Redemption of mortgage meaning. Mortgage Redemption 2022-12-22

Redemption of mortgage meaning

Rating:

6,7/10

1585

reviews

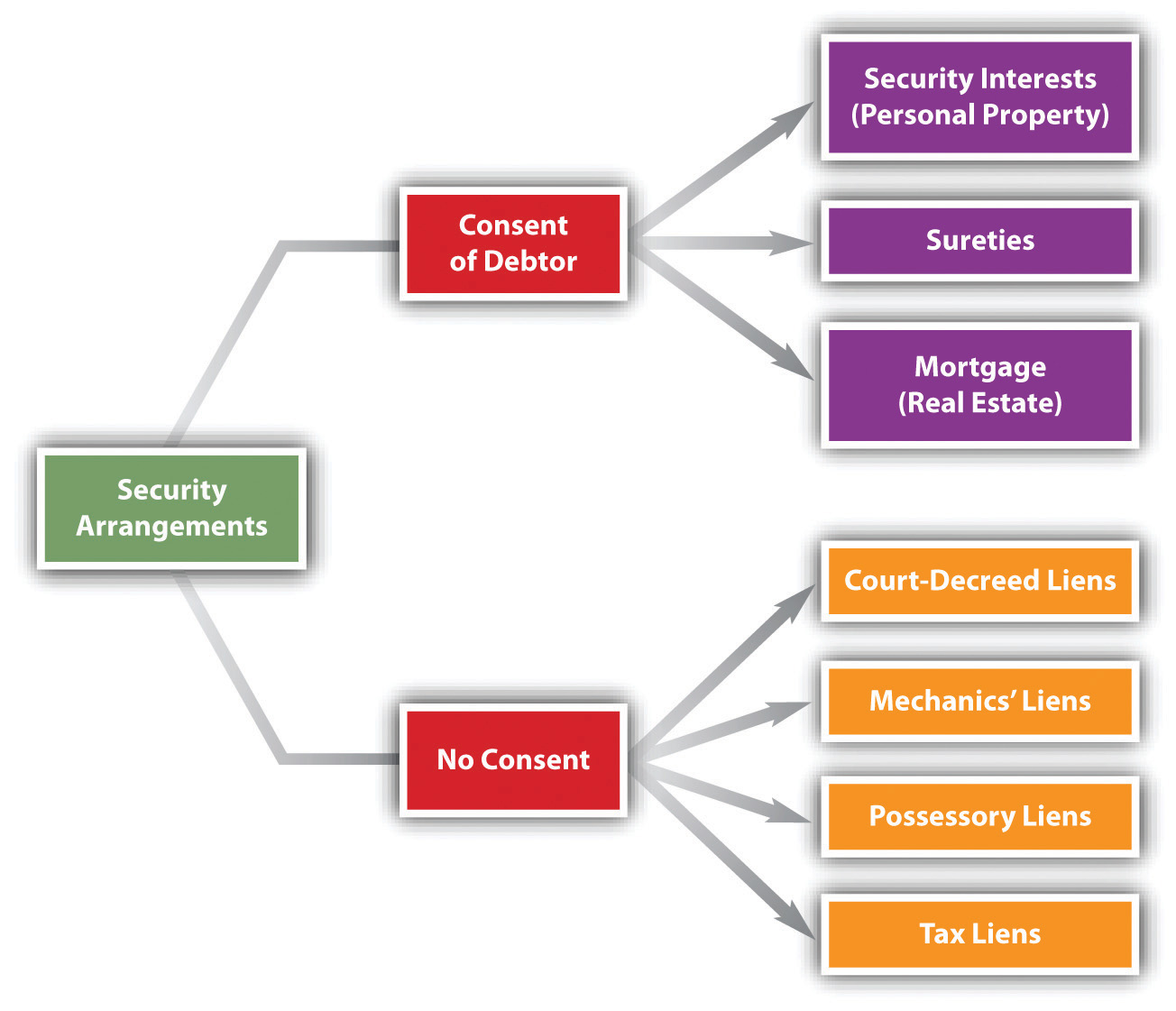

Redemption of mortgage is the process of paying off a mortgage loan and becoming the owner of the property without any financial obligations to the lender. It is the final step in the process of buying a home, and it signifies that the borrower has fulfilled their financial obligation to the lender and has gained complete ownership of the property.

