to 2018, is director of the Master of Public Administration in Global Leadership program at Columbia University in New York and a nonresident fellow at the Center for Global Development. Effects of beverage alcohol price and tax levels on drinking: a meta-analysis of 1003 estimates from 112 studies. With the legalization Underground Economy Underground economy The underground economy or black market is a market where all commerce is conducted without regard to taxation, law or regulations of trade. This measure will do away with the local practice of devising different excise duties on the same products distinguishing them by origin or by raw material content implying country of origin. Oberlander, 2008 ; particularly since taxation on these production will usher in a host of other problems. A higher tobacco tax will mean that more Arkansans who smoke will be smoking cigarettes purchased from other states. Recently, the World Trade Organization dispute court promulgated its adverse decision, saying that the Philippine practice was in contravention of the non-discriminatory trade practices in international trade.

Raising alcohol taxes are cost

The study found that most of the effective price drop was due to inflation overwhelming alcohol taxes, making it so the taxes were one-sixth to one-third of their inflation-adjusted value in the early 2010s compared to the 1950s. The American Lung Association strongly supports efforts on the national, state and local levels to increase taxes on cigarettes and tobacco products. These taxes are usually based on the amount of beverage purchased not on the sales price , so their effects can erode over time due to inflation if they are not adjusted regularly Guide to Community Preventive Services, 2007. So there would always be some more revenue from a tax increase, and that money could be used for programs that would help low-income people more than a higher alcohol tax would cost them. An excise tax, like the taxes on alcohol or tobacco, should be levied in order to offset any problems caused by those products.