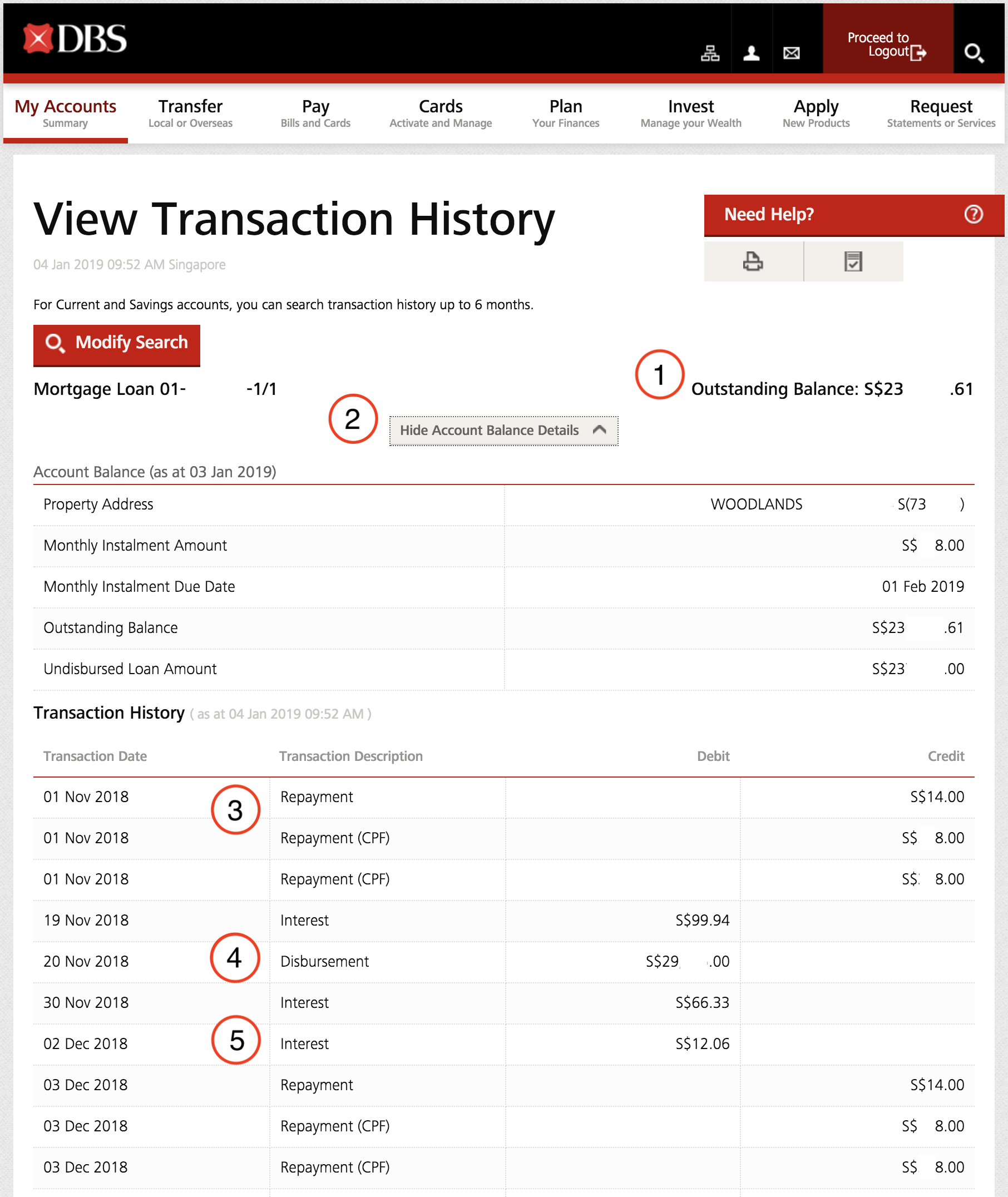

The process of redemption typically involves the borrower making a final payment to the lender, which includes the remaining balance of the mortgage loan, any outstanding interest, and any other fees or charges that may be required by the lender. The borrower may also be required to provide proof of insurance and any other documentation required by the lender to complete the redemption process.

Once the borrower has made the final payment and provided all necessary documentation, the lender will release the mortgage, and the borrower will become the sole owner of the property. This means that the borrower no longer has any financial obligations to the lender and is free to sell, rent, or otherwise dispose of the property as they see fit.

Redemption of mortgage can be a rewarding and fulfilling experience for borrowers, as it signifies that they have successfully purchased a home and achieved financial stability. It is important for borrowers to understand the process of redemption and to make sure that they are prepared for the final payment and any other requirements that may be necessary to complete the process.

In summary, redemption of mortgage is the process of paying off a mortgage loan and becoming the owner of the property without any financial obligations to the lender. It is the final step in the process of buying a home and signifies that the borrower has fulfilled their financial obligation to the lender and has gained complete ownership of the property.

Mortgage Redemption

The cost of paying back your mortgage changes on a daily basis and so your mortgage redemption statement will generally also include a daily interest figure. Many states have some type of redemption period. How many points does a foreclosure drop your credit score? What is a redemption statement? This is so that your solicitor can amend the exact amount depending on the specific day of redemption. Example - How to use Redemption Of A Mortgage is an example of a term used in the field of economics Economics -. Any creditor of the mortgagor who has in a suit for the administration of his estate obtained a decree for sale of the mortgaged property.

Next

What Is the Right of Redemption?

This was held by the Court in Pomal Kanji Govindji v. Are you struggling to make your mortgage payments? Mortgages are often worth hundreds of thousands, if not millions, of dollars. However, it is possible for the borrower to turn a profit in certain circumstances when they exercise a right of redemption after a foreclosure sale. A redemption clause answers the question as to when and how the mortgagor is entitled to redeem his property. The equity of redemption is therefore an interest in land and can be dealt with like any other equitable interest. An example of redemption is someone working hard for new clients to improve his reputation. Â The consequence of the invalidity of the long term Normally, if the right to redeem starts after a particular term, then a suit for redemption can be filed once that term has ended.

Next

What is a mortgage redemption period?

:max_bytes(150000):strip_icc()/pic28-5bfd8aa646e0fb002607b519)

For example, if you took out a five-year fixed rate and you want to repay your mortgage after three years, you are likely to pay an early repayment charge. They could then resell the home at or above market value and keep the difference as profit. You can usually do this via online banking, a CHAPS payment, in branch or by cheque. However, if the mortgagor and mortgage were on equal footing and the mortgagee was not in a position to dominate or take advantage of the mortgagor, then the long term is valid. Therefore, the legal right to redeem is limited. Stay informed with Insuranceopedia! When homeowners default on their The homeowner then generally has a specified amount of time to make good on any missed payments and avoid foreclosure. In such a case this very deed will be deemed to be a sale deed.

Next

What is Mortgage Redemption Insurance?

How Right of Redemption Can Be Exercised A right of redemption may be exercised during a time frame called the redemption period, which may be before or sometimes after a foreclosure auction has concluded. You can click on this link and join:. If you're simply paying your mortgage off without moving home or lender, you may deal directly with your lender. When the mortgagor or the property owners fail to pay their loan amount to the mortgagee then the foreclosure of the property occurs. After the expiry of 85 years, we shall redeem it within a period of six months. There are three important provisions made in section 60 of the Transfer of Property Act 1882: 1. Through suffering comes redemption.

Next

Redemption of Mortgage and Clog on redemption under Transfer of Property Act: Meaning and Conditions

In most cases, these former owners do not have the financial means to repay their missed payments and any additional fees their lenders might charge. Mortgage redemption statements are usually only valid for around four weeks. The answer to when the right to redemption accrues may also be found in the termination clause of the mortgage deed. LawSikho has created a telegram group for exchanging legal knowledge, referrals, and various opportunities. Delays in obtaining a mortgage redemption statement can slow up the conveyancing process.

Next

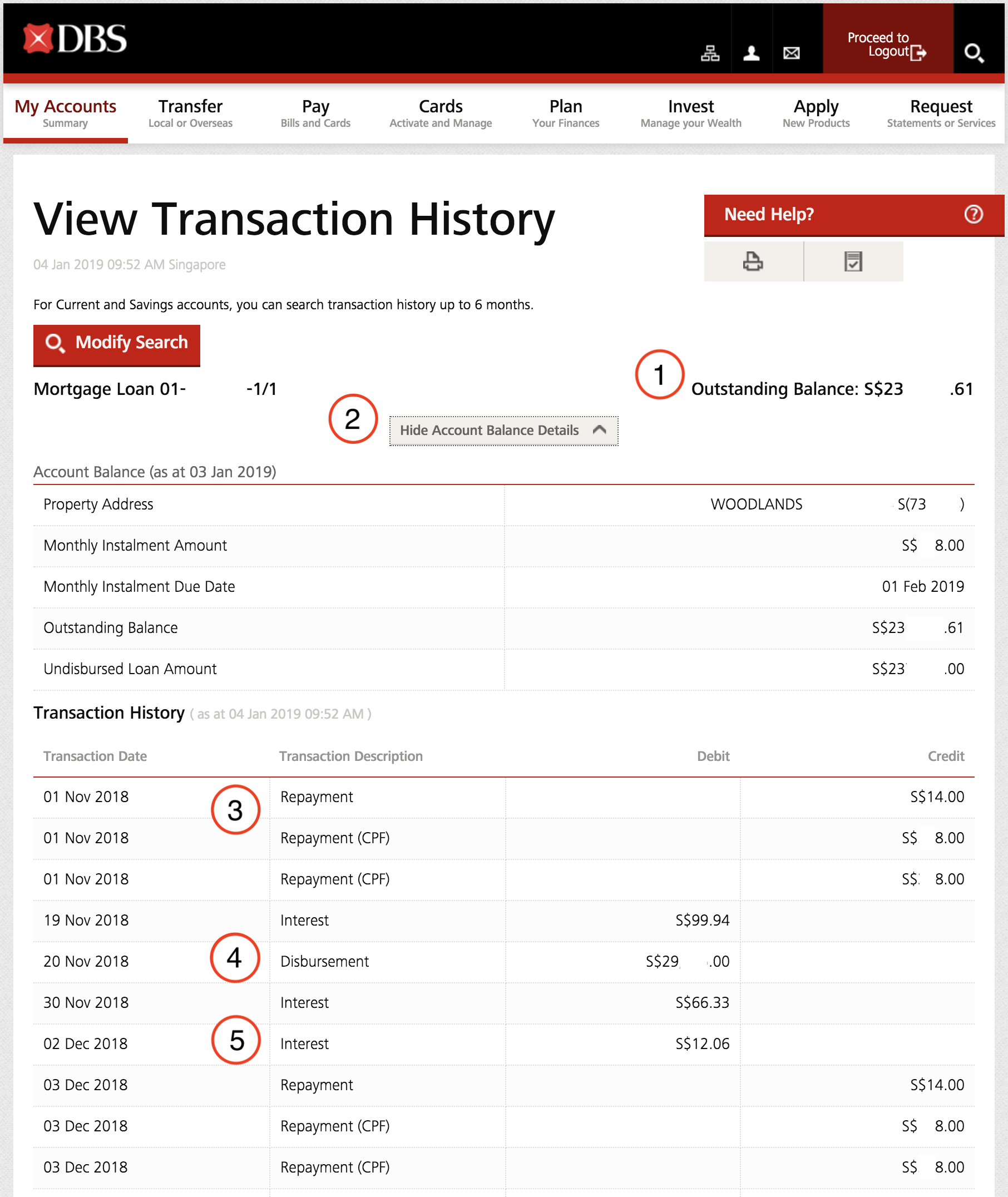

What is a Mortgage Redemption Statement?

How do I get a mortgage redemption statement? Any surety for the payment of the mortgage-debt or any part thereof; 3. Â Other clauses such as whether the interest is payable periodically or in a lump sum at the time of redemption, and the clause providing for the amount of money taken as a loan are also of importance. You may have an opportunity to get your property back, even if your home has already been sold at auction or as a foreclosure. In Seth Ganga Dhar v. Many states also allow the right of redemption to be exercised after a foreclosure sale, which is called statutory right of redemption. Furthermore, the Bank's proportion of low yielding assets i. The amended restructuring plan also envisaged capital injections in BankCo and AssetCo, a change in the lending strategy, abandonment of the active mortgage redemption programme and changes to the Competitive Framework, which would allow NR to increase its lending in and by GBP billion in total The amended restructuring plan also envisaged capital injections in BankCo and AssetCo, a change in the lending strategy, abandonment of the active mortgage redemption programme and changes to the Competitive Framework, which would allow NR to increase its lending in 2009 and 2010 by GBP 14 billion in total.

Next

How does the mortgage redemption process work?

There are other options, though, for homeowners who are struggling to make their mortgage payments that they can try to avoid falling into default on their loans in the first place. Sucha Singh 2000 4 SCC 326: AIR 2000 SC 1935 , the facts were that the mortgagor, being financially hard-pressed, mortgaged his property for 99 years for a consideration of Rs 7,000. The mortgage redemption process will be different depending on whether you are paying off your mortgage, or remortgaging or moving house. Plan of Redemption 4. All states allow homeowners to pay back their debts and reclaim their homes before their residences reach the public auction stage of foreclosure. Mortgage redemption is the process of paying off the outstanding balance on your mortgage and any other fees associated with it. There are various types of life insurance.

Next

What is Redemption Of A Mortgage? Definition, Meaning, Example

During the 90-day period before lenders offer up a home at auction, the owners of the property can reclaim their home through a reinstatement. How does a solicitor handle the redemption of a mortgage? Â The principle of clog on the equity of redemption was clearly established by the observations of Lindley, M. The ability to exercise a right of redemption, as well as how long the redemption period is, varies from state to state. How Does the Process Work When Remortgaging or Moving House? Whether this long term condition would be a clog on the equity of redemption is dealt with in the next section of this article. You can request a payoff quote from your lender to find out exactly how much you owe. The statement will normally only be valid for four weeks or until the end of the current month. What is mortgage redemption insurance? So, if the primary breadwinner dies suddenly, it can leave the surviving family members in a very difficult financial situation.

Next

redemption of mortgage definition

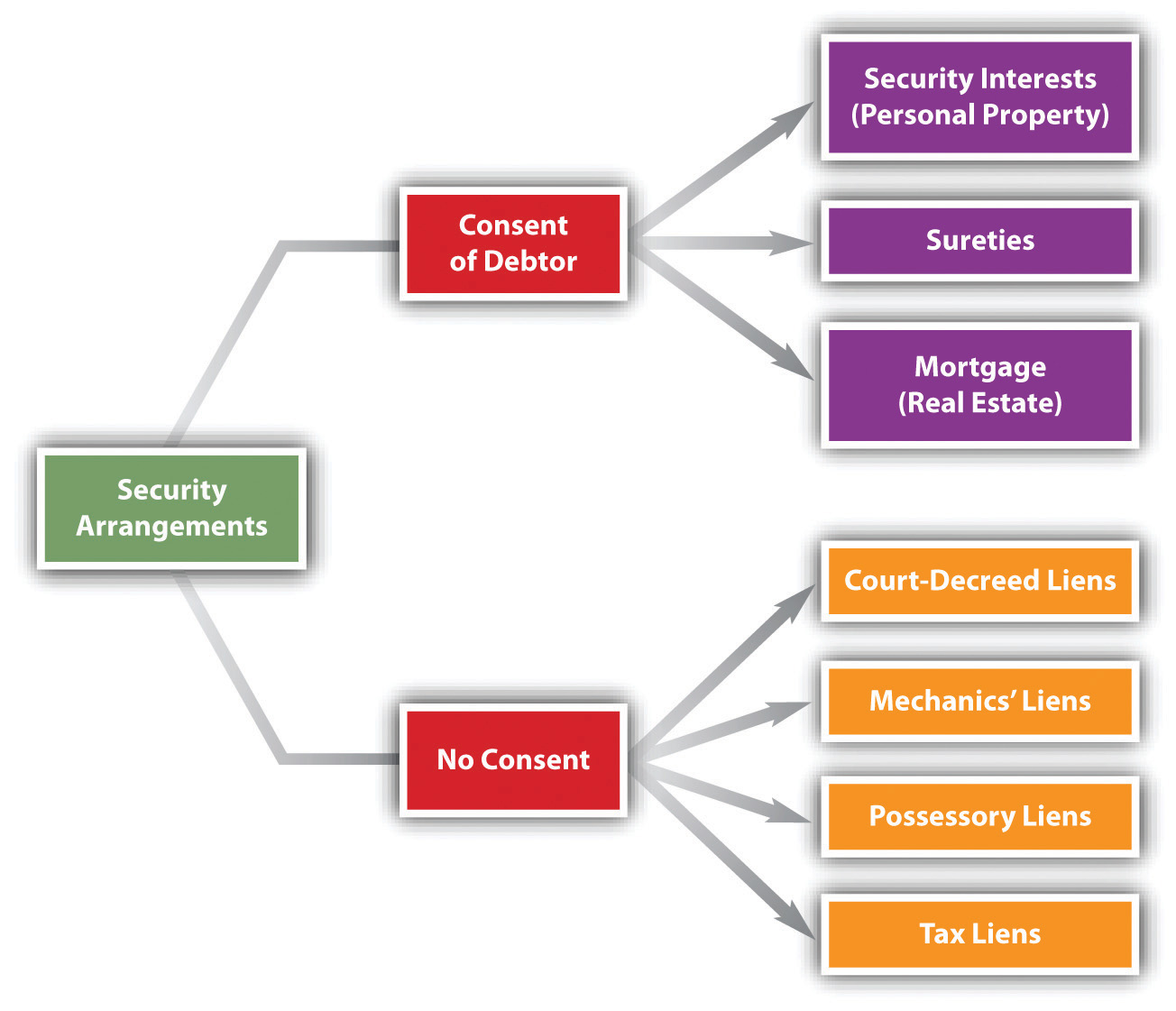

Section 91 of the Transfer of Property Act provides that besides the mortgagor any person other than the mortgagee who has any interest in or charge upon the property mortgaged or in or upon the right to redeem the same may redeem or institute a suit for redemption of such mortgaged property. In a few states, including California, Arizona, and Rhode Island, both judicial and non-judicial foreclosures are allowed, but the right to redeem property post-sale is only allowed for judicial foreclosures. Redemption occurs when your existing lender receives the amount needed to pay off the mortgage in full. This is sometimes called a discharge fee, a deeds fee, an exit fee or a sealing fee. As an exception to that rule, the merged entity may, when the balance of the loan exceeds the value of the mortgaged property, facilitate its redemption through selling off the property by providing additional finance to a vendor enabling the repayment of the outstanding balance if the provision of financing is in line with the commitment in point iii. The equity of redemption is therefore an interest in land and can be dealt with like any other equitable interest. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process.

Next